Here's the latest news to try and scare investors out of the cryptocurrency space.

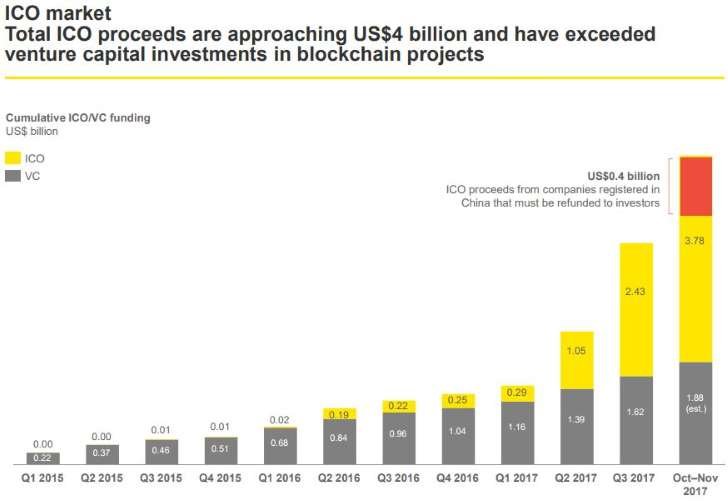

According to an audit recently completed by Big Four accounting firm Ernst & Young, investors have lost nearly $400 million after putting money into Initial Coin Offerings (ICOs). The report claims that the loses are related to coins or tokens that have either been "lost" or stolen. Numbers in the article place that loss at roughly 10 percent of the monies invested in ICOs, an amount approaching $3.7 billion.

The article goes on to claim that hackers are responsible for much of the losses, attributing theft of more than $1.5 million (USD) on a monthly basis. Many of these hacks begin with phishing attacks, giving investors another reason to be wary of any suspicious emails in their inbox (of course, we all know by now not to click on any direct links in emails, right?).

While the article goes deeper into the numbers, some of the claims don't add up. For example, the story -- which was originally posted by CNBC - claims that the average hack of a cryptocurrency exchange results in a loss of around $2 billion. Maybe it's just me, but those numbers don't seem to add up . . . unless they are limiting the $400 million in losses solely to individual investors of ICOs and not counting the exchange losses in that mix.

The article goes on to caution that may ICOs and tokens on the market are thin on information. It states that many of the offerings consist of nothing more than a whitepaper and a dream. But just like any other investment, anyone putting their money to work should do their homework and conduct ample due diligence before taking the plunge. If you're not willing to put time into your research, why should anyone feel bad if you suffer losses? We all know there are (and have been) countless stock scams and illegitimate private placements on the equity markets. Why should this be any different?

The bottom line: Don't be naïve. If it sounds too good to be true, it probably is. And don't put money into an investment you know nothing about, unless you are comfortable with the understanding that you could lose it all. Frankly, if people are going to treat crypto like it's more of a gamble than an investment, they deserve to get burned by the casino.

I really hope people who invest in ICOs realize that it's more or less like winning the lottery.

Many of them are a gamble. It's all about the utility. If the coin can prove that it will serve a valuable purpose over the long term, it could be a solid investment, especially in the early going. The problem, in my mind, is that many of them are trying to replicate payment systems already in place. I don't see a majority of consumers trading in their debit or credit cards (or even fiat currency, for that matter) so that they can use a business's token or coin for a transaction. There needs to be a deeper level of engagement and utility for the masses to buy in.

I found it weird when reading articles about this earlier that they seem to conflate having your money stolen by hackers with investing in completely unknown token coins, with no future, based in foreign countries, run by stock-photo actors lol

Agreed. They shouldn't draw that kind of parallel. Just because an ICO is new to market and unfamiliar to the investing masses doesn't make it a scam or even a bad investment. But the media seems to put them in the same class with ICOs that have been hacked. Perhaps what they should focus more on in their reporting is the lack of reliable security at ICOs. If they are having serious issues with users suffering from phishing attacks, the sites are partially to blame (though it's hard to forgive anyone who falls for a phishing attack these days). Essentially, the site needs to implement better security measures and should use two-factor authentication with every account. Until they are willing to invest in those security measures, I'd tread with caution.

I think the issue is mainstream writers don't make any effort to understand the things they write about and therefor have nothing helpful to add to the discussion (yet again). lol