While cryptocurrencies themselves are standing for decentralization and independence, entrance, exit and the trade of them is still be done via central entities: Exchanges.

Remarkable cases in the past are showing why that is a serious issue:

March 2014: Mt. Gox Hack - resulted in a loss of 473 million $US

January 2015: Bitstamp Hack - resulted in a loss of 5.1 million $US

August 2016: Bitfinex Hack - resulted in a loss of 72 million $US

January 2018: Coincheck Hack - resulted in a loss of 532 million $US

The keyword here is vulnerability. Since managing massive funds in their wallets, exchanges are an incredibly attractive target for hackers. In addition, as an exchange you need to have access gateways for customers and to rely on your own processes and security measurements, which are not backed by the blockchain. As we all know, the human factor is often the weakest.

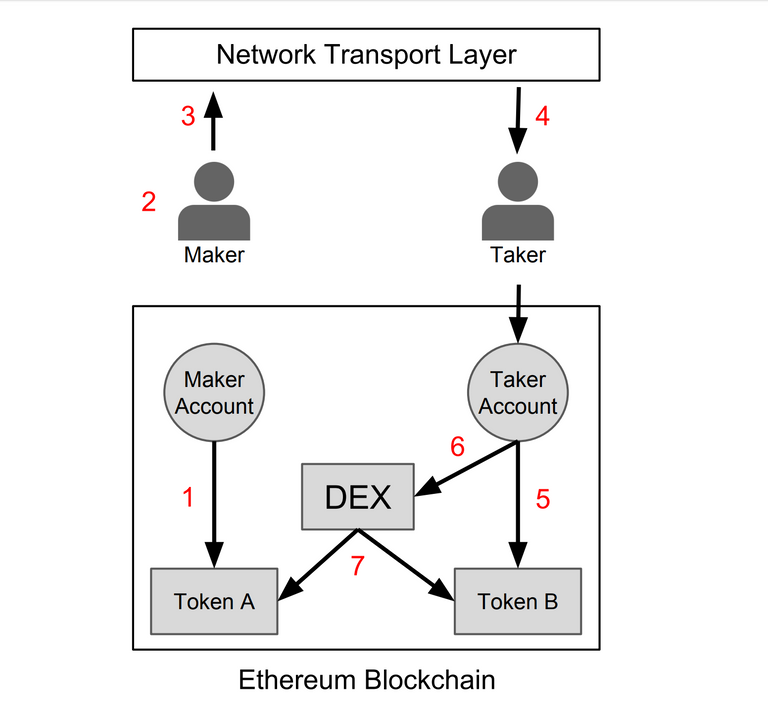

So, nowadays, decentralized exchanges (DEX) are popping up all over the eco-system aiming to tackle the topic above. That means, funds are being controlled ty the users themselves. Trading is managed by Smart Contracts. For a deeper understanding, lets take look at following graphic, explaining the workflow of the 0x exchange (published in the 0x whitepaper):

- The maker approves the DEX contract to have a access to his balance of Token A in his account.

- The maker creates an order to exchange a certain amount Token A for an amount of Token B, specifying exchange rate as well as expiration time of the order (it can not be filled after expiration). Then, the maker signs the order with his private key.

- Afterwards, the maker broadcasts the order over any medium.

- Taker intercepts the order and decides to fill it.

- The taker approves the DEX contract to have a access to his balance of Token B in his account.

- Taker submits the makers signed order to the DEX contract.

- The DEX contract authenticates the makers signature, verifies that the order is not expired as well as it has not been filled yet, then transfers tokens between the two parties at the specified exchange rate.

Well, although the described structure sounds clear and comprehensible, there are still some issues which need to be solved. These are the main reasons, why DEX platforms have not become become very popular yet.

Limitation: Since the protocol is relying on Smart contracts, most DEX are limited to the blockchain the Smart Contract is based on. That’s mostly the Ethereum blockchain, means, Ethererum and ERC20 token can be traded. For every coin based on another blockchain, another Smart Contract structure needs to be developed. Not to forget, cross-chain trades are impossible!

High network costs: Costs of trades are depending on the current transaction fees in the underlying blockchain. If networks are jammed up due to high transaction volumes, transaction fees are rising as well (just remember Crypto-kitties launch on Ethereum). That could lead to painful high trading costs.

High latency: Also depending on the current workload of the underlying blockchain, time periods till the trade and transactions have been validated can take hours sometimes.

Conclusion: As it is in life, everything has its price and one has to trade off certain benefits with other advantages. Here, convenience has to be traded with independency, anonymity with limited possibilities. But, since many teams, i.e. Herdius, are working on improving the technology behind as well as user experience, I am confident, that we will see better, faster and reliable solutions this year. If the mentioned issues can be solved, DEX systems will outperform and overtake the exchange market rapidly!

Follow me on Twitter: https://twitter.com/philipppetzka

LinkedIn: https://www.linkedin.com/in/philipp-petzka-817510105/

Good post. I used AirSwap recently to swap erc20 tokens, safe, fast, cheap and secure.

Thanks for the info! Didn't use airswap yet but will try it out.