Digital assets generally refer to all valuable assets existing in the form of digital data. The essence of the digital asset is a decentralized and peer-to-peer cryptocurrency system. Cryptocurrency typically has no asset collateral and is created, distributed and maintained through cryptographic and verification technologies as well as can be issued and distributed without the need for a centralized organization. Transaction and asset data may be stored in every corner of the world that has access to the Internet.

As more and more countries start to recognize digital assets and blockchain technology worldwide, the use of digital assets will continue to expand. The underlying and encrypted technologies of cryptocurrencies will be emerging quickly at the same time. Digital assets are expected to become one of the humans’ largest assets, and everyone has the opportunity to become a digital asset holder and investor. This will be a revolutionary change in the history of human currency.

Why choose blockchain technology?

Due to the historical limitations of liquidity, transfer, and storage of assets,

traditional credit and loan agencies force lenders to focus on the credibility and qualifications of users. For instance, users are required to provide sensitive personal information, including identification, proof of income, tax certificates and proof of assets. This inefficient procedure increases the complexity of the entire credit process and increases the cost to credit users as well as reduces the liquidity of existing capital in the form of higher interest rates.

Among this, trust is the biggest cost to the loan agencies in the credit link. The blockchain technology is a natural "trust mechanism." The use of blockchain technology, smart contracts, disposal of digital assets and other features can help us establish a new, credible and intelligent credit model, which can significantly reduce the complexity of the loan process and the cost of trust.

CHECK OUT THIS VIDEO :

What does DAGT want to do? Our vision is to create a new credit model using blockchain technology and the value of digital assets. The DAGT platform monitors the value of the underlying collateral (e.g., Bitcoin, Ethereum) and stores them in open and transparent smart contracts, in order to improve the liquidity value of the digital assets of creditors and provide an innovative, open and transparent and disposable credit product to loan agencies.

Throughout the entire ecosystem, DAGT is designed to enable simpler, more efficient, and less expensive operations

for users and intends to focus resources more effectively on the development and application of advanced technology.Throughout the whole ecosystem, loan agencies can use credit loan data provided by the DAGT platform as an important risk control basis in the credit review process and achieve seamless interface with their own risk control model so as to complete the lending operation more quickly and at low cost. DAGT will focus resources on better loan services and post-loan management.

Throughout the ecosystem, DAGT will reduce lending costs to credit users as DAGT leverages its automated loan credit of digital assets, facilitates digital asset pledges, monitors processes, as well as a mutual trust based on blockchain technology. This will effectively reduce the borrowing costs and the process complexity that credit users will have to pay.

Token sale model :

Digital Assets Guarantee Token, referred to as DAGT, is built on Ethereum.

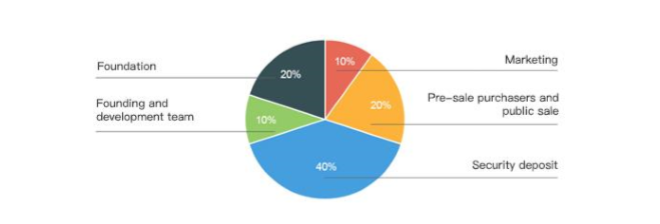

The total supply reaches 100 million DAGT. The specific allocation plan is as

follows:

20% will be used for pre-sale purchasers and public sale.

- Early purchasers who make contributions in financial, resources, strategic planning and personnel support in the development of the project.

- The funds from the public sale will be used for the development of the follow-up project, marketing, operations, finance and legal advice, etc. The use of this part of the funds will be regularly disclosed.

10% is used for the marketing. For promoting the implementation of DAGT

project's partner's applications.

40% is used as a risk deposit - A total amount of locked smart contract

- Uses smart contracts to lock out a percentage of risk-based deposits in

cooperation with lenders - When the value of the pledge cannot cover the principal and interest, the loan will be repaid according to the cooperation agreement so as to ensure the rights and interests of the loan agencies to the maximum

extent

10% is being allocated towards long-term incentives to incentivize the DAGT team and technical team, which have made great contributions to the project.

Of which, 10% of tokens will be distributed during public sale and the remaining part will be locked and will be distributed on a monthly basis starting from the second year.

20% will be reserved for the operations and business promotion of the Foundation.

The contributions in the token sale will be held by the Distributor (or its affiliate) after the token sale, and contributors will have no economic or legal right over or beneficial interest in these contributions or the assets of that entity after the token sale. To the extent a secondary market or exchange for trading DAGT The token does develop, it would be run and operated wholly independently of the Foundation, the Distributor, the sale of DAGT Token and the DAGT Platform.

Neither the Foundation nor the Distributor will create such secondary markets nor will either entity act as an exchange for DAGT Token.

For more details, please continue to follow DAGT on our social media platforms.

Facebook:https://www.facebook.com/DAGTofficial/

Twitter:https://twitter.com/DAGTofficial

Youtube:https://www.youtube.com/channel/UC8FAmhZT7Rx8dS8mSDIDfeA

Telegram:https://t.me/DAGTofficial

Reddit:https://www.reddit.com/user/DAGTofficial

Medium:https://medium.com/@DAGTofficial

Author : shalamenda

https://bitcointalk.org/index.php?action=profile;u=2076279;sa=summary