What Is Kucoin?

KuCoin is an international cryptocurrency exchange based out of Hong Kong that currently supports the trading of 210 digital assets. What’s unique about KuCoin is that they share 50% of their overall trading fee revenue with users holding their exchange-based token. In a similar fashion to Binance, KuCoin offers relatively low tradings fees and incentives for holding (or trading) its native cryptocurrency.

Back in 2011, the founders started researching blockchain tech and went further to build the technical architecture for KuCoin in 2013. 4 years later, the exchange launched with the ultimate goal of “becoming one of the top 10 worldwide hottest exchange platform[s]” by 2019.

What are KuCoin Shares (KCS)?

KuCoin Shares (KCS) are the native currency of the KuCoin exchange platform that allows holders to profit from the success of the exchange. KuCoin takes into account the amount of KCS users hold when distributing the various coins. The more KCS you hold, the more dividends you’ll receive.

What if holding 1 coin earned you 200+ different coins every day?

This payout system enables users to receive passive income by just holding. However, while the company currently does share 50% of trading fee revenue with users, it’s important to note that the percentage paid to KCS holders from these trading fees is set to reduce in the future.

The payout enters users balances at 0:00 (UTC+8) every day, done so after the accounting team evaluates the trading fees from each trading pair on the platform. Therefore, it’s possible that when you wake up in the morning and take a look at your overall balance on the KuCoin exchange, you may notice you’re holding a little bit more Bitcoin, Nano, Dragonchain, and a couple other hundred tokens you may not have had before.

Key Features of KuCoin/KuCoin Shares

-Incentives bonus: KCS holders receive daily cryptocurrency dividends

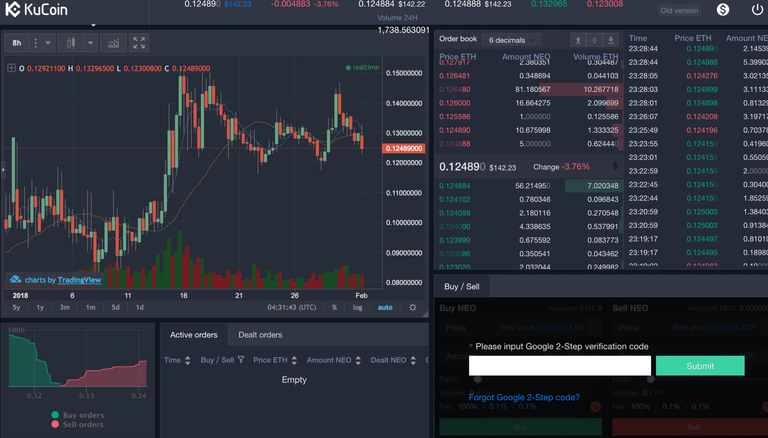

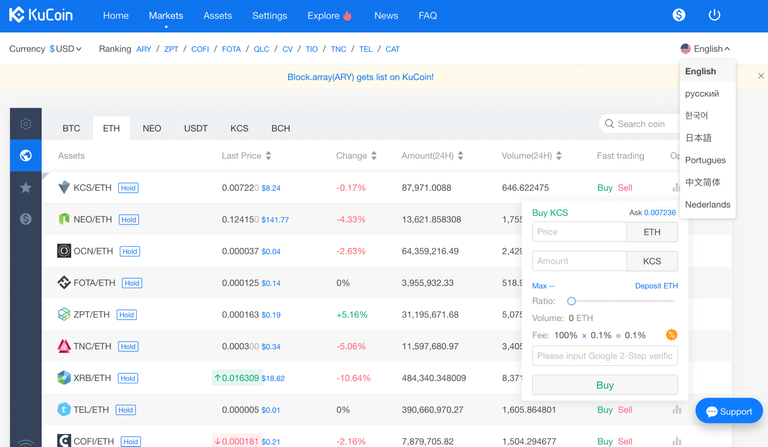

-User-friendly exchange format

-Low fee structure: Same low 0.1% trading fee as Binance (Bittrex charges 0.25%), a trading discount for KCS holders

-Exclusive KCS holder rights: Higher ranking KCS users receive one-on-one consultative services for investment

-KCS is an ERC20 token

-Numerous Trading pairs: BTC, ETH, NEO, USDT, KCS, BCH

-Exchange security: High-level privacy, asset, and operational level security system based on bank standards.

-High-performance engine for scalability

How Do KuCoin Shares Work?

The project’s whitepaper gives a great explanation of how KuCoin Shares are distributed. As stated before, the distribution methods take into consideration the amount of KCS in a user’s exchange wallets. Below is an example used in the whitepapers using the ETH-BTC trading pair if a user is holding the amount of 10,000 KCS.

Keep in mind this is just one trading pair out of more than 200 trading pairs on the exchange, all of which collect trading fees that will be distributed to users accounts based on the formula shown in the displayed image. Therefore, a user holding KCS will be receiving dual cryptocurrencies from other trading pair fees (e.g. LTC/NEO).

For every 1000 KCS you hold, you will receive a 1% trading fee discount with the maximum amount capped at 30%. For example, if you hold 20000 KCS you will receive a 20% discount, but holding 50000 KCS will max you out at a 30% discount.

About the Team

As stated on their official website which lists 12 core members, “Kucoin aims at providing users digital asset transaction and exchange services which are even more safe and convenient, integrating premium assets worldwide, and constructing state of the art transaction platform”.

CEO and founder, Michael Gam, is a former technical expert at Ant Financial, an affiliate company of the Chinese Alibaba Group. He was also a senior partner at Internet giants like MikeCRM and KF5.COM.

COO, Eric Don, is referred to as a “senior Internet researcher, systems architect, and Internet industry star”. He is also stated to be the CTO and senior partner of IT companies including YOULIN.COM, KITEME, and REINOT. However, it’s unclear if these websites actually exist as they did not show in a Google search or when entering the website domains. According to his LinkedIn, he is currently CTO at Youlin Network Technologies, yet there is no mention of KITEME or REINOT.

KuCoin Shares Coin Supply and Sustainability

According to CoinMarketCap, there’s a total supply of a little over 180,000,000 KCS with a circulating supply of just over 90,000,000 KCS. While the total issuance amount of KCS was originally 200 million, the KuCoin team has decided to go through with a “buy-back” program that utilizes at least 10% of the net profit every quarter to buy-back KCS and destroy them until there are only 100 million KCS remaining.

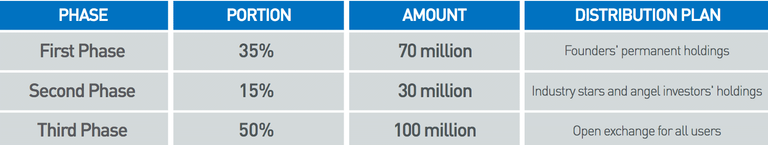

The three phases distributed 35% of KCS to founders, 15% to industry stars and angel investors, and 50% for all users. According to the whitepaper, the 70 million KCS issued to the founders is “subject to a four-year lock-up period from Sep 2nd, 2017 to September 2nd, 2021. Founders are prohibited to assign or sell their KCS holdings in any way before September 2nd, 2018.” The 30 million KCS for industry holders and angel investors follow a similar direction, yet are only subject to a two-year lock-up period. The KCS purchased during the ICO went on the exchange on Sept. 2nd, 2017 as they were not subject to lock-up.

Where Can You Buy KuCoin Shares?

Obviously on KuCoin silly!

Conclusion

While KuCoin pales in comparison to the largest altcoin market Binance with a trading volume of around $22 million USD at time of writing, it may continue to move up the leaderboard in the coming months, It would not be unreasonable to witness the success of this exchange and its native cryptocurrency, KCS.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://coincentral.com/kucoin-shares-kcs/