Content adapted from this Zerohedge.com article : Source

by Tyler Durden

The Japanese cryptocurrency exchange Coincheck had to admit having been targeted by hackers who got away with NEM coins worth half a billion dollars on Friday.

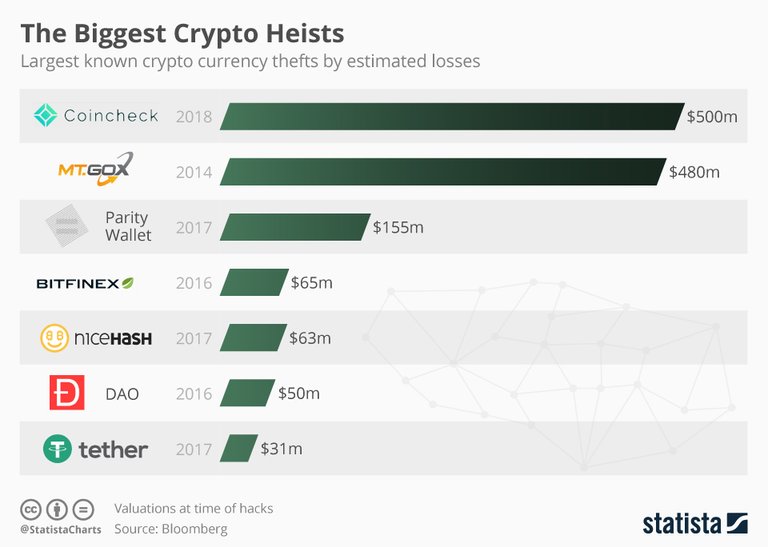

As Statista's infographic based on data by news agency Bloomberg shows, this wasn't the first such heist.

You will find more statistics at Statista

In 2014, the crypto exchange Mt. Gox lost digital currency worth some 480 million dollars. The company based in Tokyo said it had probably been stolen and had to file for bankruptcy in the United States and Japan shortly after. It had been one of the leading bitcoin exchanges.

Coincheck for its part has assuaged its customers that any losses would be refunded, and further reassuring investors - sending the price of the hacked NEM surging higher - developers behind NEM created an automated tagging system to track down the funds stolen by hackers.

As CoinTelegraph reports, the NEM development team created an automated tagging system to ensure that all funds stolen from Coincheck are traced. By tagging stolen funds as tainted funds, cryptocurrency exchanges can now easily verify if stolen NEM funds are withdrawn or deposited to regulated trading platforms.

Image Courtesy of CoinTelegraph

"Hack update: NEM is creating an automated tagging system that will be ready in 24-48 hours. This automated system will follow the money and tag any account that receives tainted money. NEM has already shown exchanges how to check if an account has been tagged. So the good news is that the money that was hacked via exchanges can't leave," said a NEM spokesperson.

During an interview, NEM Foundation vice president Jeff McDonald confirmed the development of the tagging system and the work NEM Foundation will lead in the next few weeks to prevent stolen funds from being cashed out or converted to other cryptocurrencies through trading platforms.

As of now, the hackers behind the Coincheck NEM security breach are out of options. It is not possible for the hackers to convert the stolen NEM to other major cryptocurrencies like bitcoin and Ethereum because the automated tagging system will immediately alert exchanges about the tainted funds.

Due to the sheer size of the stolen funds, it is also not likely that the hackers will go through small-scale cryptocurrency exchanges to convert or launder the stolen funds.

At this stage, the only safe option for the hackers is to hold onto the stolen NEM. Because of the technology NEM has developed in light of the recent Coincheck hack, it has become significantly difficult for the hackers to do anything with the funds. It is not possible to cash out the stolen NEM to fiat currencies like the US dollar and it is also not possible to convert the stolen funds to other cryptocurrencies.

NEM, its open-source development community, and the NEM Foundation did not have to develop the tagging system for the benefit of Coincheck, specifically because stolen funds on the NEM blockchain network would still have circulated around the network even if they are not recovered. But, NEM developers have done Coincheck and investors that lost millions of dollars in the hacking attack a tremendous favor by voluntarily creating a solution to a serious problem.

WE REACHED OUT TO WWW.ZEROHEDGE.COM AND RECEIVED CONFIRMATION THAT THEY ARE NOT AWARE THAT THEIR CONTENT IS BEING USED ON STEEMIT AND THAT THEY DO NOT CONSENT FOR IT TO BE USED HERE FOR PROFIT.

Copying/Pasting full texts of articles from known internet personalities without their consent, and without adding anything original is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

"Quinn Chuck" and the theft of 523 million coins from Neem, worth $ 534 million, Queen Chuck announced that it will return all amounts to all its 260,000 users who have fallen prey to the predators.

Exchange representatives disclosed that the funds were stored on a single-secured Internet-connected portfolio, which created a relatively low security environment.

The company is still studying the exact and systematic timing of the process. However, it has already announced that the compensation for each NEM currency will be JPY 88.549, the weighted average exchange rate during the trading period until the last announcement.

In addition, Queen Chuck reiterated its intention to continue its business, rather than declaring bankruptcy.

Neem currency theft is the biggest breakthrough in digital currency history since the collapse of MTJOX, which also occurred in Japan.

Bruce Wayne: Criminals aren't complicated, Alfred. We just need to figure out what he's after.

Alfred: With all due respect, Master Wayne, perhaps this is a man that you don't fully understand. When I was in Burma, a long time ago, my friends and I were working for the local government. They were trying to buy the loyalty of tribal leaders by bribing them with precious stones. But their caravans were being raided in a forest north of Rangoon by a bandit. So we started looking for the stones. But after six months, we couldn't find anyone who had traded with him. One day I found a child playing with a ruby the size of a tangerine. The bandit had been throwing the stones away.

Bruce Wayne: Then why steal them?

Alfred: Because he thought it was good sport. Because some men aren't looking for anything logical, like money. They can't be bought, bullied, reasoned or negotiated with. Some men just want to watch the world burn.

@zer0hedge....Correct. Both the Mt. Gox and Bitfinex hacks would have been multi-billion dollar heists if they happened today.It's the same thing with the DAO hack. That happened when ETH was only $20. If the DAO hack occurred right now, it would be roughly $4 billion in stolen funds..so, you could say that joint-stock colonial investments ended up being a financial revolution for most of the 1700s and 1800s, despite the way the SSC started the 18th century by the same token, the internet had company bubbles but both the technology and industry ("tech") and how it changed equity valuations/raising capital both ended up sticking around heheso i'd never just capital-raising colonialism, the tech sector and modern capital-raising, or cryptos on just 1 actor being a bubble ...local government. They were trying to buy the loyalty of tribal leaders by bribing them with precious stones. But their caravans were being raided in a forest north of Rangoon by a bandit. So we started looking for the stones. But after six months, we couldn't find anyone who had traded with him. One day I found a child playing with a ruby the size of a tangerine. The bandit had been throwing the stones away..thank you for sharing with us...

MT.Gox and Bitfinex hacks!!!what do u mean, I didn't get it.

@zer0hedge...Oh, shit. Don't forget the biggest heist of all: The Central Banks, IMF, BIS, and the FED. These crypto fags are like pennies in a UNICEF box when I was 7 on all Hallows Eve ringing doorbells.ust over a Billion in theft losses ,averaging 300 million per year and growing with every hack.How much more do they have to lose before classification and assignment of realistic risk..No, you're not. It seems like NEM's entire modus operandi is all about tracing and tracking. Their Eigentrust system and proof-of-importance algorithm constantly monitor the activity of all the nodes in the network. If anything could be centralized at a whim, it's this.Since the exchanges are COMPLETELY UNREGULATED. They can and are keeping account balances at their whim, and when too many people call them out - blame a hacker, keep the balances, and close down the exchange...

No, you're not. It seems like NEM's entire modus operandi is all about tracing and tracking. Their Eigentrust system and proof-of-importance algorithm constantly monitor the activity of all the nodes in the network. If anything could be centralized at a whim, it's this.If you read the news you will see they reopened under a new moniker (wex.nz) and actually refunded their customers for the FBI hold up they have fallen victims to. This is the second time this exchange refunds his customers out of their own pockets further a damaging event, which is a testimony to their honesty and integrity. Not that many exchanges could claim to have done even half of it. Lastly, it.. ethereum's buggy as hell coding language solidity. Expect many more smart contracts running on ethereum to fail because of solidity.

I heard the news that NEM Foundation vice president Jeff McDonald confirmed the development of the tagging system and the work NEM Foundation will lead in the next few weeks to prevent stolen funds from being cashed out or converted to other cryptocurrencies through trading platforms.

As of now, the hackers behind the Coincheck NEM security breach are out of options. It is not possible for the hackers to convert the stolen NEM to other major cryptocurrencies like bitcoin and Ethereum because the automated tagging system will immediately alert exchanges about the tainted funds.

The Japanese police stated that Mt.Gox, which had stolen 650,000 Bitcoins four years ago, could not have been attacked by a cheerleader as claimed, but could have been victimized by an insider stupidity.

New information about the Mt.Gox scandal, which cuts the value of the virtual money Bitcoin from $ 1,000 to $ 300, has emerged. The Japanese police explained that the company was not exposed to the attack, as claimed by the company, but could have been victimized by the insurgency.

According to a report in the Yomiuri Shimbun newspaper, it is stated that only 7,000 of the lost 650,000 Bitcoins were stolen by someone inside the company, which was captured by hacker attack.

According to information provided by Coindesk, there were no full-time employees outside of Tokyo-based Mt.Gox, the French CEO of Mark Kerpeles. Kerpeles, who served only from outside to carry out certain transactions, was shown as responsible for the disappearance of 643 thousand Bitcoins.

Mt. Gox and some independent researchers have shown the source of the problem as "transaction malleability" that prevents the withdrawal of virtual money.

I've written it before. Coincheck will be something like this. This process was done internally. The money lovers wanted it to be. It was.

The labeling system is very useful. If it is really used. If you ask me this is part of the game. If we do not steal we are trying to save. She is making statements. We do not know what is spoken in the back room. But still the labeling system must be applied to all crypto paralara. I think that will prevent this situation. At least it becomes a barrier to thieves. @zer0hedge

If the $ 534 million NEM was stolen because of the Blockchain fault, a hard fight could have happened. However, since theft was caused by Coincheck's lack of strong security precautions, the NEM development team has strictly refused to conduct Hard fork.

Instead, the NEM development team created an auto-tagging system to track all funds stolen from Coincheck. By labeling the stolen funds as defective funds, the crypto money market can easily confirm whether or not the stolen NEM funds have been withdrawn or deposited on organized trading platforms.

$534 million was stolen because of blockchain ???how bro?

Thanks for the information, i just wanted to say if you keep your crypto on a exchange or a gambling site then you take a high risk of being hack, you should also keep your crypto on a papper wallet no matter how much it is worth. They cant hack your papper wallets and never ever show anybody your private key not your wife or your mother its called private key for a reason its only for your eyes. Its very easy to make a papper wallet and its the safest way to go

Or you can keep your cryptos on a decentralized exchange like OpenLedger on the Bitshares network.

Bitcoin is looking down after the bulls failed to defend a key level in the early Asian hours, price chart analysis suggests.

Prices on CoinDesk's Bitcoin Price Index (BPI) fell below $11,000 at 01:44 UTC today and hit an intraday low of $10,805 at 03:29 UTC. The recovery seen in the next few hours ran into offers at $11,063.80, pushing bitcoin (BTC) back to near the intraday lows. The BPI was last seen around $10,840.

Do u think that bitcoin can reach 30000dollar this year??

@zer0hedge very well posted sir thats a nice way to post on steemit should be appreciated well i m new to comment on your post

If other major cryptos did this it'd be a huge win for the cryptocurrency space, people would have less fear about never recovering hacked coin and exchanges would appreciate it I'm sure. I still feel exchanges should be using a large amount of resources for security though.

This is pretty amazing work by the NEM team, I'd really like to see others follow suit sooner rather than later.

I also think so bro.

Hi @zer0hedge ! Great post, i like it, i just upvoted it ! @wildvest

Whether Visualizing or any other, Crypto is the king everywhere....✌✌✌

I always says "never leave your money in the exchanges!"

That is why I have problems with centralized exchanges. These institutions could be an amazing security system which one time will be breached and a lot of money will desapear!

People needs to see that and migrate to decentralized exchanges!

Yeah money in exchange is always risky.

Thanks for the great news. I was very interested.

Thanks for this post @zer0hedge. Seeing these hacks and scandals on a chart really helps visualise the amount of money that has been stolen from people throughout the years.

I'm glad that the hackers were unable to exchange the funds so far and I hope that they won't be able to in the future, but I feel like they will find a way to get a decent amount of the funds out somehow.

Security in the cryptcourrency markets is essential, which is why we need contingency strategies, regulations etc.

Thanks!

I am still having hard time believing that Coincheck didn't use MULTI-SIG ?! how is that possible, you have half a billion in NEM coins and you don't bother to use multi-sig. That really sounds hard to believe.

Coincheck although being the biggest heist, it had a minimum impact on the market itself, as it is a very small percentage of the total cap. Mt.Gox was something else, though.

well this is amazing i am likeing this since i am reading you arycile got to learn more]

about crypto

Shortly after the breach, the company stopped all withdrawals from the site, hoping to stop any further damage to its funds. Asked if they would begin to allow "at least" paper currency withdrawals soon, Queen Chuck replied that this would be done after determining the best way forward.

It turned out that the money was stored on a simple online wallet instead of a more secure MultiSig portfolio.

The bourse expressed its willingness to refund all lost funds, but they are still studying how to deal with the situation. According to the press conference, the "worst case scenario" is that money can never be returned.

When asked if they had any words for customers, representatives of "Queen Chuck" said they were "very sorry" for what happened.

Welcome bro

$534million loss!! I didn't know that.