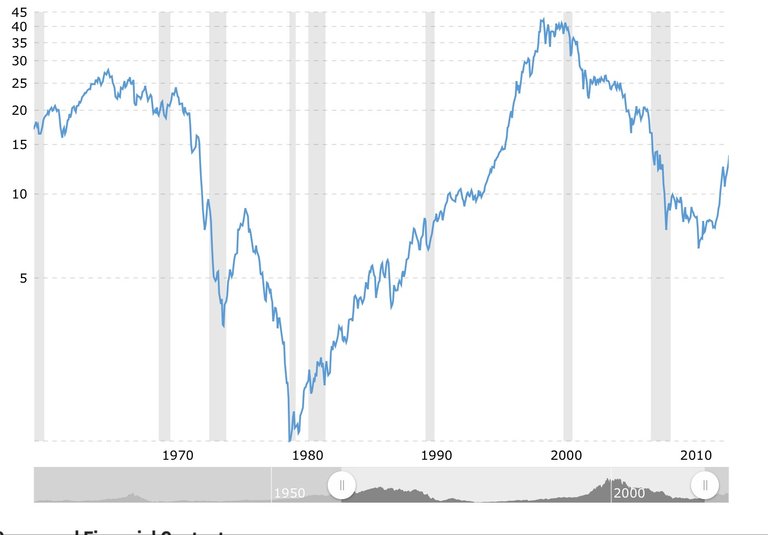

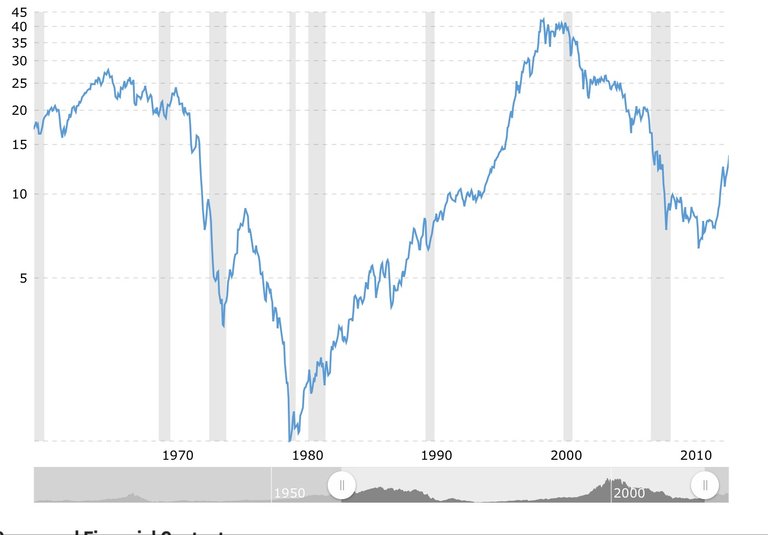

In studying this simple concept, I created a retroactive, hypothetical, multi-generational study of trading the DOW/GOLD ratio from 1971 to 2016 just to demonstrate the power of this concept. Naturally, we have the benefit of hindsight for perfect timing, even if the timing was off in reality the concept is quite compelling. The hypothetical happens in five steps:

- "Grandpa" (43 y/o) saved $710 and bought 20 oz gold in 1971 = $710.00 ($35 p/ounce)

- "Grandpa" (58 y/o) sells the 20 oz gold in 1980 = $17,000 ($850 p/ounce); Buys 15.5 shares of DJ (1.29 ratio).

- "Grandpa" (79 y/o) sells the 15.5 shares of DJ in 2001 (41 ratio) = $184,000; buys 635 oz gold (leaves it to son).

- "Son" (60 y/o) sells the 635 oz gold in 2011 ($1895 p/ounce) = $1,203,000; Buys 100 shares of DJ (6.3 ratio)

- "Son" (65 y/o) sells the 100 shares of DJ 2016 = $1,921,000 (17.5 ratio); buys 1750 oz gold (leaves to son).

- The "grandson" born in 1982 now is 35 years old and inherits 1,750 ounces of gold worth 2.1 million from an initial investment of $710.00 and waits for the ratio of 4:1 or lower.