Good afternoon my friends.

Bitcoin again bounced nicely off approximately 6000 and by the chart below you will see key support here. We are writing less frequently of late but last Wednesday at 6425 we wrote we are no buyer here and with sentiment at 78 percent bulls (DailyFX) the likelihood was to again decline to support at 6000.

There is a lot to like on a longer term basis but my point is SENTIMENT (and this is almost to the minute is BAD. You may not want to believe in "its" importance but you can see that since January at 15,000 and every 1000 plus point move in either direction, we have been "on it." (look it up.)

The dilemma for me is there is reason to "bounce" off 6000 but we are at 79 % bulls as I write and I won't forecast any reason to buy here. My "buy" at 5850 end of June was met with "sell" about three weeks later with a well over 30% return..

My question to you (and there are astute followers here I greatly respect) are we going lower and how much so? As you may know I let the market dictate rather than say "It's 4000" etc.

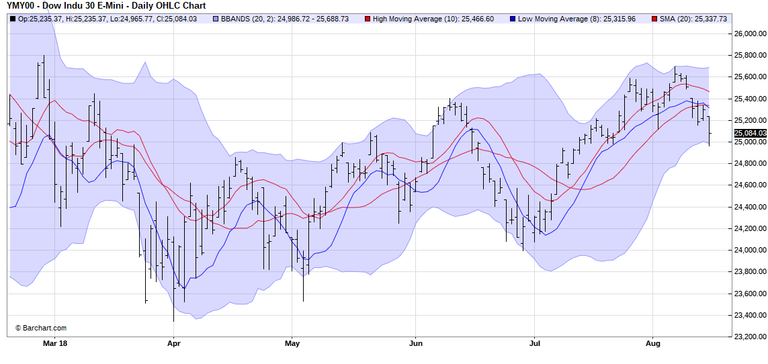

The Dow Jones: I maintain the odds favor new highs this year. Realize I said Sell in January at 26,400 and saw a great buy and called it in late June, about 24,100.

SENTIMENT at this moment is bullish. Put/call ratios are of the best in the last two years and about where they were in Late June. The last call was BUY and it remains...beware there are very dark clouds on the horizon. Turkey is just a small spec. I expect a troublesome 2019. Debt is just so out of control it is absurd and can't continue. And I believe we are playing right into China's hands. That discussion is for another time.

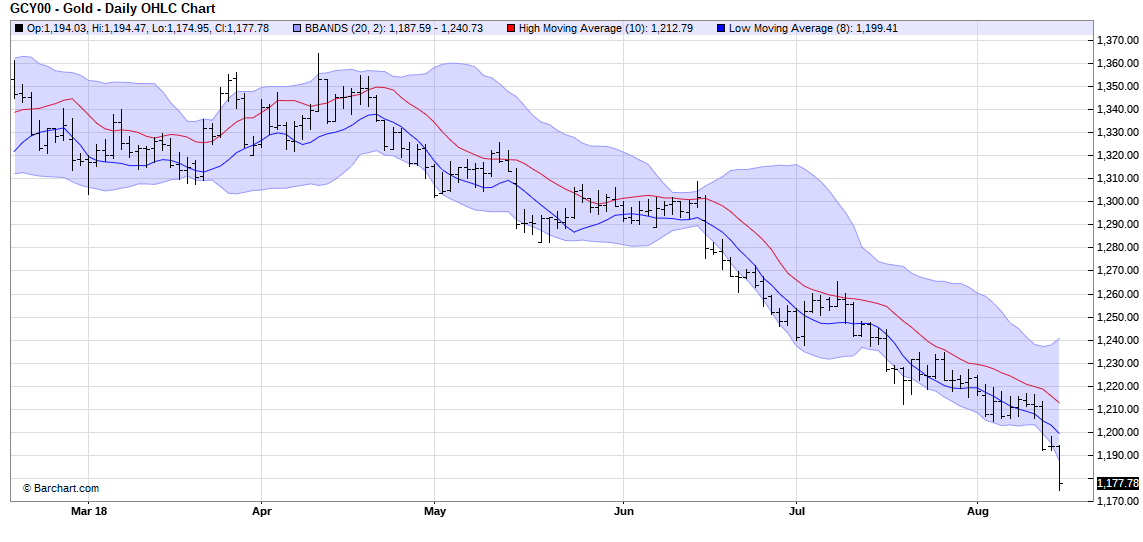

Now for the real FRUSTRATION, below.

I tell it like it is or at least try to and stated worst case lower 1200's and a Sept. bottom. Am I Frustrated? You bet. Heck I was bullish at about 1300. Of course I've mention RON ROSEN for a while. And he is (my opinion) the best I've ever read. Find his "freebie" on 321 gold about weekly. He has not wavered from 1140 in November

and then a surge of massive proportions with new highs in 2019.

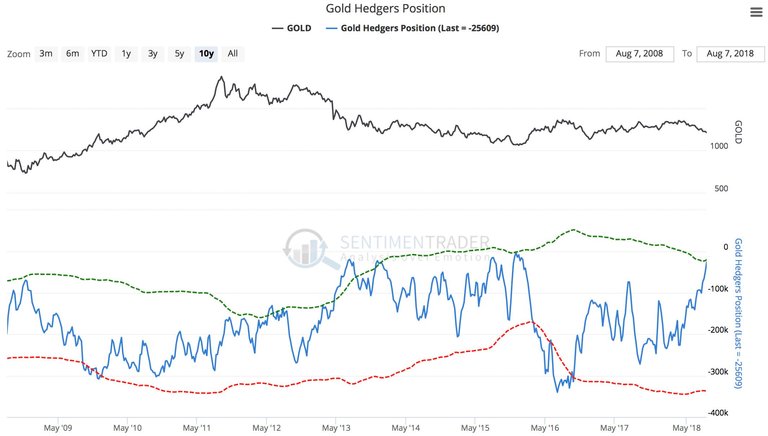

I can tell you (and see the chart above) SENTIMENT and COT reports are where every major bottom has lied. We now have the best readings (Commercials covering ) easily since '08. In fact I heard an interview with the legendary Jimmy Rogers recently and he reiterated that he was not buying at 1300 but expected a move closer to 1000 and he'd be loading up. Rogers expects (going forward) big dollar Issues and China to be very much in control! Gold? He expects it to be phenomenally higher. Actually he prefers silver!

Above see the Commercials, the most bullish in 10 years. They are about the best lead indicator. Your patience will be rewarded, but it has not been easy.

Thanks for your support, as always.

@yankee-statman appreciate your updates and reports. I'm curious what how you feel about bitcoin - longterm. You've been right on with your assessments all year long and I'm curious what you're thoughts are for 2019 and 2020. Obviously I know its really difficult to forecast that far out, but I'm still very high on bitcoin for the longterm. Thanks for the info as always...

And I greatly appreciate your support and comment! This is really tougher for me. As you see I'm bullish as can be longer term on gold/silver...and neg. the dollar, my "gut" and that is all it is, says is BTC will be much higher. Things will be in place for that to happen. The dollar will be in big trouble and my thoughts have been Bitcoin will benefit, too. I hope we are both right!

For sure! I enjoy your updates! Thanks for your assessment - I appreciate it. That is what my 'gut' has been telling me too. Right - I hope so too! Thanks again for taking the time to provide some great feedback as always.

Carnage in the coin markets and silver/gold. Loading up. Did a 1-day VOO bounce. Dollar is being pumped hard.

Thanks my friend..I first bought physical gold and silver in '02. The set up we are seeing right now is the most bullish since then.

@yankee-statman those frequent bounces on the 6k mark are always followed by the 20bi pump in market cap, strange. I'm not an expert on TA and at this point I'm scared enough to enter again on Bitcoin after my account being so negative hahahah.

Thanks for the TA.

thank you Arthur..and the best..troublesome is that there is little fear n BTC..ane that is what always moves market..that and greed..(at tops) so I have little confidence it can move higher hear with any gusto..

I will continue waiting...

I would take care of this point. Currently there is a danger of a bigger drop. Sometimes it is better to miss the chance to earn some money but

not risk losing everything.

agree...100 percent.

Wow! Wouldn't that be something. $1000 or even $1140 gold. Interesting times are ahead. Has Rod Rosen mentioned his forecasts on silver?

only gold and the dow....the dow ultimately below 10,000..Rogers speaks of silver eventually triple digits..thanks..

I enjoy your reports but I'm not sure how accurate your sentiment gauge is.

Right now shorts for BTC are closing in on an all time high (https://www.tradingview.com/symbols/BTCUSDSHORTS/) and fear is at very high levels as well (https://alternative.me/crypto/fear-and-greed-index/)

I think we're looking at a short squeeze soon, followed by a slow descent back to mid to upper 5k's.

Love seeing your thoughts, thanks for posting.

thank you...appreciated!.. that move from 5950 to 6550 was perhaps the "short squeeze"..Wehad lots more "pessimism" in late June..but I agree likely to visit mid 5's.

I would tend to agree if I saw the shorts depleted, but they're still on the way up and haven't dropped the way they would in a squeeze. Whatever the high of that squeeze is, I'm guessing 6800-7200 is likely where we start making our way down to the mid 5s.

Time will tell!

that is true..and we are at an important juncture..and that 6800 -7200 could be.!

Thanks for the post Statman. NVT will have to drop below 20 to make the rate of return more inticing.

Smart money should start entering at those levels. That will happen by a price decline or price consolidation while waiting for user growth to drop the ratio.

Unfortunately there is no statistical advantage in predicting a breakout in either direction at this point. But I am leaning towards the downside or a flat price until we get better valuations.

A 20 NVT would give bitcoin a MC of $80B ($4B daily transaction value) or $4700 per. If we do see a breakout on the downside, $5k is the buy zone for me at this point. Thanks again for sharing your ideas. It is very helpful and appreciated.

excellent!! thanks

Great post.it is very nice topic

Thanks for the analysis, it's a shame that you are writing less often at the moment.

thank you so much for the support..we will pick up the activity in the fall!

Woah

Posted using Partiko Android

Thank you for your continued support of SteemSilverGold

tough times of late..and thanksTP