Please watch from 10:15 in this YouTube video:

I was watching through Binance's CEO CZ's video on how Binance itself is regulating new ICOs by holding ICO funds(around 70%) and slowly flooding the market as the company behind ICO reaches milestones. (Watch from 10:15 in above video to understand current ICO Deals on Binance) Now, this seems like a great idea for protecting traders and investors from ICO scams but there is one BIG FLAW. That is, Binance is acting as a police/central bank for ICOs and the ICO team at Binance is the central team that controls the majority supply of these ICOs.

Since Binance itself is just an exchange and they are not an approved platform by the government or any 3rd-party entity, this can easily end up with insider trading within Binance. In other words, too much power has been given to Binance with too much supply of new coins. Also, when a new milestone has been reached, insiders will buy or sell the coins few hours before and pump up or dump down the price while Binance dumps new coins on their exchange. At this point, you will simply have to "trust" the ICO team at Binance and hope that no one leaks information before the coins are released.

The main problem here is that humans are greedy and when an insider trading is possible, people WILL take advantage. The solution to this problem is to make sure there is a 3rd-party auditing company who watches these coin releases from Binance and make sure there is no insider trading going on or simply do not let Binance control the supply of these ICO coins. Also, Binance is charging ridiculous amounts of money (near $1 million USD) for ICOs to get on their platform. Basically, this is a totalitarian nazi-like method that benefits Binance more than the traders or ICO companies.

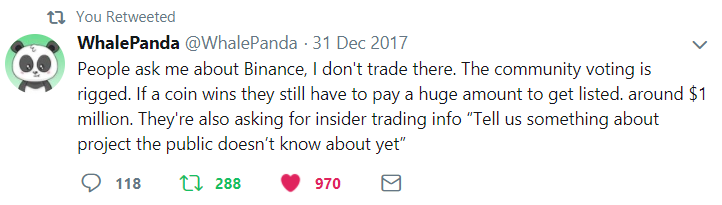

(You can see many OG crypto traders are staying away from Binance for this very reason, a flawed ICO system.)

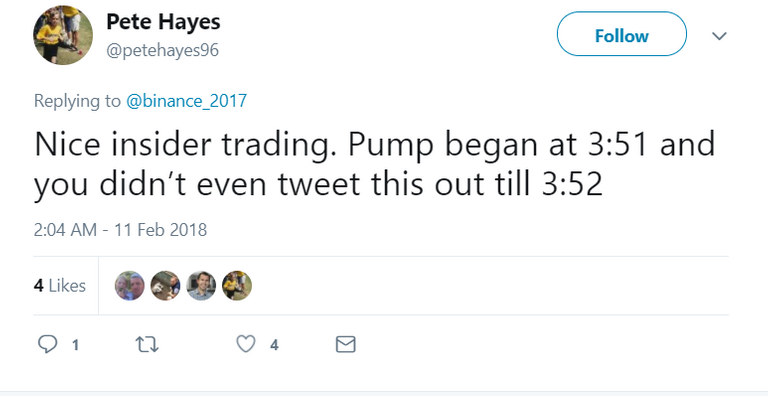

Now, cryptocurrency is NOT regulated, insider trading is 100% legal at this point. And we already have multitude of evidence that insider trading is going on and I have been a witness to it. Couple weeks back, when Steem got on Binance, we saw a very big pump 3 hours before the announcement and Steem getting on Binance, which clearly demonstrates insider trading. While Steem isn't an ICO, that event clearly proves insider trading has been going on at Binance. While Binance employees might not directly do insider trading but they can easily tell their family or friends about it. THAT is the problem, the way it is setup up at Binance, insider trading is going on while all of us traders have no idea.

There are also 2 reddit posts about insider trading from Binance which I posted them on Twitter yesterday but Binance reddit has moved since the last 12 hours! Binance is certainly trying to hide all evidence.

(Someone at Binance does not want truth to be told, Binance has moved Binance reddit to a new one to erase evidence as of this morning.)

So what?

Binance's rise in the last 6 months have been exponential, they did this through a lot of affiliate pyramid marketing(referrals) and by holding a lot of new ICO coins(70%) in their exchange. While CZ's idea is a great idea for preventing fraud ICOs, it is also inviting new insider trading from Binance's own employees.

Why did I write this?

I have been very fond of Binance and started trading on the platform about a month back. In the recent problems with the exchange shutting down for around 48 hours due to too many users and DoS attacks, I have been worried about Binance being hacked. While I don't think it was hacked or it was a big enough hack to affect anything, I have stumbled onto CZ's video and realized how flawed their ICO deals are. Also, CZ the CEO Binance went out of his way to block me on Twitter(while I have not tweeted him nor checked out his Twitter before that), which seems strange as if I were him, I would reach out to my customers and try to communicate things thru.

Okay, the truth is that insider trading is going on many exchanges anyways but my point is that you should all be aware of things that may be going on in the background with these exchanges. Knowledge is power and hopefully this enlighten you on what could possibly go wrong when an exchange has too much power.

Best, Max

More evidence:

Also see:

https://bitcointalk.org/index.php?topic=2813504.0;prev_next=prev

P.S. Try doing your own research, do a search on Twitter for "Binance Insider" and you will find many more suspicious events.

Great expose Max, thank you! I don't use Binance much myself because you can't trade fractions of a coin, it's just always annoyed me, I still have dust there that I can't get rid of.

Yeah that is ANOTHER problem.

Hey Max just want to say man, I'm such a huge fan of your YouTube channel. Crypto has been my life the past year and watching your videos has been such a massive part of my journey. Staying up late every night researching on reddit, CMC, trading on the exchanges and watching your hangouts for a laugh to keep me going. It's been a crazy journey, not many of us out there as determined as your audience I think. I'm sure I'm not the only one.

Thanks for everything you do!

Lol me too man, never NUNCA ever give up, there will be many millionaires in the next few years and really all you gotta do is buy some good coins and hodl.

Definitely, I'm hodling tight! Hey Max have you thought of delegating out your Steem Power? You know you can delegate it to services like @minnowbooster and get paid SBD and SP every day. We've both got around the same SP and if you're not very active here on Steemit it's a good way to just have some passive income coming in. It's what I've been doing for a few weeks now and I get around 4-5 SBD a day, so around $15-$20.

Good write-up Max! There are many issues, and potential issues, with the current exchanges and what one of my Finance Professors called the "Agency Problem". For those in economics, banking, or finance, you may be familiar with this. The Agency Problem is based on a core tenant of capitalism: that each individual in an economic system is driven by their own self-interests creating market efficiency- an unfortunate downside of free markets. Knowingly or unknowingly, those with better position, greater knowledge, have little disincentive to act in their own interests even if it negatively impacts their customers/clients. Again, I believe there are situations where this is not intentional, and it can be challenging to determine the intent of the parties involved.

Fortunately, Max brings up a good point that seems to be supported by the recent congressional meetings.

Self-regulation by the community. Some, it seems, interpret this as the individual organizations regulating themselves. However, the "3rd party audit" is a solution, as Max mentions in this article.

The 3rd party doesn't necessarily need to be a "company", as that typically implies centralization, which could lead to further challenges and potential corruption.

How would a decentralized, open, crypto-audit organization look? How might one function?

An Idea for a new article!

All the best,

Travis

This is not a Binance-only thing. For some time already odd transactions are facilitated by "offshore" Ethereum wallets, which cross-trade massive volumes, both ETH and tokens, from one exchange to another, systematically.

Tell me, who owns this wallet?

https://etherscan.io/address/0x6523a1744ab3901607db71c45c5fe624a2bcdf23

KuCoin, Binance, or Gate.io?

Maybe a form of wash trade, or just something I overlooked. Anyone care to give some insight? Have literally dozens and dozens of such wallets bookmarked.

And to get ontopic, loads of other exchanges promote coins by competitions etc. Whales always win those competitions, and the price they win is of course a nice compensation for the risk taken by pumping that coin. It's a win-win for everyone except the customer.

Binance as well recently started doing these coin trading competitions, and they are listing their own ICO's, and they have a enormous pile of money. Well, do the math. Whale time is over, the zerg time has come.