The Bitcoin Fad Is Fading for Now

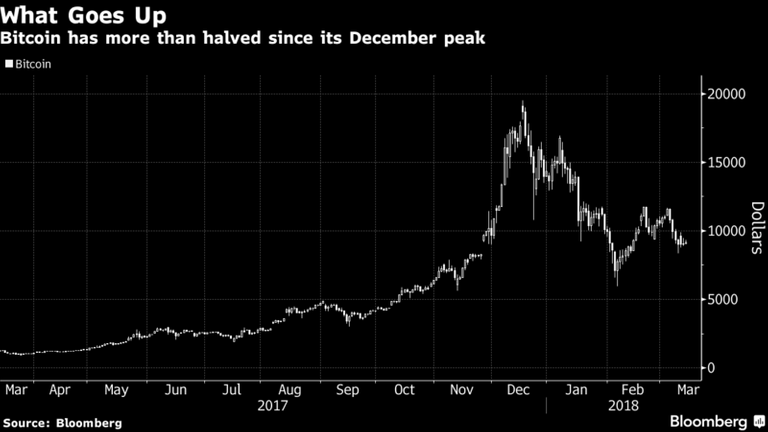

It might be hard to believe. But after the 1,400 percent rally of 2017, with wild swings along the way, the great crypto craze has cooled, at least for now. For the past month, Bitcoin’s price has stalled between $8,500 and $11,300 -- a minuscule range by its standards. And internet searches for “Bitcoin” have plunged, suggesting public interest has, too.

“The general public is now realizing that this is not a risk-free, get-rich-quick, investment opportunity and general interest has since diminished,” said Lucas Nuzzi, a senior analyst at Digital Asset Research.

Google Search Interest in Word 'Bitcoin' Over Time

A value of 100 is the peak popularity for the term

.gif)

The 2018 lull shows just how quickly investment fads can come and go. Gone for now are the days when Bitcoin dominated talk at holiday tables. Stories lately look a lot like the ones in the back sections of financial papers -- dry accounts of regulatory scrutiny, market structure and legal wrangling.

Online searches for “bitcoin” fell 82 percent from December highs, according to Google Trends. Tweets that mention the coin peaked Dec. 7, at 155,600, and are now down to about 63,000, BitInfoCharts says. And the number of bitcoin transactions is off 60 percent from its record on Dec. 13, according to Blockchain.info.

December brought “Bitcoin Craze Propels Coinbase App to No. 1 in Apple’s Store.” Now there’s “Bitcoin’s Wildest Days Are Over as Regulators Circle.” Indeed, Bitcoin’s been in the news for all the wrong reasons lately.

Its price slumped Wednesday after Google said it would prohibit cryptocurrency ads, following Facebook’s move from January. Major banks including JPMorgan and Bank of America banned crypto purchases on their credit cards, the Securities and Exchange Commission has stepped up cryptocurrency oversight and Congress is holding hearings on how to treat the digital coins. Earlier this month, Allianz Global Investors argued the the coin’s “intrinsic value must be zero.”

“The story with Bitcoin is pretty straightforward,” said Roger Kay, president of research firm Endpoint Technologies Associates Inc. “It went up fast, and then came down even faster. Consumers who flocked to it late got burned. They are in the shadows now, licking their wounds. And others contemplating how to get rich quick are acutely aware that what goes up can come down, and maybe Bitcoin isn’t the way to go about it.”

Of course, Bitcoin’s obituary has been written countless times in its nine-year existence. In fact, 111 such stories appeared last year when it was on a tear, according to 99bitcoins.com. Almost forty have been written so far in 2018, on track to top that level.

Still, just Wednesday, people familiar with the matter said hedge fund billionaire Alan Howard made sizable personal investments in cryptocurrencies last year. And even Allianz doesn’t think Bitcoin is done for, not as long as the number of speculators and crypto true believers remains high. Coinbase says it still has more than 20 million customers, though it’s not clear how many have been active recently.

And this isn’t Bitcoin’s first slump. It’s had at least three declines of 70 percent or more since 2010 only to come back with a vengeance and reach higher highs.

For now, though, boring might be the new normal as the decline in public interest could leave Bitcoin in what for it could be considered a tight range. Remember, after a rally boosted its price 84-fold in 2013, it tumbled back down in the next week and held there until lifting off again in 2017.

Yes, the slump lasted more than three years.

Bitcoin Is Worthless, Bubble May Pop Soon, Allianz Global Says

By Cormac Mullen

It’s a matter of when, not if, the Bitcoin bubble will pop, according to Allianz Global Investors.

The cryptocurrency is worthless, even if blockchain technology could bring significant benefits to investors, said the investment arm of Europe’s biggest insurer, which manages almost 500 billion euro.

“In our view, its intrinsic value must be zero,” Stefan Hofrichter, the company’s head of global economics and strategy, wrote in a recent web post. “A bitcoin is a claim on nobody – in contrast to, for instance, sovereign bonds, equities or paper money – and it does not generate any income stream.”

While one could make the same argument about gold, the yellow metal has been widely accepted as a store of value for more than two-and-a-half thousand years -- compared to less than a decade for Bitcoin, he said.

Textbook Case

In addition, the world’s largest cryptocurrency “ticks all of the boxes” of the essential criteria for any asset bubble, including overtrading, “new-era” thinking and rising leverage, he wrote. Bitcoin mania is a textbook-like bubble, “one that is probably just about to burst.”

Hofrichter joins a chorus of commentators casting doubt on the underlying value of the digital currency. University of Pittsburgh researchers concluded it’s “an asset which has no value by traditional measures” and economist Nouriel Roubini called it the “biggest bubble in human history.”.

Bitcoin traded 0.7 percent higher at $9,126 as of 2:45 p.m. Tokyo time. It pared an advance of about 2 percent after Google announced it would ban online advertisements promoting cryptocurrencies and initial coin offerings starting in June. The digital currency has more than halved from its December peak.

Still, the bursting of the Bitcoin bubble won’t have a large impact on conventional asset classes such as stocks and bonds, according to Hofrichter.

“Bitcoin’s demise would have few spillover effects on the ‘real world,’ since the market for this cryptocurrency is still quite small in size,” he said. “As a result, we believe that the risks to financial stability stemming from bitcoin are negligible -- at least as of today.”

Source

https://www.bloomberg.com/news/articles/2018-03-14/google-to-ban-cryptocurrency-initial-coin-offering-ads-in-june

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/news/articles/2018-03-14/bitcoin-pop-culture-moment-fades-as-fad-gives-way-to-regulators