When it comes to cryptocurrency investing or trading, there is always risk involved as the cryptocurrency market is very volatile and heavily influenced by a lot of factors which means that no prediction is 100% certain and the market can anytime go against any price prediction. This is where risk management comes into play because it is basically a strategy that helps a cryptocurrency trader or an investor to reduce risk and in turn make the most profit.

In trading or investing, there is no set out formula as nothing is certain most especially in the cryptocurrency market. There is always pros and cons in ever strategy used by traders that is why every trader have their own strategy that works for them. For me, when it comes to risk management, I focus on stoploss, risk/reward ratio, take profit, investment portfolio and risk capital.

Stoploss

Stoploss is a very good risk management strategy and I make use of it in trading any cryptocurrency asset. Because of the highly volatile cryptocurrency market which is heavily influenced by a lot of factors, stoploss is very important to help reduce loss if a trade goes against my prediction. I like to set my stoploss not too close my entry price but at the same time, not too wide from my entry price. This is because when the stoploss point is too close to the entry price, there is a big chance that it will get triggered when there is a sharp drop and rise in price. Also, if the stoploss is too wide, there loss will be greater if the market continues to fall and triggers the stoploss.

I always try to find the right balance when setting my stoploss. Trailing stoploss is also another amazing feature because it helps me to always retain profit even if the market begins to fall. I start with the regular static stoploss when entering a trade, and when the trade is in profit, I change to a trailing stoploss to always preserve profit while also riding the upward movements to any limit until the market reverses and my trailing stoploss would trigger and preserve the profit.

.png)

Risk/Reward ratio

This for another risk management strategy that I use whenever I want to any cryptocurrency asset. Risk/reward ratio is important because it allows me to make the decision and decide what I am willing to lose in order to chase the gain, ahead before venturing into a trade. I like to use the risk/reward ratio of 1:2 because for me, I consider it a reasonable and logical ratio. Risking $50 to chase $100 is smart for me because it is not being too greedy but logical.

For instance, I might find a good cryptocurrency to buy with a capital of $1000 at a price of $1 per coin. My analysis tell me that the coin would make me a profit of $100 in a short time, however, since it is a new coin, there is a chance that the price might fall. I can set my stoploss at 5% of my capital and take profit at 10% of my capital. This means that if the price rises to $1.1, I would make my profit, however, if the price falls to $0.95, I would exit the market and wait to buy lower or move on.

.png)

Take profit

Take profit is another very important risk management strategy that I use because the more profit taken, the less loss in capital. I always try to take profit whenever I venture into any trade because anything can happen in the cryptocurrency market and profit made can be wiped out in an instance due to many factors such as sentiments, negative news. Depending on the trade, I can use multiple take profit points or take profit by exiting the market. This is important for me because it means I would have more capital to buy another cryptocurrency or wait for the price to inevitably retrace so as to enter the market again.

.png)

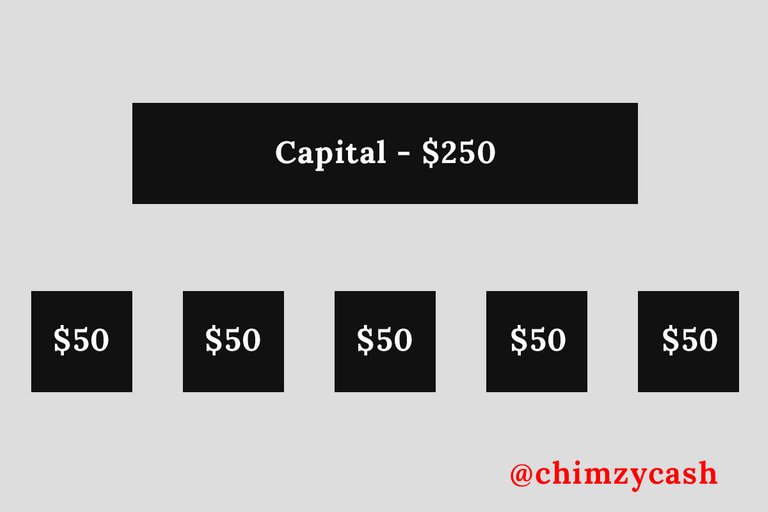

Segmenting trading capital into parts

Before venturing into any trade or investment, I like to segment my trading or investment capital into multiple parts and only trade with one part on a particular cryptocurrency. This is important because there is less risk of losing all the capital on a single trade. For instance, with a capital of $250, I can segment the capital into 5 parts of $50 each. I would only trade with $50 on a particular cryptocurrency so even if the market goes against my trade, I only lose $50 and still have capital left to enter another trade that can make me more profit and recoup the loss and still be in profit.