Bitcoin is the first scarce digital object the world has ever seen, it is scarce like silver & gold, and can be sent over the internet, radio, satellite etc.

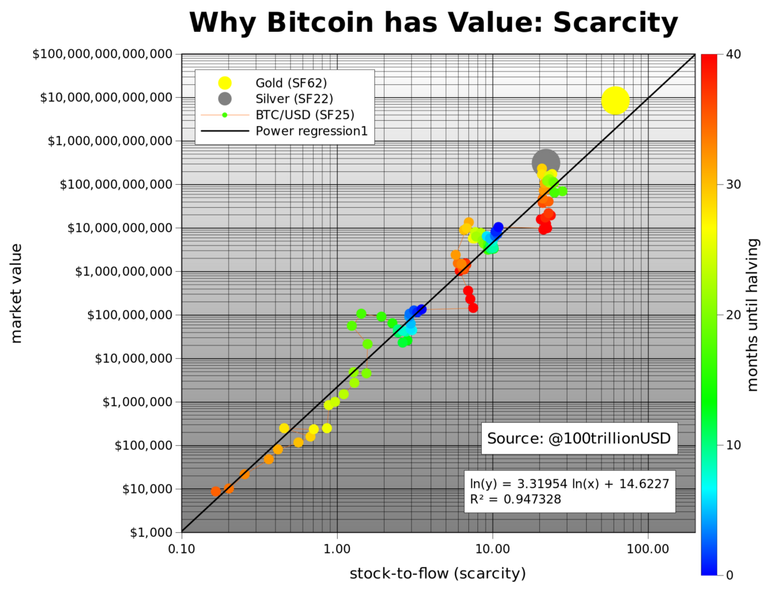

Surely this digital scarcity has value. But how much? In this article I quantify scarcity using stock-to-flow, and use stock-to-flow to model bitcoin’s value.

A statistically significant relationship between stock-to-flow and market value exists. The likelihood that the relationship between stock-to-flow and market value is caused by chance is close to zero.

Adding confidence in the model:

Gold and silver, which are totally different markets, are in line with the bitcoin model values for SF.

There is indication of a power law relationship.

The model predicts a bitcoin market value of $1trn after next halving in May 2020, which translates in a bitcoin price of $55,000.

Source of shared Link

This is the main reason of the increase of btc dominance, and the misery of altcoins. :)

I couldn't say it better!

Is steem in the misery of altcoins too?