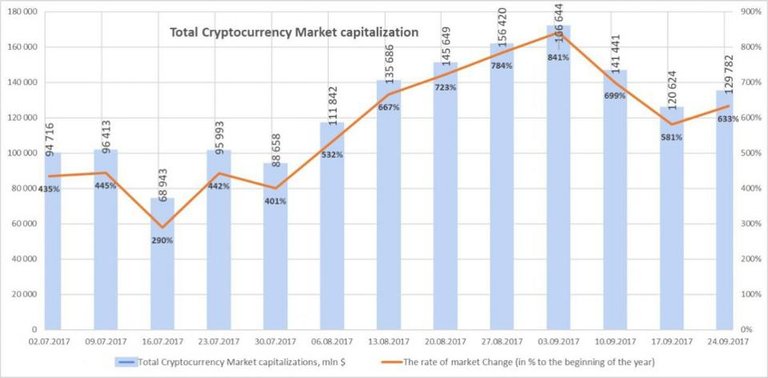

Whether it's the Chinese, or the Koreans, or the Russians or us Americans is anybody's guess at this moment, but what it looks like for a few cryptocurrency players out there is that the Chinese have found a new way to get back into the game. China banned initial coin offerings and bitcoin exchanges in the first week of September. The ban caused a precipitous drop in cryptocurrency flows worldwide. As of Sept. 24 at least, the market is making a comeback.

"We could say that it looks like the 'Chinese effect' that provided downward pressure in the cryptocurrency market is over, but we cannot prove it quite yet," says Dima Zaitsev, business analytics chief for ICOBox in Milan. Zaitsev and Dmitri Kornilov, director of economics at the Russian Academy of Natural Sciences, devised the chart for ICOBox, a cryptocurrency fund raising platform and service provider. "If this continues, then I would say with almost certainty that the downward pressure is over."

Nearly a billion dollars have reportedly returned to Chinese investors that put money to work in some 40-plus ICOs that took place on the mainland this year. An ICO is a crypto-currency funding mechanism for start-ups. Some say that the money was not really returned, but was redirected to Hong Kong and Singapore, where stronger investor protections exist.

China's central bank banned ICOs on Sept. 4 and later banned all bitcoin exchanges from operating in the country.China's ban is likely temporary. The U.S. and Japan are quickly moving to create rules that will help to legitimize cryptocurrencies by giving investors protections under existing securities laws. That will help companies raise capital through alternative methods, rather than via venture capital and the equity markets, potentially opening up a whole new financial marketMost crypto-currencies have recovered since China took a hammer to the two biggest names: bitcoin and ether. Bitcoin prices are over $4,000 again.

China outlawed ICOs and, shortly afterwards, bitcoin exchanges on the mainland. Regulators demanded that companies return their capital to investors.

Xinhua news reported on Sept. 22 that 90% of the money had been returned. Between January and August, over $1.1 billion had been raised in more than 65 ICOs, according to government figures."To understand what’s going on with ICOs and China you need to understand that fundamentally there are two kinds of Chinese," says Anton Dzyatkovsky, CEO of MicroMoney, a global fintech blockchain company and lending services provider based in Singapore. He recently attended the Global Blockchain Summit in Wanxiang, where many bright-eyed Chinese are looking forward to a digital economy. "The first kind is afraid of everything, to the point that some execs didn’t come to the recent blockchain summit because the event had the word 'blockchain' in its name, and they feared that Chinese police would take their picture there and use that as evidence to repress them later on. The second kind of Chinese is the type that is not afraid of anything. And these are the ones who are re-registering their blockchain companies in Hong Kong and Singapore, and will continue operations shut down by the central bank," Dzyatkovsky says.

During the Wanxiang blockchain conference, rumors were already circulating that founders of new tech firms that tapped the ICO markets had come up with new ways to get around the ban. They were indeed returning the money to investors, but would re-register in Hong Kong or Singapore. Some investors said they would put their money back in. If that is true, then Chinese money pulled from the market found its way back via Hong Kong and Sing.

BTCC, the largest cryptocurrency exchange on the mainland, stopped accepting yuan and cryptocurrency deposits on Wednesday. All trading will be banned starting Saturday. All funds in cryptocurrency wallets in China have to be withdrawn by Oct. 30. The other two exchanges, OKCoin and Huobi are also halting exchanging cryptocurrencies for yuan by Oct. 30.

The Wall Street Journal reported on Sept. 21 that some Chinese were trading digital currencies via WeChat, the messenger service owned by Tencent Holdings, a publicly traded company listed in Hong Kong. It is likely that China will crack down on that trade by the end of October too, and either Chinese money will continue to move offshore, or we will see a reversal of the current trend of rising market cap for crypto.

Good luck to the Chinese Government.