Back in early 2017, after Ether Classic existed only as a post-fork coin from the Ethereum chain (actually the original chain pre-fork), I told the traders on Elliott Wave Trader that I was seeing a very bullish pattern in the coin. I was paying member, not an analyst at the time. We had the classic 5up and three down we look for using Elliott Wave, that completed in January 2017 in the $2.00's, with more confirmation as price started to breakout a couple months later.

I had taken a lot of flak for that call from a few folks. Afterall, it was a dead coin. That is, it didn't have an active project team at the time. But the market seemed to know something I didn't, and I took the trade. The projection from the setup we had was $7.47, that is the 200% extension of wave 1 in log. This is not what we saw at all. Instead we got a super extending third wave. Where the 5th was supposed to hit $7.47, we didn't see a top of the third until $23.80, and then we see a fourth that last 4+ months before the fifth came to peak in January at $46.96.

What do we learn from this? In my view, sentiment is the only true 'sentient intelligence' in the market and it leaves a signature in price action. Sentiment doesn't care if a coin is 'dead'. It doesn't care if a project is amazing. Sentiment summates the affect of all participants in the market- the lovers, the detractors, the bulls, and the bears. Sentiment even accounts for the insiders. Afterall, they are participants and have a opinion. Sentiment knows 'no pump and dump' just euphoria run amuck. It knows no flush, just bearish extreme. Sentiment is not subjective when you know its structural signatures through Elliott Wave, though it leaves a 'feeling' if you are listening.

Fast forward, and Ether Classic is now in a wave ii in my primary, though it is shallow enough to consider it a higher degree fourth wave in my alt count. This correction though large in percentile terms, is very flat in log proportions to the runup last year. Soon, we expect this to bottom, likely around $7, unless another view of this correction becomes evident in our study of its structure.

We also now know that the ETC team is very active, and while I haven't dove into all their plans, it seems IOT is a main solution set they are pursuing. I'll leave others to more expertly weigh on their project. However, sentiment and Elliott Wave is my 'wheelhouse' and for right now, I'm very bullish.

Open chart in a new tab to see zoomed out.

Note that free 15 day trials are available for our trading room and community on Elliott Wave Trader, where I am a full time analyst. You'll rub nose with, professional, amateur and traders in the learning process, while getting trade calls and ongoing direction for the market. No credit card is needed for a trial.

hey elliot,

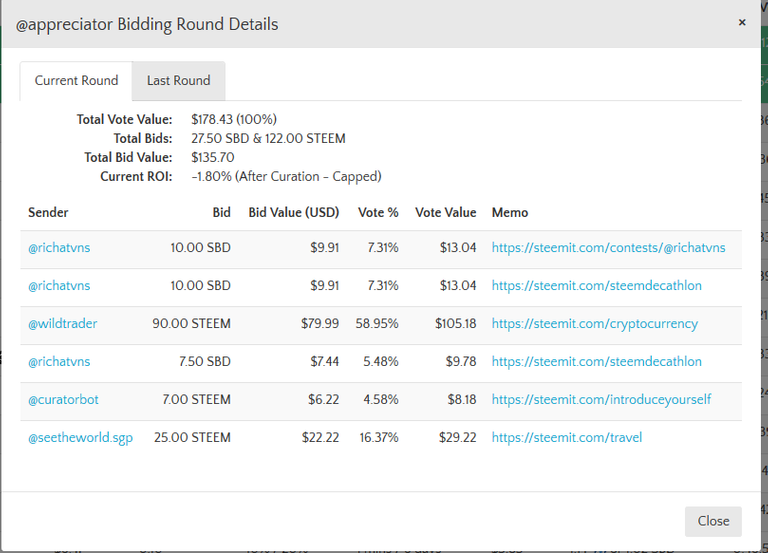

Do me a favor, stop bidding over the curator give back on bots...

You come in with a bid larger then the bot can handle...

And turn your money spent on your bid into a lose because of curation!

And you mess up the other large bidders.

for instance I had $27.50 in bids on @appreciator, which means that the give back to me at 15% removes $42 from the $178 pool.

Meaning the remaining amount in the pool was $136.

That meant for you to get the 15% profit, $90 was to big a bid.

$90 + 1/3rd for curation = $120 then $120 + 15% for profit = $138...

So immediately the return you can get out of the pool is less than max

ON TOP OF THAT with 45 min left someone else will surely jump in...

and of course they did $25 worth.....

MAKING YOUR $90 UPVOTE AND MY $27.50 AS -1.5% ROI after curation....

Thanks Rich

While I don't want to harm someone else, I'm not sure I follow. My post is showing a ton of profit over what I spent. I am happy to learn, I am new to bidding. (well, as of September)

basically when you put in really big bids it makes you earn less than you could because others are attempting the same thing. its better to spread it around to a couple of bots or services.

How do you know if too big. I don't time to watch these bots until it is time to vote, so I like to catch them early. Is there a formula for 'too big'. Im not going for % return, but don't want to lose. I track my PnL and I don't lose money. But I don't want to become a hated bot bidder LOL.

indeed i feel you on that. with my other account ill usually split my bid up into 3 or 4 if its more than $50. i usually average about 15% return with that method and it gives me space to use different bots.

we also have an upvote service that dosen't even cost steem or sbd. come talk with us over on discord

Interesting. I usually bid $60-100 per bot if it has the capacity, and average 30%-50% but it must be all the follow on votes. I track it diligently in a spreadsheet. Average since I started is 36.01%

wow i need to use your strategy bro! tthat'sa great return, I normally average <20% when i fool with those things. except when i use @yensesa which has a whole different type of scale.

check steembottracker.com

That guy is trying to "profit" on bidbots. I believe you are using it for promotional purposes. In that case you are ruining his business model. 😂

But I believe you are doing good for Steem community, because using bidbots for promotion is better than using them for plain profit.

Thanks for the post

It's very hard, nigh impossible for ETC to catch up to ETH right now

Hi @wildtrader I'm a bot, and wanted you to know that I've upvoted and re-steemed your post to help you with your promotion efforts! -exp

Thanks for the post, quality work...

I'm bullish for ETC.

nice work, btc bull is near.

One takeaway from this: Sentiment does not care if a coin is dead or if a project is amazing.

Well done.

Hi @wildtrader!

Your UA account score is currently 3.354 which ranks you at #7074 across all Steem accounts.

Your rank has not changed in the last three days.Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

In our last Algorithmic Curation Round, consisting of 477 contributions, your post is ranked at #296.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

@wildtrader thanks for the well explanation

Thank me later http://b.link/cryptotab

Your post was mentioned in the Steemit Hit Parade in the following category:Congratulations @wildtrader!

Great post!

But I think ETC is far from dead; it's still somewhat relevant and in marketshare terms, it's on the 15th rank right now on CoinMarketCap.

Unfortunately you've become rare on this platform.

I've seen your recent intermediate outlook on this one. Could your primary B of iv or alt red 2 also be a failing fifth wave given that it is a double bottom?