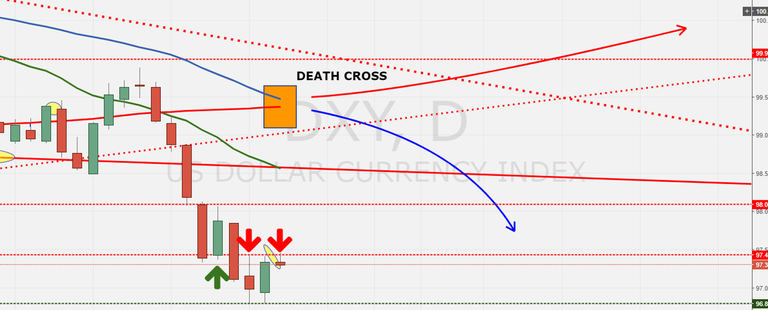

First, we must examine the status of the impending 50/200dma cross (Death Cross).

Let's look closer...

97.43 is the key. It acted as support but is now acting as significant resistance.

Next, let's look at the Gold-to-Silver ratio. 73.25 is the battle line between the precious metals bears and bulls.

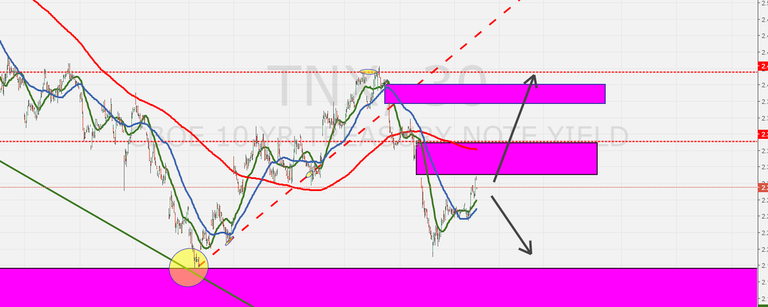

Money has been moving out of the 10-year but two overhead gaps may tamper that movement. This is a must-watch and see situation, imo.

SPY is at a critical point where it will fall out of its rising wedge at the open. Will the Head & Shoulders force it down or are the markets still the only game in town?

And, finally, USOIL. The inverse Head & Shoulders pattern is still valid. Notice that price action is challenge a former resistance point. It MAY be flagging which could send it much higher. Is this a prelude to war?

The Maestro!

www.themaestroway.com

Thank you for your analysis, Maestro!

Absolutely! Have a fruitful day!