What it is Distributed Credit Chain?

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

Problems

The traditional financial industry is highly centralized. Financial transactions rely heavily on the endorsement and support of large financial institutions, with substantial transaction fees paid out to these institutions. Monopolistic financial institutions have in fact raised lending rates for borrowers and reduced the interest income for lenders.

Cost

The core model of a credit agency is to share the costs of non interest-earning elements and bad debts by charging the "good guys" who can pay back the money. For borrowers, it brings an additional cost.

Efficiency

From the credit agency's perspective, a lot of time and efforts are wasted in verifying the credit of borrowers who do not meet the agencies’ risk criteria, which leads to wasting resources and decreasing efficiency.

Profiteering

A centralized credit model entices many financial institutions to deviate from their primary purpose— serving customers. Aiming for profitability, they deduct lenders while squeezing borrowers, and expand their profits by extending their customer base.

How does Distributed Credit Chain solve problems? Here's how Distributed Credit Chain solves the problem:

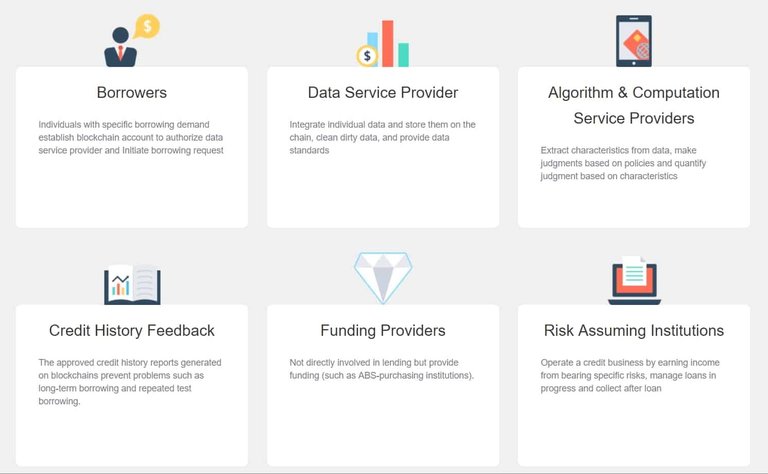

Borrowers

Individuals with specific borrowing demand establish blockchain account to authorize data service provider and Initiate borrowing request;

Data Service Provider

Integrate individual data and store them on the chain, clean dirty data, and provide data standards;

Algorithm & Computation Service Providers

Extract characteristics from data, make judgments based on policies and quantify judgment based on characteristics;

Credit History Feedback

The approved credit history reports generated on blockchains prevent problems such as long-term borrowing and repeated test borrowing;

Funding Providers

Not directly involved in lending but provide funding (such as ABS-purchasing institutions);

Risk Assuming Institutions

Operate a credit business by earning income from bearing specific risks, manage loans in progress and collect after loan.

DCC ECOSYSTEM

DCC is the credential used to pay for jobs in the Distributed Credit Chain. Any work in the DCC needs to be paid for with DCC. DCC balance is managed through DCC token contract to maintain a fixed total amount of DCC. As the financial service system in the DCC grows, more and more distributed business scenarios are embedded and used more frequently, which greatly increases the liquidity.

DCC's payment is handled based on the DCCpayment contract, which is responsible for the DCC payment rules for multi-payer participation.

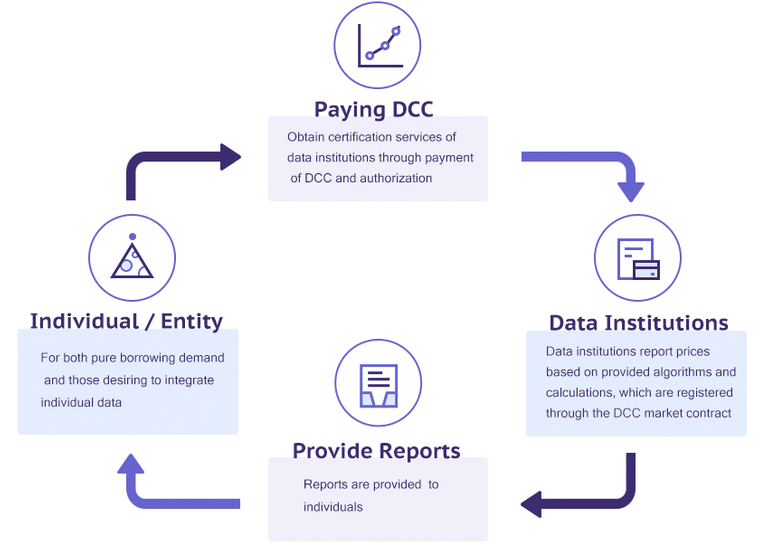

Use of DCC in Distributed Credit Chain

In DCC system, the individuals that require data or reports from data institutions need to pay DCCs. Such mode will transform the orginal way that data institutions generate revenue, that’s, from making profit through collecting and reselling user data to through providing better services to customers.

Credit institutions also need to pay DCCs to the certification body when verifying the validity of the data. However, the changes in the revenue structure of the data institution will greatly reduce verification costs , which will further reduce overall cost of the borrower.

ICO

Token info

- Token: DCC

- Platform: Ethereum

- Token Price (in ICO): 0.00007299 ETH (0.0328958631 USD)

- Total raised: 49,000,000 USD

- Token for sale: 500,000,000 DCC (5%)

- Token supply: *10,000,000,000 DCC

Investment info

- Soft cap: 200,000,000 DCC

- Hard cap: 500,000,000 DCC

- Accepting: ETH

- Restricted countries: China, United States of America

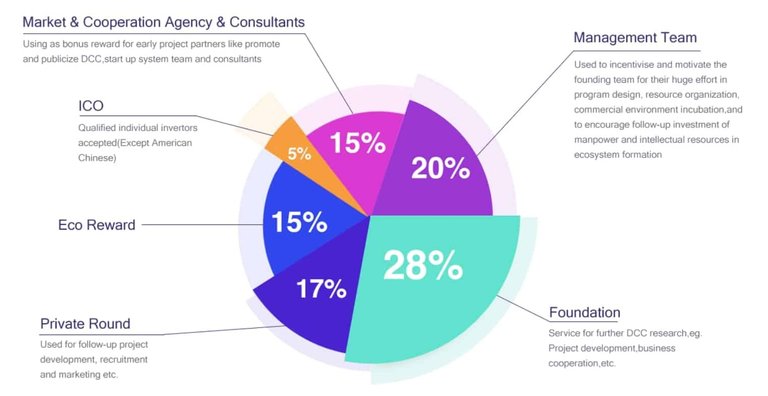

Token Allocation

Roadmap

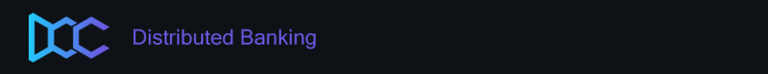

Core Team

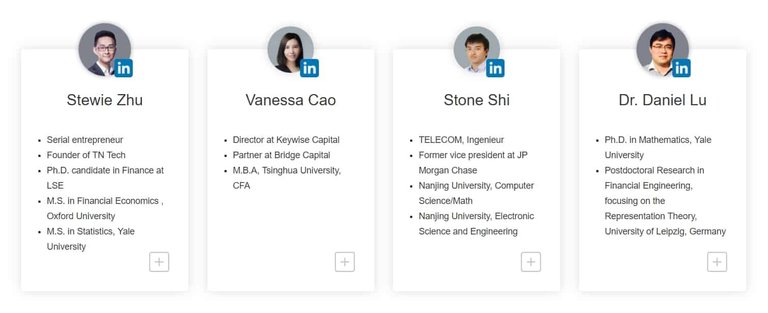

Advisors

Advantage

Break the Monopoly

With a global distributed banking ecosystem, DCC aims to break the monopoly of traditional financial institutions and to return earnings from financial services to all providers and users involved in such services so that each participant may share the return of ecological growth. distributed banking will ultimately be a way to truly achieve an inclusive system of finance.

Decentralized Thinking

Through decentralized thinking, distributed banking will be able to change the cooperation model in traditional financial services, building a new peer-to-peer and all-communications model of cooperation across all regions, sectors, subjects and accounts.

Transform Business Structure

As it pertains to business, distributed banking will completely transform traditional banking's debt, asset, and intermediary business structure. The tree-like management structure of the traditional bank will thus evolve into the flat structure of a decentralized bank, establishing distributed standards for various businesses and improving overall business efficiency.

Government Regulation

As it pertains to regulation, the fact that all records registered in the blockchain cannot be tampered with will enable regulators to penetrate the underlying assets in real time. Big data analysis institutions will also be able to help the regulatory bodies understand and respond to industry risks more quickly based on blockchain data analysis.

To study this Distributed Credit Chain project in more detail, I recommend that you read all the necessary technical documentation and social resources of the DCC, on these links:

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://dcc.finance/

Congratulations @wirshtrez! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes