If you don't know who Jim Rogers is, he's the charming southern gentleman above. He's famous for co-founding the Quantum Fund with billionaire George Soros. The fund made a boatload of money in the 70's returning an eye watering 4,200%.

Rogers would go on to pursue other business and investing ventures, while breaking a couple of Guinness World Records along the way (including riding a motorcycle around the world). Meanwhile Soros would go on to become the world's greatest super villain.

So how did Jim Rogers become so wealthy?

While he's written a lot of books on the subject and has been super generous with his time as far as interviews go. Having read much of it I'm going save you some time and attempt to paraphrase... but first let's see what the man, the myth, the legend has to say:

I know, earth shattering, can you expand?

Ah, you want me to be patient... But I want to be rich now!

Tell me what to do already!

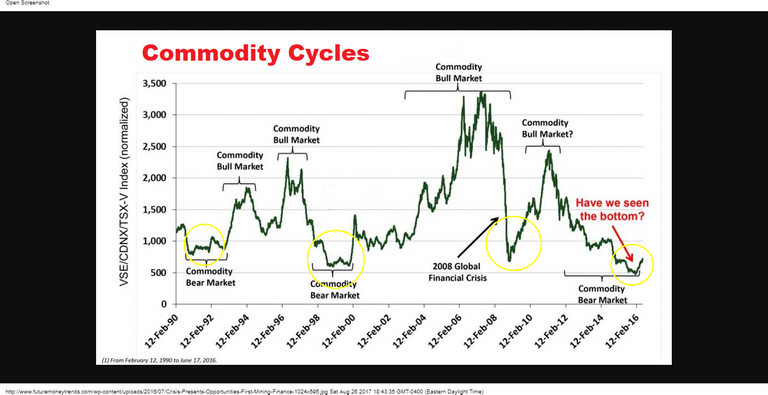

Jim Rogers has been successful in many markets. He's recently been pretty vocal about being long the dollar and short general market indices. However he's famous for his success in the commodity markets. Like all markets, commodities are deeply cyclical. Meaning they go through big BOOM and BUST cycles.

Go back and read Roger's quotes again. He's basically saying the same thing in both quotes. "Buy low and Sell high." When a pair of jeans or a sofa goes on sale, everyone rushes out to buy it. Think Labor Day Sale, 4th of July Day Sale, Black Friday, people are nearly killing themselves to hand over their hard earned cash!

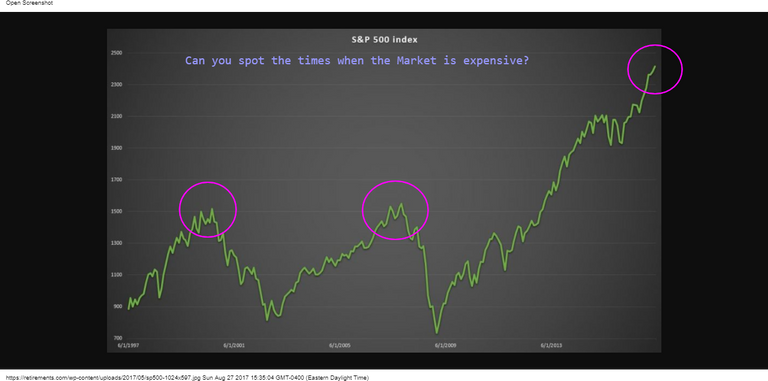

However when a financial market goes on sale it's called a CRASH and everyone loses their minds!

Meanwhile savvy investors like Mr. Rogers are in there backing up the truck, scooping up assets literally for pennies on the dollar!

Take a look at this chart, can you spot the buying opportunities?

Yup, yup, yup and yup.

Listening to Jim, he often laments that he is a terrible trader and "the worst market timer in the world". What he is good at is having patience and moving in when everyone is moving out. Take a glance at that chart again, you absolutely do not have to be a financial professional to spot a bargain.

Likewise if the market has been moving up for years, the best gains have already been made and it's probably a wise decision to employ some Jim Rogers like patience.

Now look, no one said this would be easy. We are social creatures and as such are preconditioned to follow the crowd. If somethings gone down 90% in price, then it must not be any good right? But you must fight this feeling, this need for social validation with every fiber of your being!

Feelings, who needs em' That's what I say!

Plus let's be honest, when it comes to commodities unless we want to stop driving our cars or stop using our tablets, smart phones, and heck even electricity period! We're always gonna need zinc, steel, copper, silver, uranium etc. As legendary resource investor Rick Rule puts it:

"..measured by the TSXV (shown above), this is a market that fell by half and then it fell by half again and then it fell by half again. This is a market that is down by 90% in real terms which means it is precisely arithmetically 90% more attractive than it was in 2011"

In case you don't know who Rick Rule is, he's worth listening to. As head of Sprott USA a resource firm, he has a personal net worth north of $500 million dollars.

Wait, wait, and wait some more...

Your take away is this: If your friends are all telling you about a hot new stock pick or how they're getting rich on Tesla or the latest crypto fad, run the other way! Remember you want the assets that are out of favor.

You want to buy Oil after the BP spill, Stocks after the dot com crash, Real estate after the '08 mortgage crisis.

That's where the bargains are.

When the asset is out of favor, when they're hated, unloved, that's when Mr. Rogers sees money laying around and walks over and picks it up.

Maybe you should consider doing the same.

Until Next time.

Hmm, I've been long silver since the end of December. My money senses are tingling!

Mine too. Silver is interesting, it gets pushed around very easily.

This volatility can make you crazy if you follow the price tic by tic like I do. Just the same it's setup for a really good 2018 I think.

The main point I wanted to make with this article is that Rogers doesn't chase price. He buys cheap things early. Years early and then just waits.

Sometimes waiting is the hardest part!

True, very true.