What is BitMEX?

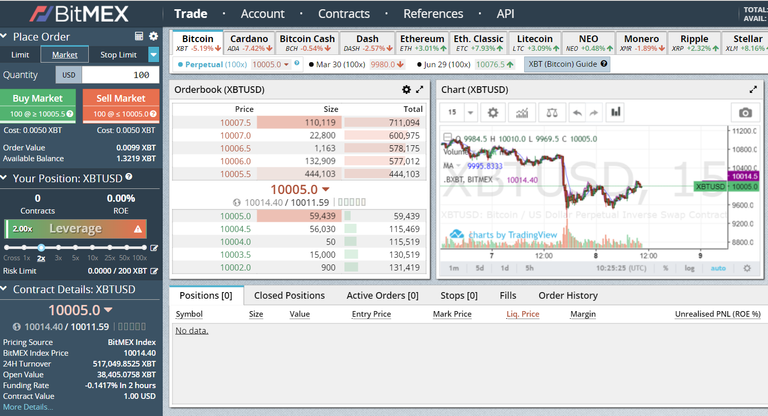

BitMEX, or Bitcoin Mercantile Exchange, is a cryptocurrency exchange founded in 2014 by HDR Global Trading Limited. The exchange is known for its highly-leveraged trading, including bitcoin futures contracts and perpetual swaps.

Today, BitMEX is the most liquid bitcoin derivatives exchange. At the time of writing, BitMEX had about twice the 24 hour trading volume of the next closest competitor, Binance. This high liquidity means tighter spreads and the least amount of slippage when executing market orders.

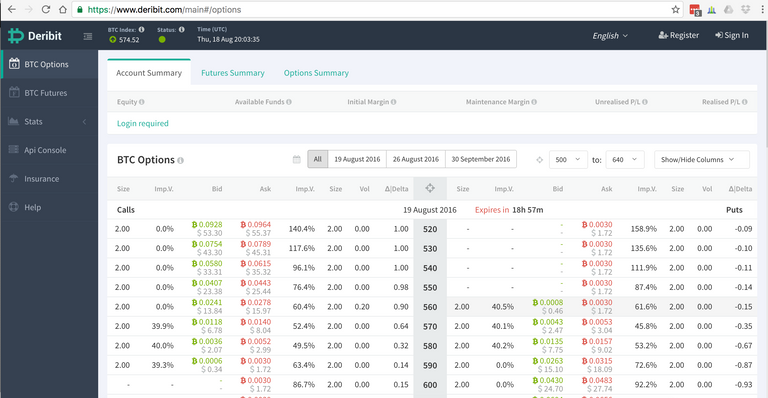

What is Deribit?

Deribit, meanwhile, is a Netherlands-based bitcoin futures and options exchange founded in 2017. The exchange launched with the goal of supporting simple, “vanilla” bitcoin / USD pairs.

In mid-August, Deribit decided to launch its own perpetual swap pair. Deribit announced plans to launch a BTC/USD perpetual swap in an effort to capture some of BitMEX’s $5 billion a day trading volume. BitMEX offers an XBT/USD perpetual swap.

What’s the Difference Between Perpetual Swaps On Deribit and BitMEX?

BitMEX and Deribit are competing against each other in a number of different ways. Options and futures traders, however, may be particularly interested in the differences between the way the two exchanges handle perpetual swaps.

The first and biggest difference between perpetual swaps on Deribit and BitMEX is the way the pairs are calculated. BitMEX calculates payouts every eight hours, while Deribit calculates payouts continuously.

BitMEX

BitMEX’s perpetual swaps work during an eight hour period. During this eight hour period, the system performs a time-weighted traded price versus a spot price representation. If the pair is at a premium, then traders in the long position pay traders in a short position, which makes going long less attractive and reduces the premium. If trading is at a discount, then traders in a short position pay traders in a long position, which attracts buyers and raises the price.

BitMEX recalculates this price every 8 hours. At 12:00, 20:00, and 4:00, BitMEX makes the payout between longs and shorts. Because of this interval payout feature, traders can jump in just one second before the scheduled payout and exit one second later and still receive payout.

The goal of BitMEX’s perpetual swap system is to provide the benefits of a futures contract without the annoyance of expiration. The main weakness, of course, is the interval gap payout of cash flow.

Deribit

Deribit’s perpetual swaps work differently. On Deribit, payouts are made continuously instead of at the end of the interval. The perpetual swaps system itself is similar. However, instead of clearing a payout every 8 hours, active positions receive continuous payouts based on the premium or discount versus the spot price. That means as soon as you enter the position, you’ll start receiving (or paying) a cash flow from (or to) the other side.

The benefits are obvious. Deribit’s perpetual swaps lead to a much smoother adjustment mechanism between periods where the contract deviates (i.e. a premium or discount) from the underlying spot price.

BitMEX Versus Deribit: Other Differences

BitMEX has been the king of crypto futures and derivatives markets for several months, leading all exchanges in trading volume by a significant margin. The launch of perpetual swaps on plucky Dutch startup Deribit, however, will lead to greater competition within the market.

Last week, crypto analyst Flood tweeted a number of advantages, disadvantages, similarities, and differences between BitMEX and Deribit. Here are some of the important points of comparison between the two exchanges:

Liquidity

BitMEX is the most liquid bitcoin derivatives exchange. That means BitMEX has the tightest spread and the least amount of slippage when executing market orders. For comparison, BitMex does about 400,000 BTC of trading volume per day, while Deribit does about 10,000 BTC. BitMEX is the number one exchange by volume, with twice the bitcoin futures and derivatives trading volume of the next closest competitor, Binance. Deribit, meanwhile, just cracked the top 10.

Futures Contracts

Deribit and BitMEX both offer similar futures contracts. In fact, the two exchanges are identical in terms of futures contracts now that Deribit has added perpetual swaps. Both exchanges also offer monthly futures contracts.

Leverage

Both BitMEX and Deribit now offer up to 100x leverage. Deribit, which previously offered up to 50x leverage, just added the opportunity for 100x leverage this week.

Options

Deribit offers a wider range of option contracts than BitMEX, including strikes ranging from $2500 to $45,000 USD with expiration dates as far out as March 29. In comparison to BitMEX, there are, as Flood explains, “quite literal scams where you trade against BitMEX’s MM [Market Maker].”

Fees

Deribit and BitMEX both offer very similar fees. For perpetual swaps, Deribit has a maker rebate of 0.025% and a taker fee of 0.075%. For futures, Deribit has a maker rebate of 0.02% and a taker fee of 0.05%. Deribit charges a delivery fee of 0.025%. BitMEX, in comparison, offers a maker rebate of 0.025% and a taker fee of 0.075% along with settlement fees of 0.05%.

Contract Size

BitMEX’s contract size is $1 USD. Deribit plans to change their contract size to $1 USD in the near future (contract prices are currently at $10 USD).

Order Execution and Transaction Times

Deribit appears to have faster order execution that BitMEX. Here’s how Flood explains it:

Deribit has key advantages over BitMEX during periods of High Volume. Average order execution at Deribit is only a few msec. While the average transaction speed at bitmex is 20-40x longer in a stable market with the difference increasing during high volume

In other words, that means Deribit will have no overload. Deribit’s team has already successfully tested 1,000 orders per trading block per second. They know their system can handle at least 5,000 orders per second. BitMEX, meanwhile, can handle approximately 500 orders per second before being overloaded.

Conclusion

Yes, Deribit is a trendy new exchange that may challenge BitMEX’s dominance. As we saw with the rise of Binance, even a new startup with no history can rise to the top in a short period of time.

Deribit still has a ways to go. However, the launch of perpetual swaps and the addition of 100x leverage could help the Dutch startup challenge BitMEX at the top of the crypto futures and derivatives marketplace.