Now this is tulips.

Most people seem to know that tulips were a speculative bubble in Amsterdam in the early 17th century, the first known speculative asset bubble. What's less well known was that it was not simply that tulips became more expensive in general (they did, but it was not the driving force of the bubble). Farmers discovered that their tulips were taking on unique patterns. Those patterns could be recognized while the tulip was still just a bulb, but it was difficult to actually selectively breed for, it was not simply passed genetically as normal traits are. We know today that they were caused by a virus, but it was a mystery at the time.

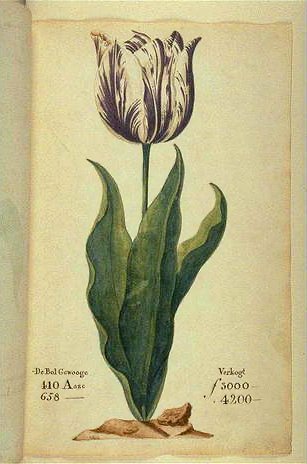

Because the tulip patterns were extremely rare and unique, they became symbols of status for Dutch aristocrats, who paid a lot of money for the most rare/impressive speciments. The one below was worth the equivalent of $300,000 today.

The Amsterdam stock market began to sell Tulip futures for certain breeds, so that you could be guaranteed a specific price for a certain speciment at a point in the future when it became available. Prices rose quickly on speculation that French aristocrats would join in on the craze. They did, a little, but not enough to prevent the whole thing from completely collapsing in February 1637.

This Crypto-Kitties thing has a lot of parallels. I wonder how what the ratio of craze to speculation is...

Interesting. I knew the overall story of the tulips, but didn't realize what started the craze.