DEFI stands for decentralized finance. There are many smart and not so smart contracts on Ethereum that have pioneered the concept and have working products of DEFI e.g. Maker, Compound, NEXO, NUO, dydx, fulcrum, celcius.

In these products, users

- put their tokens (e.g. ethereum) as collateral and take loan in the form of stable coins like DAI, USDC, Tether etc at an annual interest rate

- loan out their tokens (e.g. ethereum, DAI, tether etc ) and earn an annual interest rate

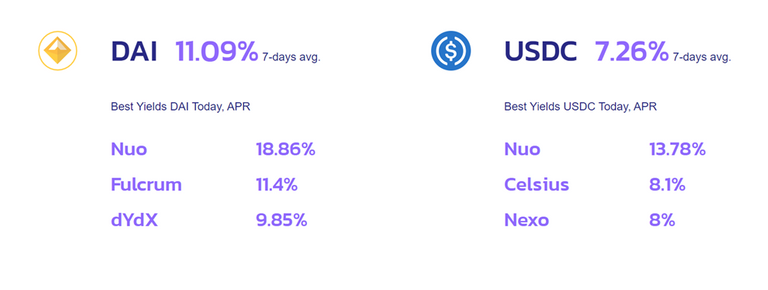

Below figure shows prevalent interest rates for DAI and USDC:

The appeal of these products is rising as they are offering much better interest rates in US$ terms and that too on a trustless network than offered anywhere in the world. It appeals even more now as 17tn$ equivalent bonds globally are now offering negative interest rates.

The developers on other platforms like EOS, TRON are also trying to introduce similar products.

What about Steem?

Steem token due to its inflation has inbuilt mechanism to earn through upvotes, delegation etc. Some of the products on steem that help you earn are described below:

SteemPower

Steem are liquid tokens that can be sold at any time. However, if these Steems are powered up then they can only be withdrawn in 13 equated instalments. Powered up steem is called SteemPower. SteemPower gives many advantages and benefits to user - like resources to interact with the blockchain, say in decision making, selection of witnesses, earn from inflation pool through upvotes, plus a 2.5% APR passive earning .

Steembottracker

This website lists almost all the bidbots that are operation on steem blockchain. Users can delegate their steem power to any of these bots and passively earn steems. The earning can vary between 10-25% depending on the policies of the bidbot.

DEFI on Steem

As of now following two projects can be classified as functioning DEFI projects on Steem blockchain:

SPINVEST

In this project users will buy their tokens from steemengine and they promise to invest those steem within steem ecosystem to generate stable return over time. They call it SteemPower Investment Club. Details are descibed in their launch post - SteemPower Investments Official Partnership Agreement and the formation of the SteemPower Investment Club. They have not spelled out about range of the annual returns.

USDONE

According to their launch post - USDONE : Combines Stability and Earning in One Token, they claim to provide a USD pegged stable coin with guaranteed earning of 7% per year. They claim to invest in many type of opportunities on and off blockchain in order to fulfill their promises. They have been in operation for 5 months. The user base is almost nil as of now. But they have been providing dividends as promised and submitting their audit reports on monthly basis onto blockchain. This steem project has all the features that are their in ethereum based defi projects.

There may be other projects that help generate passive income on steem blockchain but not as well defined as these two. But all these projects lack smart contracts as in the case of ethereum projects. It is good that he developers have started building DEFI projects on Steem blockchain but they will have to do more to help retain users trust with complete automation.

I hope with the introduction of SMTs, which can happen by the end of this year, the developers of these and any new project would be able to resolve these issues and contribute to DEFI movement.

👍

~Smartsteem Curation Team

I am thrilled to be upvoted atlast by you.

@prameshtyagi, DEFI sounds very effective step to strengthen any Community Project. Let's see that more projects will come up with DEFI MODEL.

Very informative post!

thank u for such a nice article about us. we appreciate you and @actnearn