Although new, there are now few defi apps that have established themselves since the last bull market and continue to work and operate. The DEXs, lending platforms, liquid staking to mention a few. Some new are emerging from time to time as well. We now have a working defi industry.

How are the defi apps doing under the current market conditions?

Let’s take a look at the top DeFi protocols and compare them.

We will be looking into the following protocols:

- Uniswap

- Jupiter

- PancakeSwap

- Raydium

- Lido

- RocketPool

- Curve

- AAVE

- MakerDAO

There are different types of applications above, like DEXs, lending protocols, staking protocols etc. It can be a challenge to find a common denominator for all of them to compare them to each other, but we will be looking at the following parameters:

- TVL

- Trading volume

- Users

- Top trading pair on each platform

- Fully Diluted Valuation / TVL Ratio

- Market cap

The data is extracted from multiple sources like Dune Analytics, DeFi Lama, protocols web pages etc.

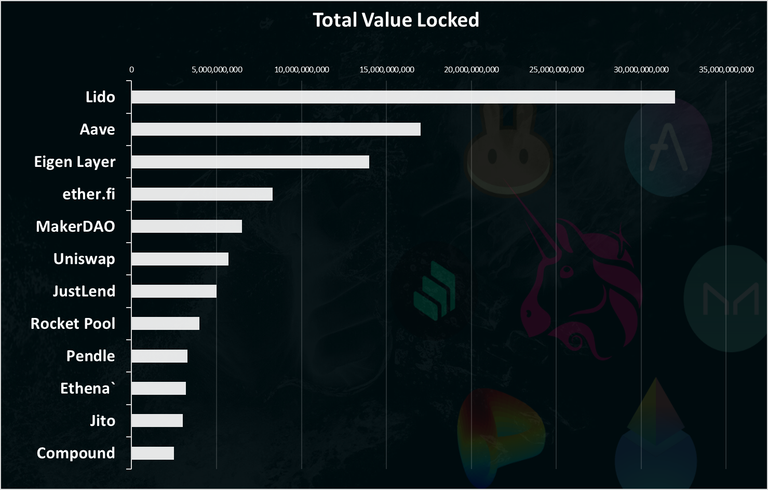

Total Value Locked TVL

One of the key metrics for the defi protocols is the total value locked TVL.

Here is the chart.

Lido comes on the top here by a lot with 32B. For those who don’t know it is a protocol for staking Ethereum. Lido has been a dominant protocol providing this service. Users stake any amount of Ethereum and get a return on it from the Ethereum staking rewards. There are multiple protocols that provide this service, but Lido is on the top.

Aave the lending protocol is on the second spot with 17B, then comes another liquid staking platform EigenLayer, etc.

When it comes to TVL, all the dominant players are coming from Ethereum.

Trading Volume

The trading volume is not 100% applicable for all the apps above, as it is most a DEXs parameter, but we can have a look at the lending protocols as well, in terms of deposits and withdrawals of collateral.

Here is the chart.

Interesting Raydium, the Solana based DEX is on the top spot for trading volume with more than 3B in trading volume and has overtaken Uniswap after a long time, that these days has close to 2B daily trading volume.

Another DEX, this time on the Binance Smart Chain, Pancake is in the third spot. Aerodrome a DEX based on the Coinbase, Base chain is next.

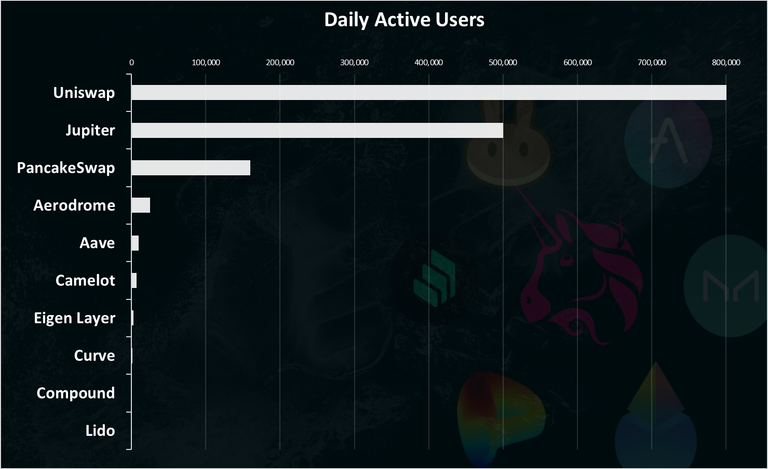

Numbers of Users

Here is the chart.

Uniswap has grown a lot in DAUs and is now the number one. This is mostly because of its expansion to other L2 chains, like Arbitrum, Base, etc, where the fees are lower.

Jupiter, the Solana based DEX is next with somewhere around 500k DAUs. Pancake is on the third spot.

We can notice that the protocols with the highest TVL actually have a small amount of users, meaning the users there are playing with large sums.

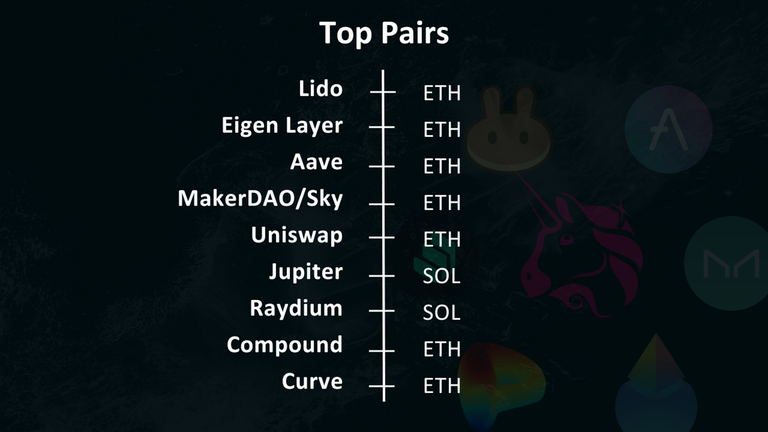

Top Pairs

What tokens are traded/used the most on each platform? Here is the chart.

As we can see most of the platforms have Ethereum and staked Ethereum (stETH) as the most used/liquid tokens, followed by SOL.

It’s basically a competition between Ethereum and Solana for the DeFi apps now.

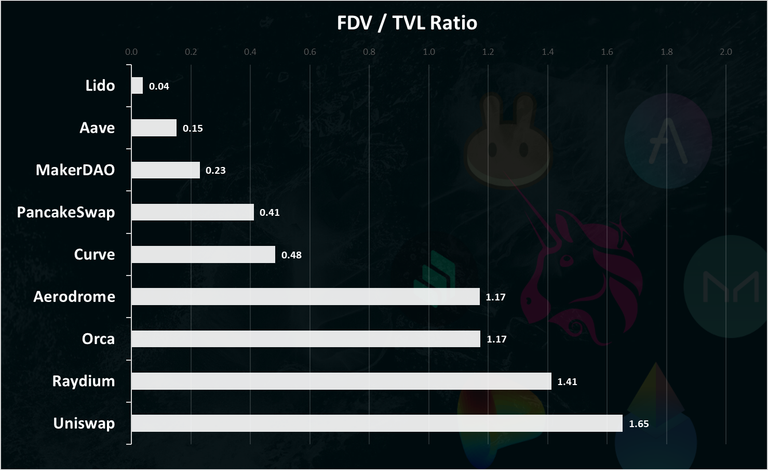

Fully Diluted Valuation / TVL Ratio

This is one of the most used metrics for DeFi apps. It shows the ratio between the value of the project and assets under management so to speak (TVL). When this ratio is small it could mean that the project is undervalued and the opposite. For example, if a project has a 1B valuation and is managing 10B in assets (TVL) the ratio will be 0.1, that is considered low.

Here is the chart.

Lido comes on the top here, since it has a lot of assets under management, but it also has a specific function for staked assets.

Aave, with a broader use case with lending, is in the second spot with its FDV / TVL ratio, followed by MakerDAO.

We can notice that the staking and lending protocols are on the top in this metric, but this is more because of the nature of the apps, than their values. These apps are passive so to speak, unlike the DEXs where the assets are in pools where the tokens are being moved all the time trough trading.

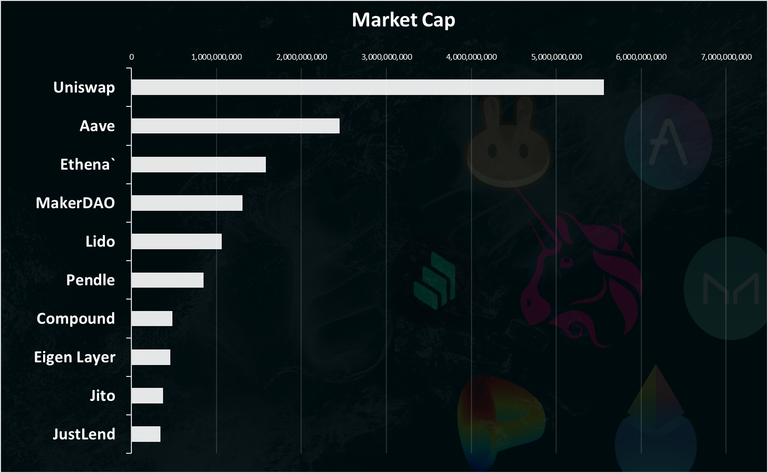

Market Cap

At the end the market cap. Here is the chart.

Uniswap remains the strongest defi application in terms of market cap. It is now valued at 5.5B. Aave is in the second spot with 2.5B. Ethena is next, followed by MakerDAO/Sky.

All the best

@dalz

It makes sense that ETH on Lido has the Total Value Locked and that Solana on Raydium is the most traded. ETH pays handsome rewards for staking and a lot of people trade SOL because of the memecoin frenzy. These numbers are going to increase sharply in the coming months with the coming of the bull run. Thanks for the update.

Good timing, we can watch how that value crashes over the next few days.

https://decrypt.co/292275/california-court-rules-lido-dao-members-can-be-held-liable-under-partnership-laws

DEFI projects are not very popular lately. However, the future of crypto and its point of alignment should be DEFI. With the increase in the price of ETH again, DEFI projects will start to become popular. However, the important thing is permanence.

Still there are some projects in the market which have low prices so here we can invest in them. Uniswap is performing better than ever.Your post always increase the knowledge in the market.

!PIZZA

$PIZZA slices delivered:

(8/10) @danzocal tipped @dalz

Interesting to see Lido at the top. I looked into a while back but forgot about it. 😂