Still building up the initial liquidity pool to allocate rebates to people meeting certain criteria on my tract and the idea is to distribute 50% in DEC where 50% gets retained and 50% gets sent out so the pool keeps growing and the distributions per land owner get larger over time. Also the tract holders will get a piece of the taxes collected from the keep as well as part of a grain LP just like the USDC-DEC LP it will retain 50% and distribute 50% of the income from the pool which will grow overtime in rewards. The USDC portion of the DEC pool that is not used will be used to buy SPS and stake it in order to rent it out as well as receive additional staking rewards in SPS and DEC. The SPS or DEC earned a portion will be used to buy PNS to support the project as well. Right now it is just in build it up mode for the first month so the pools can be seeded with the initial capital needed and the distributions will start in 2 months to give people time to move there cards if they are going to do so to take advantage of the various rebates depending on PP placed on the land.

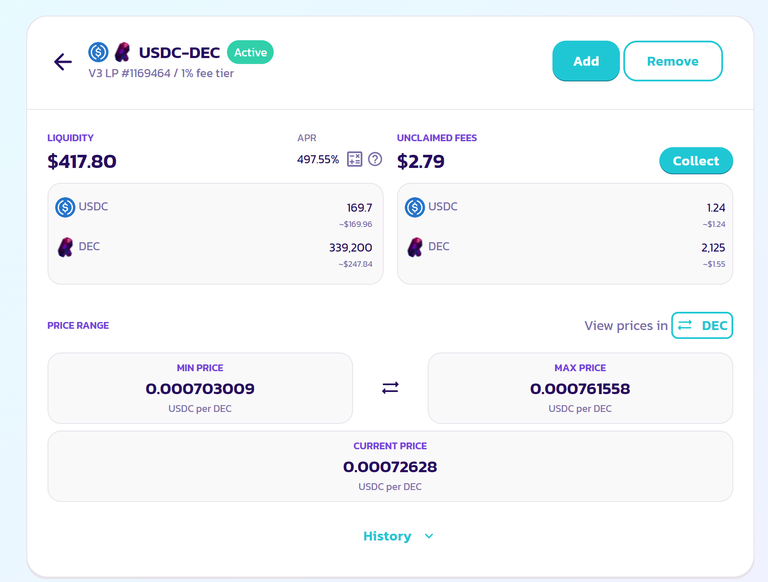

The DEC LP is doing a pretty high APR today in the tight band section. As long as DEC remains pretty steady for a bit should be able to collect some good fees on the tighter lp range. Eventually will need to move to a wider range but for now will leave fairly tight to capture the extra yield and just watch it.