Hi traders, let's look at Bitcoin.

Bitcoin.

Another uneventful day in crypto, Bitcoin moving range bound on low volume...

... with the rest of the market moving in sync.

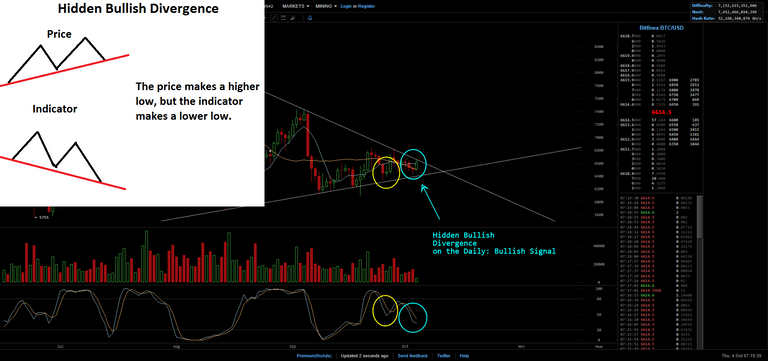

On the lower time frame there is a case to be made for a bullish break out of this wedge based on what appears to be a forming bullish divergence.

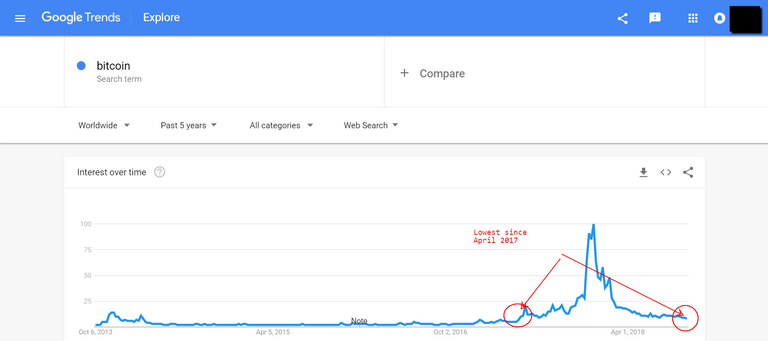

However, with so little money coming into the space.

And market sentiment being somewhat unenthusiastic.

Bitcoin Longs (BITFINEX):

Bitcoin remains at the mercy of larger players and trading bots until more fundamental news come out.

Strategy.

Our position is that the Bitcoin market has bottomed and ran out of sellers, finding fair value at around $6000 USD and likely to consolidate there for a while.

We believe that only some fundamental news can now stir the market one way or another. All eyes are on SEC and the much anticipated Bitcoin ETF rulechange proposal (remember you can leave comment to support the proposed rule change here).

Also looming on the horizon is ICE's BAKKT Bitcoin contracts which is meant to launch next month.

Finally we recommend you pay attention to the broader equity market, the SPX is looking very extended and has been rising on lowering volume.

.png)

We believe that the crypto market (which is pure risk capital) will be first to suffer if the stock market suddenly turned bearish.

Trade carefully.

FØx.

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

If you liked this article, make sure to show some love by up-voting or following the blog. You can also follow us on Twitter at F0xSociety.

Buy Digital Assets: Coinbase

Buy Digital Assets: Coinbase

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Published on

by FØx

Those are great analysis... I'm a day trader but hope to start thinking long-term since we have a lot of sentiments affecting short-term trading making it so hard to predict. I would like to know more about TIMM. Also do you know about Digitex Futures exchange? Looks really promising for Bitcoin futures traders.

Hey there @bait002 nice to meet you! Yeah the market doesn't lend itself well to day-trading these days, I personally only take long swing trades, don't like the complications that come with day trading :D

TIMM is a mentor market where you can follow mentors and buy coaching services from them etc. It's developing slowly but I am one of the mentors of the platform.

Never heard of Digitex X, do they only trade futures?

Yes they only trade futures; their model is why I'm paying more attention to futures trading lately since they do not charge any fees at all. About TIMM, would you mind hooking up on discord?

Sure, here's a link to my community we can chat there:

discord.gg/KrPEday

I really doubt it dude, they're a business so they have to make money somehow, typically these "fee-less" exchanges make their money on the spread which is basically a hidden trading fee.

Talk to you soon :)

They use their native token to generate revenue. Traders on the platform will collectively propose how many tokens is to be minted for that purpose. It's like token issuance stroking out transaction charges.

So they sell tokens to traders as trading fee, is that correct?

I googled Digitex X and one of the first results was a shady video referencing Bitconnect... I would stay away from that project if I were you, I smell scam.

No, the token belongs to the trader and that's the native instrument to be used for trading futures on their platform. Besides, that's not a new thing with exchanges; Binance for example. That video is an independent review. Why not look at official papers such as their white paper and press release.