To receive James Stanley's analysis directly via email, please sign up here

In yesterday's article, we looked at a flood-off in the USS. Dollar after a report began to circulate that China may be looking for slow or halt purchases of usS. Treasuries. This brought a quick spike in US rates along with a steep-lower in the USS. Dollar; but as we moved deeper into the U.S.S. session, calm avoided and the flood-offs reversed in both treasures and USD. Later yesterday, China looked to replace those reports: the State Administration of Foreign Exchange issued the determination that they may be looking for slow or halt. "

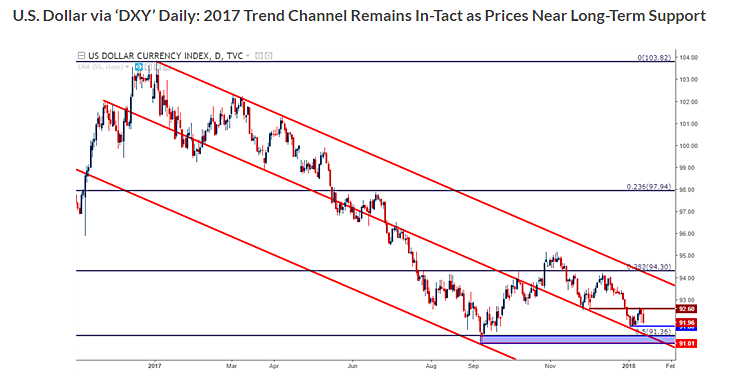

This helped to bring prices in the dollar (DXY) up towards that area of resistance that we have been following around 92.60, taken from the December swing-low; but sellers showed up at 92.55 produce a lower-high on the chart. This is when we will be able to move to the next stage of the U.S. CPI and advanced retail sales figures.

Looking for longer-term analysis on the U.S.S. Dollar? Click here to access our Q1, 2018 trading foreclosures.

BASE. Dollar via 'Dxy' four-hour: recovery from yesterday's Sell-off short-lived

On net, this leaves a fairly busy Setup on the U.S.S. Dollar's daily chart. The trend channel that guided the price action for much of the last year in the greenback remains in-tant, but we're approaching what a great deal. The dollar fell down to 91.01 in September last year, at which point a recovery showed all The way into November. But, after sellers blame back in November to re-grab control, prices drop all the way down to 91.80 short after the Open of the New Year. That support, so far, has held-up, with yesterday's sell-off producing a 'higher-low' when buyers came in around 91.92.

The big question is whether or not the dollar is in any form of trend. Early in the week, the U.S.S. Dollar was rallying, all the way to prices. After resistance set-in, that report from yesterday helped to bring on another bearish move, but after prices received a bit, another lower-high showed up around the euro session.

Traders looking to take a directional approach to the U.S.S. Dollar will likely want to allow a break of this current range, running from the rough values of 91.80 up to 92.60. A support side break options up the probability of deeper short-side targets, toward the Fibonacci level at 91.37 along with the 2017 low at 91.01.