Any protocol that creates assets which are pegged to other asset prices such as fiat currencies (stable coins), stocks or commodities in principle faces the same challenge: How to manage to have at any time enough value locked in the protocol to remain solvent when asset prices move.

Most stable synthetic asset protocols solve this by locking up cryptocurrencies such as ETH as collateral. However, the problem with this approach is generally, that both asset prices fluctuate — and especially in the case of cryptocurrencies the fluctuations can be quite heavy. Additionally, unlike cryptos, real world assets tend to not be traded 24/7, which can result in price gaps once markets reopen. In order to be robust, these protocols thus need to be overcollateralized — by how much depends on the volatility of the asset and the collateral.

Unfortunately, this approach is not very capital efficient and it also comes with the immanent risk of liquidation. In order to be relatively sound, collateralization ratios of 200% or more are thus not uncommon — and still in most cases the user will need to adjust its collateral position over time, which results in gas fees to be paid and work to be done.

The ISSUAA protocol has solved this problem by issuing its synthetic assets always as a pair. When minting new assets, the user will escrow a fiat pegged stable coin. In return, the user will receive a pair of synthetic assets: A long token, which mirrors the value development and price of the underlying asset, as well as a short token, which mirrors the development of the underlying asset inversely. This means that if the price of the underlying asset increases by 1 USD, the long token will gain 1 USD in value while the short token will lose 1 USD in value. The change in value of the two assets combined does thus not change. The underlying assets will thus remain fully funded, no matter in which direction the price of the underlying asset develops.

In comparison to other protocols, you thus get not one but two assets for a similar or even smaller amount of collateral. You can thus put the whole amount of your investment to work in the liquidity pools. And you do not have to worry about liquidation.

The introduction of long and short tokens on the same asset adds another interesting opportunity for liquidity providers: it allows to reduce the price risk of the underlying asset.

Typically, liquidity providers are exposed to a significant price risk. If one of the assets in the liquidity pool depreciates significantly in value, this causes also a significant loss for the person holding the assets in the liquidity pool.

Let's assume that a liquidity provider invests 1000 US-Dollar into a liquidity pool, which consists of 50% TokenA and 50% a US-Dollar stable coin. If the price of the TokenA would drop by 50%, liquidity providers would also suffer a loss of 29%. While this is called impermanent loss as the loss would disappear if the token price would return the original price, this is quite a misleading statement as this loss can very well be permanent.

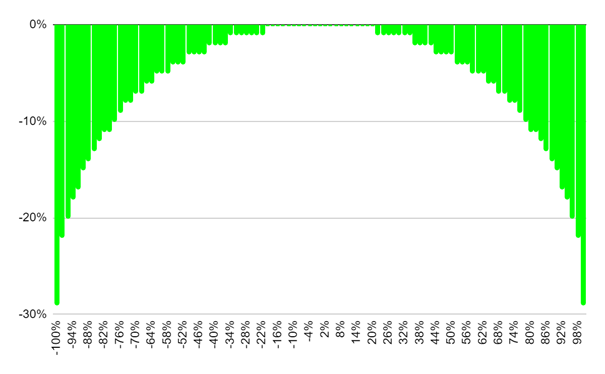

The ISSUAA Protocol, however, allows Liquidity Providers to invest in both long and short tokens. While they would still lose slightly when the price of the asset changes, the losses would be relatively small and easy to compensate with the earned trading fee. In the above mentioned example of a drop of 50% in the value of the underlying asset, the loss for the liquidity provider would be a mere 3% - which is easily compensatable by the earned fees. The following graph shows the expected losses depending on the change of the underlying asset price:

Impermanent loss depending of the development of the underlying asset

Even in the scenario of a price change of 70%, the loss for the liquidity provider would not exceed 10%, which would likely be more than compensated by the expected trading fee.

In summary:

- The ISSUAA protocols avoids over-collateralization and is thus highly capital efficient.

- Users do not have to care for the risk of liquidation.

- Due to long and short assets, the system allows to reduce price risks when yield farming.