The most important thing in the era of digitization is speed. The speed of transactions, the speed of the internet and the acceleration of everything we use in our lives has given us the chance to create more leisure time in our lives. Many revolutionary developments such as the development of mathematical and cryptographic techniques in the era of digitization and the coming into our life of blockchain technology have begun to follow each other. Decentralization term has gradually begun to take its place conceptually in our lives. People now want to live in a world where transparency and trustworthiness remain in the forefront of everything and personal privacy isn’t exploited. The financial world make itself apparent at the primary of platforms where this require is the most externalized. At this moment, a change of wind encompasses all of the world. The innovations offered by crypto money technology and every other day of development news continue to create excitement in people. It's time for a change.

It is continued studies on the use of decentralized and distributed ledger technology that are provided by blockchain in the banking industry. The footsteps of distributed banking have become sensible day by day. It’s clear that Distributed Banks, which can integrate distributed financial services into their ecosystem, will take place of Traditional Banking's structure that tired out its customers because of over costingg, unwieldy and is deep in procedures. This concept is closer to throw a spanner in the works of the traditional bank into the monopolized order that operates against the customers. Prepared to build a inclusive structure, Distributed Banking aims to disrupt an unfair and stereotyped order through the return of the gains from financial services to users and providers. An inclusive financial system, where every contributor can be encouraged for an order that will benefit everyone, now has a vital prospect beyond an obligation. The concept of decentralization will be built traditional financial systemsfrom scratch with a new model based on mutually co-operation, and Distributed Banking will be able to give a new direction to the financial world. This model, which will include all divisions, sectors and accounts as peer to peer, will constitute the basis of distributed banking.

Distributed banking will change traditional banking completely by replacing the business structure of debt, assets and intermediary by bringing a distributed system instead of wealth management, credit reporting, debt recording and brokerage, which isn't possible vice versa in the blockchain world. Blockchain is a disruptive technology. DCC, which will bring a new and better one to the place of the old one, will transform the unjust tree-like management structure into a planary and egalitarian structure and build a distributed standard structure. I think a structure like this, in particular, has the potential to overcome common behavior of traditional banking, such as mobbing, constant repression and endless financial target setting, and a change of wind is backed of it. Thus, when things that block the system are taken away from the banking system, business efficiency will increase spontaneously.

Distribution and decentralization will eliminate excessive premiums derive from information asymmetry between intermediaries and will bury the concept of intermediary to the dusty pages of history for good of everybody as returning these premiums to the participants of the ecosystem. The concept of decentralization, which will use a digital consensus algorithm, will pave the way for establishing a fair ecosystem.

The most important feature of the system in my opinion is that the data recorded on the blockchain can never be changed and can never be falsified. Thus, regulatory authorities will have access to a source as being real-time insight into underlying assets. Based on Blockchain-based analyzes, instutitions that conduct research on Big Data will take a chance on regulatory bodies for acting more effectively to better scrutinize the market situation and respond faster against industry risks. Thus, the Basel Accord, which is considered as the constitutions of the financial world, will be paved the way to reconstruct for the management system of blockchain-based distributed banks from scratch. The change resembles dominoes. The financial system is ranked as if these domino stones are arranged side by side. It is possible to create a motion sequence that will affect the entire system when your finger pushes one of them. Here DCC will establish Distributed Credit Chain for various distributed financial services such as consensus on registry ledger, implementing business contracts, building business standards, arranging liquidation and clearing services.

Distributed banking will come to more agenda in the coming years. Taking the first steps of a long-running project, DCC is currently working on building the bases of the system. The financial systems will run through the nodes that will work on it, and the flow of money will be ensured and traditional businesses can be involved in this ecosystem through Distributed Banking. DCC will begin to build and execute a platform that will build its credit system over its own created chain. DCC has realized and implemented that rid of the central monopoly is to get rid of those who try to classify people with primitive methods such as credit rating. There is no solution other than the decentralization of access to appropriate credit conditions and the removal of intermediaries. I think that the existence of many financial institutions that only provide credit service officially in digital framework for a long time outside the banking will allow the concept of distributed banking to be adopted without being too uncomfortable. Also, in the absence of things that block the market, it will eliminate the monopoly created by traditional banking, thanks to the fact that users are included in the system on faster and more convenient conditions, regardless of what they are taken for.

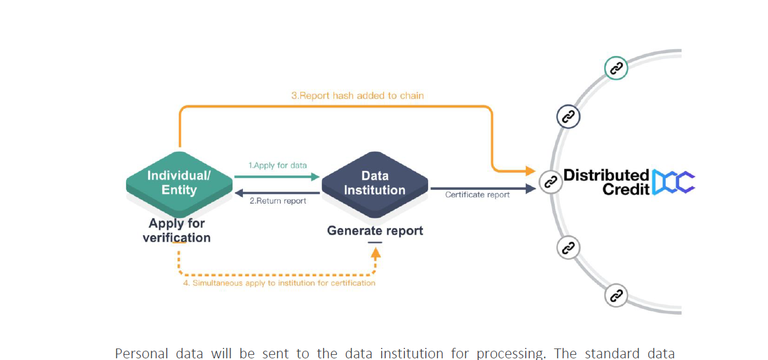

The functioning of the system will be as follows. User information will only be acquired once within platform where protect securely of personal data. So you won't put the skids on system by being deep in the same procedures again from the beginning. Debtors and lenders will be in the same system. Those who will give credit will determine their own conditions. It will be defined as a borrower who wants to take out a loan and will create an account by specifying his own personal data. This debt request will be processed by a service provider. Of course, these service providers will also ensure that the data are collected and cleaned up to check compliance with the procedures. The platform will provide credit history feedback for participants using a self-rating application.

Thanks to the repayment of each loan, the credit history of the borrower is created and the points on the positive side are earned for the credit rating such conditions as repayment in the course of time. The risk factor in here is completely left to the user. The risk of the credit you receive will directly affect the our profit. Of course, all of these will go within the policies set by the DCC. In the end, if the system is approved and the credit process is positive, funding will be provided.

The system will operate mutually depending on the smart contracts and will take place the blockchain technology on the basis of the system. Both the borrower and the lender will be reliably protected from unilateral changes to the contractual conditions. The platform database can't be attacked despite the fact that data isn't stored in one place. All data is distributed across independent network nodes. This is where Distributed Banking will change everything.

Patented artificial intelligence-based algorithms are designed to analyze the credit history in the most accurate way. Rapid approval of the use of financial services will be handled through artificial intelligence algorithms. Deep learning and AI risk control systems and anti-fraud and modeling algorithms will be used to help financial institutions process personal data without storing data. It is already most important to build a system that will run in checking risk.

Be prepared to install the Distributed Banking ecosystem instead of the traditional one.

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1158275

DCC Website: https://dcc.finance/

DCC WhitePaper: https://dcc.finance/file/DCCwhitepaper.pdf

DCC ANN: https://bitcointalk.org/index.php?topic=3209215.0

DCC Facebook: https://bit.ly/2LucSz6

DCC Twitter: https://twitter.com/DccOfficial2018/

DCC Telegram: https://t.me/dccfinance_bot

DCC Medium: https://medium.com/@dcc.finance2018

The financial systems will work through the nodes that will work on it.

Such a credit system may be necessary for a fairer financial system in the future

Pardon I only remedy spelling errors. I have no other purpose