What is Dimensions Network

Dimensions Network approaches the cryptocurrency ecosystem in a business‐centric and operative way. We focus on research and innovation which will lead to tangible results within a projectable time‐frame. We learn valuable lessons and build knowledge while solving real world problems, and use this to leverage our position within the market.

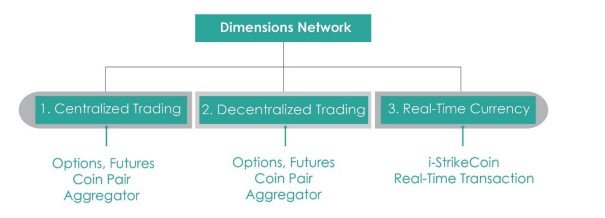

We have started by building a centralized Derivative Trading Platform that supports coin pair trading, options contracts and futures contracts. We anticipate a great interest for these new derivatives and a substantial return on investment. Moving forward we will expand our services onto a decentralized network, and offer our users cryptographically secure derivative trading. We will leverage our customer base and industry knowledge to develop a real‐time transactional currency. We will build out solutions and focus our rollout on geographies where there is significant friction in the existing banking system, and hence a great opportunity.

Let’s Join with Dimensions Network : https://dimensions.network/

Unstable and Underdeveloped Market

Many organizations are working on technical solutions to address the key limitations of the current ecosystem. These innovations tend to focus on scaling and decentralization, and include:

- Second layer protocols

- Cross chain interactivity

- Blockchains within blockchains

- Decentralized trading networks

- Making cryptocurrency spendable

Dimensions Network is one of these organizations, and we have multiple objectives to complement instead of compete with existing initiatives. We will stand on the shoulders of giants, and use their exceptional technologies to build real world solutions which will generate solid returns.

Dimensions Network Vision

Build and operate the most professional cryptocurrency trading platform, with a full range of services from coin pair trading to options, futures and other derivatives. Establish ourselves as the leading Centralized and Decentralized trading platforms within the crypto ecosystem with interconnected liquidity pools. Disrupt the fiat currency system by using our hard fought innovations to establish a real‐time cryptocurrency with global reach and accessibility to the masses.

Dimensions Network Mission

A financially sustainable approach to cryptocurrency trading and development, and to overcome major technical and industrial challenges facing the crypto industry.

Our Umbrella Plan

Phase 1 — Centralized Platform — Rapid Revenue Generation Build a scalable high performance trading platform for: coin pairs, margin, shorting, options contracts, futures contracts. This platform will deliver significant financial returns as the appetite for hedging and leverage grows, and will help towards funding future developments. Our Institutional clients will be drawn to our platform by our multi‐exchange Liquidity Aggregator. We will pursue banking licenses in multiple jurisdictions to guarantee our users the ability to deposit and withdraw FIAT.

Phase 2 — Decentralized Platform — Security and Transparency Our second objective is to utilize decentralized networks to replicate our platform. This will allow unrestricted, fully transparent trading, free from centralization risks. The initial Liquidity on this decentralized network will come from linking this new decentralized platform to our existing centralized platform. The two platforms complement one another and allow breathing room for the future development of decentralized technologies and protocols. Users will be able to interact with our platforms in a manner which best suits their desires and risk profiles.

Phase 3 — Real Time Currency Our third objective is to produce a real time transactional currency and exploit our customer base to gain traction in key markets.

Centralized vs Decentralized Platform

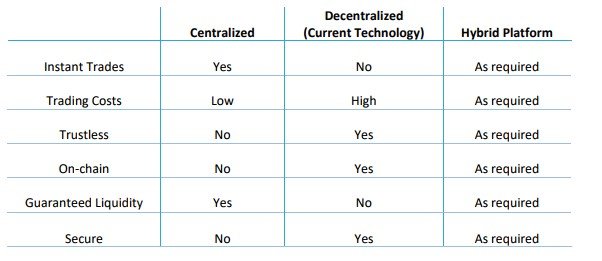

The critical limitations for the current decentralized exchanges are the speed of trades and the limited blockchain capacity; the lack of liquidity is merely a consequence of the existing network limitations.

We are building both a centralized exchange and a decentralized exchange, and will link them together to build a hybrid platform where our users can choose how to interact with the platform based on their preferences. The performance of our decentralized platform will continuously be upgraded as and when newer technologies become available. It is impossible to know which blockchain, protocol or project will be first implement a network capable of handling the volume and speed of trades comparable to a centralized exchange, we will therefore adapt to the ever‐changing ecosystem and interface with a number of these new systems.

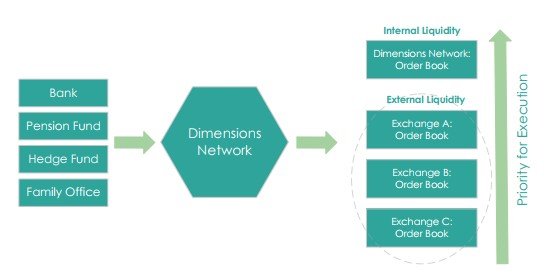

Exchange Aggregator

Our Institutional clients will be drawn to our platform by our multi‐exchange Liquidity aggregator. A key requirement to attract institutional clients to our platform is to have the best market liquidity. To this end we will build an Aggregator which connects our platform to all major exchanges via their APIs and adds their liquidity to our own. We will provide FIX API for our users to connect to either our exchange or any of the major exchanges for their orders. Also the user can use FIX API to indicate if they want the best price for their orders or use a particular exchange to execute the order.

The Challenge

A hedge fund wants to purchase 20 Million USD of ETH. They need an exchange or OTC facility which can accept their 20 Million USD without problems or delays, then purchase sufficient cryptocurrency without impacting the current market price. The hedge fund does not want to deal with multiple exchanges to try to spread the order across the market, they want a single point where they can buy and sell at the best possible price.

The Solution

The second phase in our roadmap is to obtain a banking license, as this will allow us to accept and send large fiat transfer without issues. We will accept their funds and use the liquidity on our exchange, and the many other exchanges we are connected to, to source the required quantity of coins with the minimum impact to the market price on any one exchange. We will use the forex markets to match our clients’ currency with the purchase currency on the relevant exchange.

Trading Engine

Our trading engine is written in Erlang to allow for maximum availability and scalability. “Erlang is a programming language used to build massively scalable soft real‐time systems with requirements on high availability. Some of its uses are in telecoms, banking, e‐commerce, computer telephony and instant messaging. Erlang’s runtime system has built‐in support for concurrency, distribution and fault tolerance.” https://www.erlang.org/

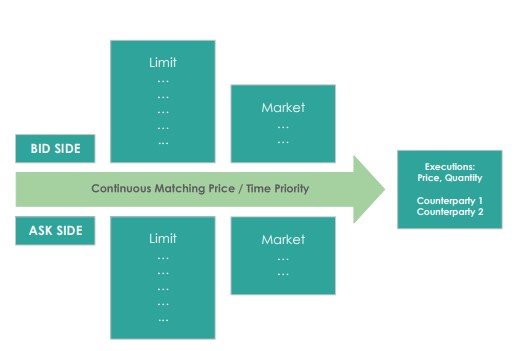

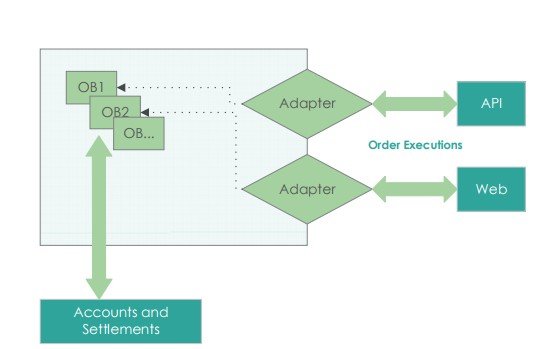

The trading engine consists of matching engine for each financial instrument. Where each matching engine runs as a node under the umbrella of the exchange. Initially the exchange will support the following order types, and then expand as required by our users:

- Market Order

- Limit Order

- Stop Loss

- Stop Limit

- Trailing Stop Loss

- Trailing Stop Limit

The core structure of Matching engine is as follows :

Each matching engine follows this state transition :

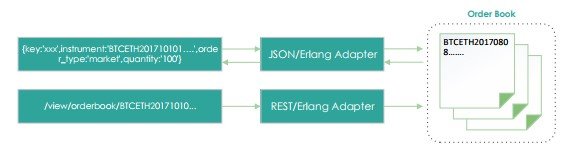

The exchange will consist of set of matching engines and JSON/REST adapters

Token Trading

Tokens will automatically be distributed to the Ethereum Sending Address. The tokens will be locked until 3 weeks after the completion of the token sale, after which point they will become tradable. We plan for an initial listing on :

- Etherdelta

- Liqui

- Bittrex

- Binance

Derivatives Trading :

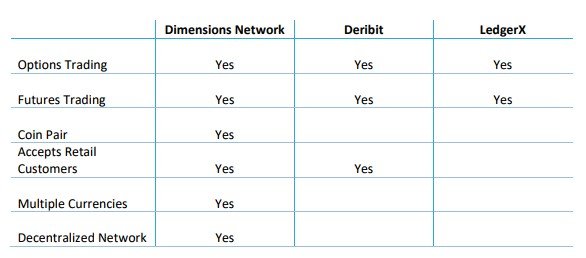

The competition in the derivatives market is much smaller, and this is where we stand out:

- Deribit:

Strength: Established with existing customer base.

Weakness: Centralized. Trading only Bitcoin. Charges fees based on underlying value of contract.

- LedgerX:

Strength: Experienced team looking to launch in September 2017.

Weakness: USA focused and regulated. Targeting only high net worth and institutional investors.

There are several newly funded projects which include exchange platforms and derivative trading in their road maps. The majority are focused on building decentralized networks on unproven technologies, which will take a substantial amount of time to develop and will not be as performant as a centralized platform. These could be our future competitors, but at this time we consider our direct competitors in the derivatives market to be Deribit and LedgerX.

Building a Real Time Cryptocurrency

A number of companies and organizations are trying to move blockchain technology toward where it could be used as a real time currency, used by billions of people on a daily basis. The value proposition here is compelling, as the use case and network effect would give this blockchain an incredible financial value.

- Dash

Strength: Existing commercial partnerships and users.

Weakness: Not Turing complete blockchain. Establish blockchain which makes changes difficult to implement.

- OMG

Strength: Established parent company with a connected payment gateway business. Parent company has local government and corporate connections. Currently developing a new blockchain which aims for fast high volume transactions and interface with existing blockchains. Experienced parent company with insight digital money related knowledge.

Weakness: New blockchain currently under development, with unknown challenges. R&D focus without a near term plan to generate revenue. Parent company operates as business to business (B‐B) with limited access to end users.

- Dimension Network

Strength: Founder with banking technology background with major international banks. Direct access to a varied customer base from trading platform (Retail, Business, Corporate. Multi network approach to decentralized real time currency could be faster / higher throughput than single network approaches.

Weakness: Not first mover.

Threat: Existing companies expands or a new entrant takes market share before we release our platform.

Opportunity: Access to international retail customer base, which provides competitive advantage on geographic expansion.

Marketing Strategy

Our token holders will be key stakeholders and brand ambassadors to champion our platform. Word of mouth is the single most effective method to build trust in the community and introduce new customers to our platform. We will take a multi‐staged approach to marketing :

- Target Retail Customers

- Target Professional Traders / Investors, Banks, Financial Organizations

- Rollout of our real‐time currency We will increase our visibility through trade events and partnerships.

For more information, please visit links below :

Website : https://dimensions.network/

ANN Thread : https://bitcointalk.org/index.php?topic=2261537

Bounty Program : https://bitcointalk.org/index.php?topic=2386175.0

Twitter : https://twitter.com/DN_STC

Facebook : https://www.facebook.com/dimensionsnetwork/

Telegram Official : https://t.me/DimensionsOfficial

Telegram Talk : https://t.me/DimensionsTalk

Reddit : https://www.reddit.com/r/DimensionsNetwork/