In order for any digital or cryptocurrency to grow, it needs a strong community and comparative advantage (I will write about the community element in my next post). It has to be fundamentally more useful than that which it wants to replace.

The core pitch of cryptocurrency especially to users in the developed world, is must be to focus on the capacity to make electronic payments cheaper and more efficient. To see how's that the case, we must first look at how the traditional payment system works and the many costs that it generates. In order to do that, lets go buy a cup of coffee.

Lets say you were buying a cup of Latte in Starbucks on Orchard Road in Singapore, where a grande latte costs SGD 5.30. You hand over your credit card for payment to the cashier (a sunset job maybe?). Within seconds, and without having to sign for anything, your card has been swiped and is back in your wallet as you head for the door, sipping on your foamy coffee.

Who needs cash anymore? Why risk dropping a twenty dollar note on the floor or the hassle of frequent ATM visits? Anyways, the cost you paid for the latte is the same even if you paid with cash or a credit card. All this extra, modern convenience of electronic payment costs you nothing...... or so it seems.

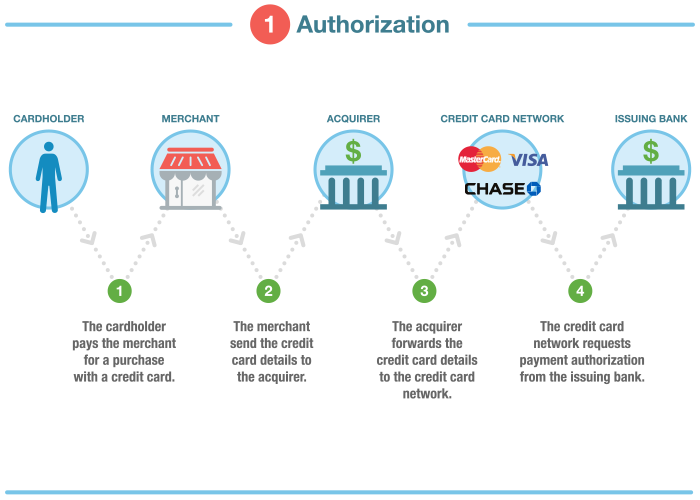

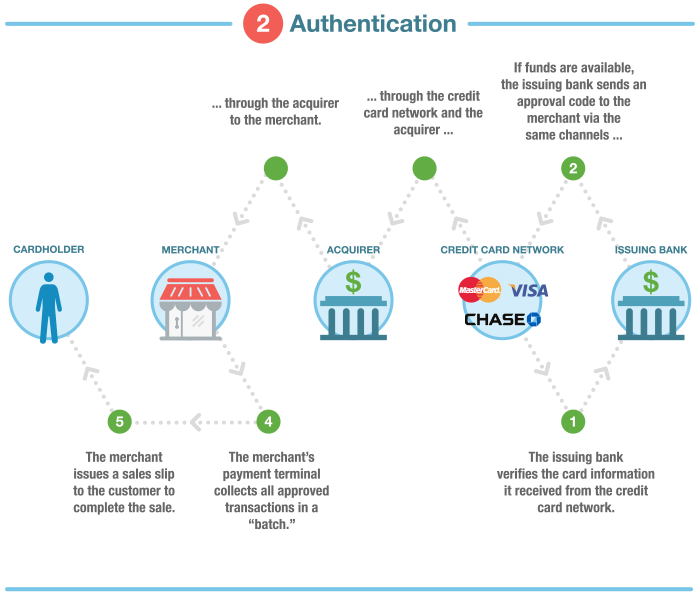

Now, lets take a closer look at what happens from the time the cashier swipes your card at the terminal. With that action, the personal information container in its magnetic strip- your account number, the expiration date, the billing address zip code, and the CVV (credit-card validation code)- is sent to something called a front-end processor. That firm, one of the hundreds in operation worldwide, specializes in handling payment information on behalf of its merchant client-in our case- Starbucks- and for the bank into which the coffee vendor's sales receipts are deposited, an institution that's referred to within the transaction chain as the acquiring bank. For now, both Starbucks and its bank simply need to know whether the credit-card attached to your account has enough funds to cover payment. The front-end processors job is to check that out-quickly. It then forwards that information contained in the card to the network of the relevant card association- MasterCard, Visa, American Express, or one of the others-which figures out which issuing bank your card came from.

Having left imprints of itself on multiple databases already, its now time for your personal information to move along to a seperate payment processor representing the issuing bank, the one whose name is on your card and manages your account. Once your bank has verified the validity of the information and checked for sufficient credit, the signal goes back all the way. The bank tells its processor to give the all clear to the association, which conveys it back to the front-end processor so that Starbucks and the acquiring bank can be satisfied... for now. The cashier is notified of the approval via the " authorized" message that appears on the card-reader display. This long series of electronic communications has all occurred within seconds.

You're now strolling down Orchard Road, sipping on your Latte, and thinking of shopping. But the payment system is far from being done with either you or Starbucks. For one, the cafe still hasn't been paid for delivering the coffee. For that, it must spend a follow-up request to its acquiring bank, usually in a batch of receipts at day's end. The acquiring bank will pay the merchant for those receipts, but it will need to place a request a reimbursement from the issuing bank, using an automatic clearinghouse (ACH) network managed by either the regional Federal Reserve banks or or the Electronic Payment Network of the Clearing House Payments Co, a company owned bu eighteen o the world's biggest commercial banks. Still, you're bank will not release funds if its not convinced that it was really you who bought that latte. So before it even gets the request for payment, its anti-fraud team has been hard at work analyzing the initial transaction, looking for red flags and patterns of behavior outside your ordinary activity. If the team is not sure about who is swiping the card, it will call your cell to try and confirm that it was you that swiped the card on Orchard Road. Once your bank is satisfied that it was you that swiped that card, it will release the ACH settlement payment and register a debit on your credit card account. The money then flows to Starbucks acquiring bank, which credits Starbucks account. The whole process usually takes 3 working days.

So as you can see, one simple purchase of a Latte, involved seven different entities in addition to you and the cafe. Five of which in addition to Starbucks had access to your identity information on your card. Each of the players in the ecosystem demand a cut for its part in the operation, adding up the total transaction fees range from 1 to 3% of every single sale depending if a debit or credit card was used. Usually the biggest piece of the pie goes to the bank, which has as of recent years turned this operation into their most important source of income. The fees are paid by the merchant. That is in addition to chargebacks the acquiring banks will impose should a dispute arise, requiring the merchant to forfeit both the money and the sold merchandise. Other fine and fees might also be levied to reimburse banks when fraud occurs.

It is an illusion to think that you (the consumer) is not paying for any of this. The costs are folded into various bank charges: card issuance fee, ATM fees, checking fees, and interest levied on customers that don't settle their outstanding balances in full each month. Starbucks will also have to added all these costs into the SGD 5.30 they sell to you. As the saying goes; there's no free lunch in this world.

TLDR;

very good post and very useful,

but what do you think about the price of sbd and steem at the beginning of this month?

I think Steem prices have been lagging behind the rest. So we might see a big spike up. I'm quite sure USD 10 isn't too far away.

As for SBD, I think it's suppose to be USD 1 each so I will keep converting it as I earn it.

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by cryptochindian from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews/crimsonclad, and netuoso. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP. Be sure to leave at least 50SP undelegated on your account.

Where's the food

Thanks for the quick summary on how credit cards work. One wonders how much Visa and Mastercard make on a daily basis just to provide the networking infrastructure.

Really informative stuff. Great job - from one chindian to another :)

This is just a copy of the beginning of chapter 4 of the book The Age of Cryptocurrency with very, very small changes.

If you want to provide information based on what you learned from a book, at least do it in your own words, cite the source and add something to it, otherwise it's plain plagiarism.