‘Equity tokens are the next important milestone for crypto. Waves is technically exceptionally well suited for security tokens support. The next big thing for Waves DEX is compliant security tokens trading’ — Sasha Ivanov, CEO of Waves.

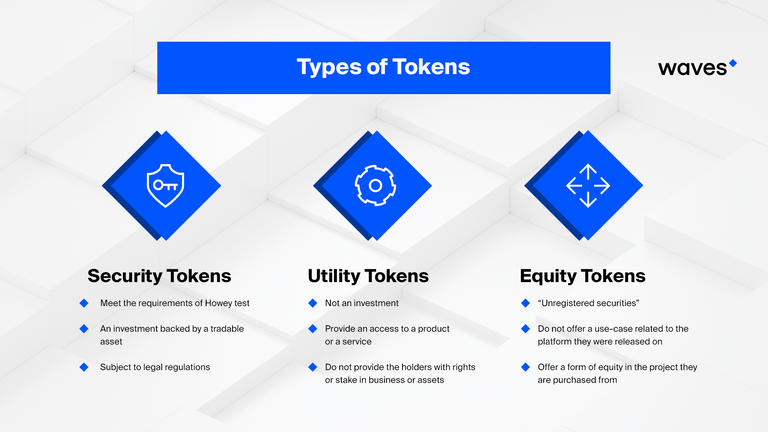

Blockchain, being a rapidly evolving technology, is at the centre of a harsh regulatory debate. This applies to every aspect of it, whether running a token sale, exchange of crypto or token types, in particular. Currently, there are three types of tokens: utility, equity and securities. What’s the difference between them and what issues do they each have?

Utility Tokens

This is the least debatable type of token. A utility token represents access to a company’s product or service. It is not tied to any tradable asset. Utility tokens can be compared to coupons or vouchers. Points in loyalty or discount programmes are a good example of a utility token use case.

Security Tokens

Security tokens provide their buyers with a share in the company, so token holders are entitled to ownership rights. Since these tokens are backed by tradable assets, they are subject to legal regulations and institutions, including the SEC in the US. Currently, most ICOs are trying hard to ensure their tokens will not be classified as securities. For the token to be classified as a security, it must meet the requirements of the Howey Test.

Equity Tokens

Equity tokens are something in between utility and security tokens, their legal regulation is unclear. They are sometimes called ‘unregistered securities’ because they offer a form of equity in the projects from which they’re purchased. Obviously, these types of tokens do require a complex legal framework.

There are other aspects to be taken into consideration. This is what Waves CEO Sasha Ivanov thinks:

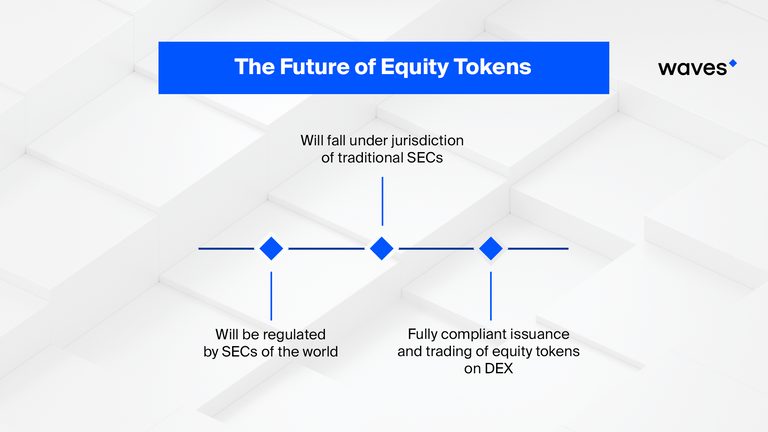

There's an ongoing debate about utility and equity tokens, with no end in sight. The current consensus is closer to the following stance: the SECs of the world have to regulate all security tokens, i.e. tokens tied to cash flow from/or an equity in a business and do not have to regulate utility tokens at all. All right, but who decides if a particular token has any actual utility? Regulators don't do it - there has to be somebody else (the SEC just wouldn't have the technical expertise, even if they wanted to do it).

Another situation — Suppose I issue an Ethereum token and claim that it will later be swapped into a very useful utility token, or will gain new usage as a utility token. Effectively I did not issue a utility token, I issued a security, and so those ICOs have to be regulated as security ICOs. Expect some other government entities with a deeper technical background to regulate such token sales soon (such as ministries of communication, special IT agencies, etc.)

Like anything blockchain-related, classification of tokens and their regulation is a complex phenomenon. Since its creation, Waves contributed significantly to establishing a legal framework around these concerns. As Sasha says, ‘We want our DEX to be the first regulated decentralised exchange, which is not the oxymoron it first seems since every successful DEX will still need some sort of KYC and AML policies. Blockchain is the future of securities trading, and we will lead the way”. Check out Sasha’s article ‘Security tokens? Inevitable’ in our official blog.

Moreover, Waves COO Max Pertsovskiy has met with the officials of the Ministry of Finance of the Grand Duchy of Luxembourg recently. The meeting marked the determination of both sides to mutually create an effective legal framework for the global blockchain industry, including measures on promoting transparent and effectively regulated ICOs.

So, the settlement of token debate is inevitable, and Waves is leading the way. Stay tuned for the updates!

Join Waves Community

Read Waves News channel

Follow Waves Twitter

Subscribe to Waves Facebook

korean translate ver.

[블로그 번역] 토큰의 미래/Waves가 이끕니다.

https://steemit.com/coinkorea/@coolzero/4rjfyt

I hope that waves will be the best blockchain platform!

Congratulation wavesplatform! Your post has appeared on the hot page after 37min with 29 votes.

Waves blockchain will be a huge one in near future

Best of luck to the waves project, looks promising.

Tokens are digital shares that are used for payment transactions and receiving rewards for participating in projects. The development and growth of the token rate will directly depend on the project within which it was created. In addition, at this stage tokens have been recognized as a promising field for investment, which puts their value at the same level with the digital currency.

a very informative post

Most of wave base projects are very success best ability

Waves has seemed to be dying down lately, even though I really like the project!

I learned a lot of new things from this post. Great post mate.

I also have a steemit blog, where i post daily analysis of CRYPTOCURRENCY AND FOREX MARKETS to help the new traders. If I get help from a blogger like you, then I will benefit a lot and newcomers trader can also benefit from me. So if it is possible, then please subscribe to me @syeedhossain24

Thanx! Really interesting and clearly presented position!

Realised that my PKTs are utility tokens

Very detailed article for a new breaking technology!