If we take a glance at the financial world today, we will see that digital currency and plastic monies have created an upsurge and are giving a tough competition to the traditional fiat currencies. These virtual currencies popularly termed as Cryptocurrency are used by groups or private individuals for the digital means of exchange.

But these digital tokens are yet to be regularised by several national governments and as such these are regarded as an alternative currency that resides outside the realm of the monetary policies. Several new cryptocurrencies are evolving every month, but Bitcoin holds the largest position.

Table of Contents

*An Introduction to Cryptocurrency

*How Did Cryptocurrencies start?

*Top Cryptocurrencies

*Understanding how to invest in Cryptocurrencies

An Introduction to Cryptocurrency

Cryptocurrency is accompanied with complex code system, i.e., cryptographic protocols utilizing which encrypted sensitive data are transferred.

These protocols are built on advanced mathematics and computer engineering which protects them from duplicity or counterfeiting of currencies. Using these protocols, Cryptocurrency users make transactions, thereby allowing the funds to flow to specific groups or individuals.

Cryptocurrencies are digitally created “coins” using cryptographic techniques that most people use in security/privacy fields.

How Did Cryptocurrencies start?

In the year 2008, a whitepaper submitted by Satoshi Nakamoto laid down the first outline of Bitcoin, the world’s largest cryptocurrency today. It is the first publicly used digital currency that uses a combination of user anonymity, decentralized control and record keeping using the blockchain technology.

Before we analyze how to pick the next Crypto winner, let's look at some Top Cryptocurrencies

1.Bitcoin (Payments & Storer of Value)

Invented by Satoshi Nakamoto, Bitcoin was meant to be an alternative for central banks. Since its inception in 2009, Bitcoin has been effective in solving real-world perils. To overrule the inflations associated with the centralized ledgers, Bitcoin was invented to showcase that a decentralized currency can be created as a means of financial exchange. Moreover, Bitcoin is used as a reliable value storer, which can be preserved for ages just like gold.

2. Ethereum (Smart Contracts & dApps)

Vitalik Buterin founded Ethereum in 2014 for creating a one-stop shop for the smart contracts and decentralized applications. After three years of the struggle, the smart contract and DApps are successfully implemented in the real world.

3. Ripple (Bank’s cryptocurrency)

The cryptocurrency Ripple is especially for the banks. It is a payment mechanism which allows the banks to send real-time international payments without the requirement of clearance hub. It complies with the central banking institutions so that it can be implemented on the top of the swift infrastructure.

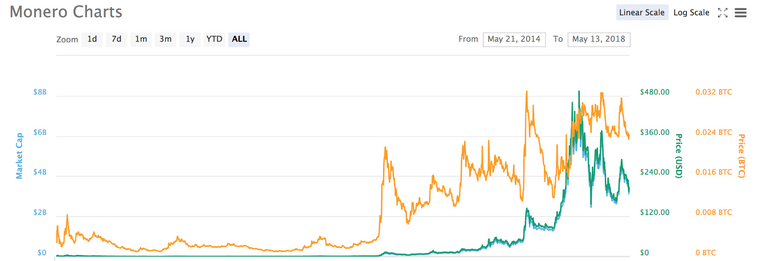

4. Monero (Anonymous, Private & Fungible Digital Money)

Bitcoin function on the blockchain technology where everything resides on a public forum and is transparent. Thus, Monero came into existence in 2014 with, a concept of making private, anonymous, and fungible digital currency. In 2017, Monero successfully implemented the ring signatures, stealth addresses, and ring CT technologies. But it is still left to implement the IP obfuscation.

5. Factom (Decentralized Notary)

In late 2014, Factom as an immutable universal record keeper came in the cryptocurrency market. Thus, once something is entered in the Factom platform it can’t be altered; thereby it acts like a trustable record keeper for the monetary transactions.

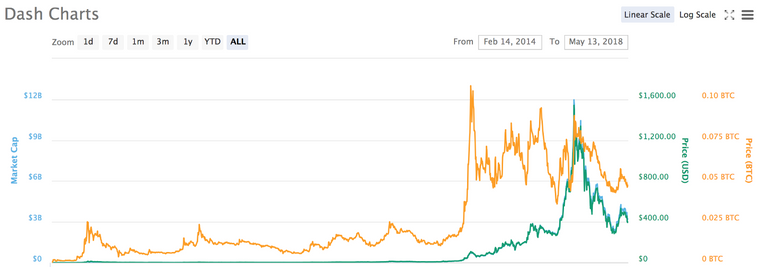

6. Dash (Digital Cash)

Incepted in 2014, Dash envisions studying about the best practices in the fiat world and help in the development of user-friendly products for the people. Although it is used in the backend users will not face any hassle while interacting with Dash because of the well-known traditional banking UI.

Understanding how to invest in Cryptocurrencies

First we need to understand why there are so many cryptocurrencies exist and how do you choose the winners.

As while investing in the stock market one has to consider which sector(Financial, Aviation, Tech etc) the stock belongs to, in crypto you need to understand which asset class the cryptocurrency lies in. So that you can have a diversified portfolio with a better chance of good returns.

The cryptos which we explained above are just a few from the ocean of cryptocurrencies. Here are many more being developed to solve different real world problems. Following are the categories which are getting disrupted by the cryptos. We will talk about all these in details in coming posts.

1. Digital Cash (Bitcoin, Litecoin, Dogecoin, Reddcoin)

2. Privacy Coins (Monero, Zcash, Dash, Bytecoin, Verge)

3. Smart Contracts and dApps (Ethereum, Neo, QTUM)

4. Blockchain As Service (Komodo, IO coin, FCT)

5. Entertainment (Game Credits, Funfair, ENJ, VIB, TIX)

6. Media and Communication ( TRON, Gifto, Vibe, Poet, STEEM)

7. Identity (Civic, SelfKey)

8. Infrastructure As Service (Golem, Siacoin, ELF, RLC)

9. Finance (Augur, ETHLend, Bytom, HMQ, NAGA)

10. New Tech (VOX, Vibe, MANA, Cindicator)

11. Governance (Crown, Wings, District0x)

12. Internet Of Things (IOTA, ITC, Waltonchain)

13. Exchange (Bancor, BNB, Kyber Network Token)

14. E-commerce/ Marketing (Syscoin, Bitbay, Phore, AdEx

Picking the winners is hard, but if you invest in different crypto asset classes then the chances of your returns improve drastically. To understand more about the various crypto asset classes and the currencies we believe are the winners in that category subscribe to our investment series below.

The next article will be on Digital Cash Asset Class covering the winners and losers in the category, so do subscribe.

This article was originally published on CoinSwitch Blog