Hello World! It's with great enthusiasm that I can share that the DSwap alpha is rolling on out! Many thanks and congratulations to @cryptomancer, @bait002, and @lion200!

Check it out at DSwap!

What's a Hive-Engine

Hive doesn't have native smart contracts, and various projects on the chain need tokens and it doesn't make much sense to do it all through ERC20s or wait indefinately for HMTs (Hive Media Tokens). So, we built a platform. Now, Hive users have the ability to mint fungible and non-fungible tokens using custom Json posted on the Hive blockchain as the layer 1 for the project. The Hive-Engine system interprets custom Json and mints/trades tokens on the layer 2.

What's a DSwap

DSwap is an addition to the Hive-Engine ecosystem that allows for convenient and automated trading. There's two parts: Market Making and Market Taking.

What's a Market Maker?

A market maker is an automated piece of software that places orders on both sides of a trade. It makes money by having a small spread between the bid and ask so as money is sloshing back and forth the person/group running the market maker has the ability to skim a little off the top.

What's a market taker?

A Market Maker places bids and asks, but never pushes into the depth chart. It offers things for trade, but it doesn't take other people's offers. A market taker is when a user or piece of software takes one of the offered trades.

In the case of DSwap, the goal is to provide a convenient tool to swap between different cryptos/tokens. You would enter I have "X" I want "Y" and authorize it with a few configuration details, and all the steps would be handled automatically. And it'll automatically exchange (Swap) for you.

What's rolling out right now?

The Market Maker alpha is ready as of TODAY! So, if you'd like to setup an automated market maker you can do that starting now. There might be bugs, we've tested to the best of our ability, but there could be other inconveniences as well. That's why it's an alpha. We also have many additional features and trading strategies to add, so there's a lot of development work left to do.

Why should I do market make?

You have a chance of making money through automated trades!

How much can it make?

While the earliest data isn't much to go off of, Neal who has been running one using direct commands (rather than the friendly interface we're rolling out) averaged a 37% annualized yield after the first 9 days. Hopefully as we optimize it and more people use the exchange this increases. You'll note on some days he lost money (because the money didn't just slosh evenly but only one side of the pairs were bought). At some points he's actually sold out of half the trading pair. Even with those he's still averaging a 37% annualized return!!!

It's not completely set it and forget it, but I'd argue it's a low effort way to make money if you have money.

https://peakd.com/hive-167922/@nealmcspadden/hive-engine-market-making-the-first-9-days

What's in this for Hive-Engine?

We just want more volume on the exchange. Yes, we take fees, but also it attracts more projects to build here on Hive because if there's more volume, there's more money, and it's easier to see how one could raise/make money on the platform by doing projects or trading here.

What are the fees?

For the people taking markets there's still the 1% deposit/withdraw fee, and then it's whatever the spread is. If you're trying to move small amounts of money it'll be slightly over 2% in some cases. If you're trying to move large amounts of currency it'll be higher. It's still substantially lower than 10% fees I've seen (and experienced) charged by other prominent swapping tools. We're currently investigating capping the 1% fee for larger exchanges or lowering it for a period of time.

For the people making markets there are no fees on the trade. This is a huge deal because it means that no one is taking a piece on EVERY transaction. The real advantage of the fee system is that the large liquidity providers aren't hit on every trade they make!

The market maker itself does have fees. The one that actually costs something is a 100 BEE (100 ENG when it goes live on steem-engine) which is burnt when registering an account. There is also staking required, it'll be 1000 BEE or more depending on how much you want the market maker to do.

Keep in mind, staking doesn't actually cost you anything. It just means that you're parking money somewhere for a while. So, in our case you have to spend ~$20 to register an account and park ~$200 bucks here for a while (less if you buy the bee on the open market or got in airdrops). I paid $500 for the trading bot that I've used in the past. So, kindly put that in perspective before railing against me for daring to charge for the services we provide.

What's the advantage of this being a smart contract?

Normally everyone has to run their own program. If it requires it's own server you need a computer science 101 background to be able to run tools like this. HOWEVER; that's not how this works. The smart contract is now part of the Hive-Engine node software. You don't have to run your own program, you don't have to be a dev, you don't have to maintain this stuff. It's running as part of the core backend of the project.

So, what you have to do is register the bot and give it some configuration details. We maintain the damn thing.

What's next?

On the market maker side we're adding more premium strategies. The first one is wall nesting. So, if there's a giant buy or sell wall, you can nest right up against it, which provides some certainty of a backstop for your trade.

The second strategy will be what I call lures, as in fishing lures. In that you'll be able to have one bid/ask pair close to the gap, and a second or third+ pair further back from the gap between the pairs. It's similar to saying "if you want a $10 trade it will cost you X, if you want a $100 trade I'll charge you Y, and if you're looking to trade $1000 right now it'll be Z."

On the market taker side, we're still working on the backend, and hopefully sometime in September this whole apparatus will be working to make and take bids/asks on the exchange.

Overall though, this is a project that basically never has an end. There's a lot more strategies and automated things we can do with the tool now that the core components (configuration tool, execution tool) are out. We could for example get DCA tools running where you say how much of a token you want to buy, how frequently, and how much you want to collect, and it'll sit there and buy it for you over a period of time. We're trying to make your trading automated, inexpensive, and convenient.

Want to give it a try?

I'm willing to do some discounts to get this started. So, for the next week if you get this up and running let me know. Depending on how much liquidity you're willing to provide I'm willing to cover some or all of the costs to you including reimbursing fees for the market maker and fees for moving in Hive/Steem/Crypto.

You can find me in [discord](https://discord.steem-engine.com] as aggroed.

This is patriotic for Hive!

Just lastly, keep in mind that by supporting this project you're supporting the ecosystem as a whole. I like things that elevate the community while simultaneously providing me and the users of the platform with money. This counts for that. As you're trading, increasing volume, it makes building projects on top of Hive-Engine and Hive more attractive. So, do your patriotic Hive duty and start making trades and automated trades today!

EDIT

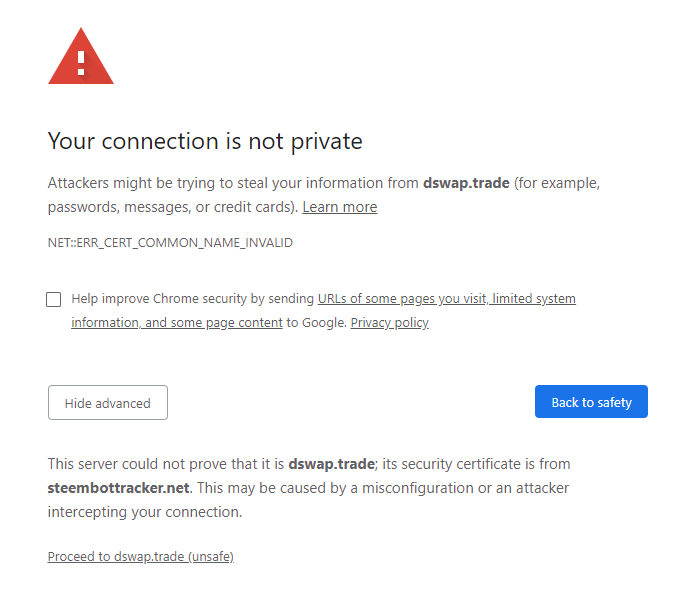

https://dswap.trade was initially not setup, I took that link down and replaced with http://dswap.trade, but now it is working and I've restored the links to the https://dswap.trade. Sorry for the inconvenience.

You should add #defi, and mention it at least ten times in the post, otherwise nobody would notice ;-)

defi is just a buzzword so all @aggroed has to do is CALL hive engine defi

staking is defi we should rename it thats all

defi ants

defi engine

defingine

Fees too high.

Should decrease them in proportion to Hive the user has powered up.

Very cool project, will support/use it but think the 1%/2% Hive-Engine fee is too high, if the fee is lowered (and or capped for larger trades), Hive-Engine could become a serious DeFi competitor considering Hive's zero tx fees.

The 1% fee is only for deposits & withdrawals. There are no trading fees.

A 2% fee (1% deposit + 1% withdrawal fee) sounds hefty compared to a small trading fee. #market #psychology

Auf Leodex zahlt man statt 1% nur 0,25%! Selbst ausprobiert, es funktioniert.

Danke für die Info, das wusste ich gar nicht. Das sollte Leodex stärker bewerben.

HIVE needs smartcontracts ASAP.

I get that it's a good idea, but centralized "Layer 2" are just a very bad bandaid.

u cant unless u use telos and thats what im talking to @dapperd telos white paper author about now that hes STUCK with my idea of telos scot now that @appics is on telos

its gona be work but basicaly new actions on the existing eos or telos acount https://bloks.io/account/appicsappics

I recommend readers to calculate the potential profit themselves. I have been market making pretty much alone (if I do not count in those who were doing it manually) for almost a year on multiple pairs and did not really earn a fortune by it. I guess a lot of people will now try this mm feature and of course... the more market makers are there, the less potential profit is there to make (smaller spread, more competition). If many people start using this service, volatility will make much more influence on your investment than the market making itself. But good luck to everyone. I am looking forward to see how the volume reacts to smaller spread and how it affects my own market making activities. :D

Btw, those 37 % are not really a stable income. You should look at the article to see how his potential APR fluctuates. After 9 days, volatility makes much more of an impact than the trading itself and the number does not really say much. And I am not saying 37% is not possible. I think that in the last year, I had more than that (but the initial investment amount was not that much)... but now there will be more market makers, of course... so who knows what the future brings.

But overall, I am pretty excited to finally have a mm war. :D

Good day, that's very good to hear however I'm getting an error it says, "Cannot GET /"

Whoops, small error. We have it as http://dswap.trade. Still getting the https cert. That should be in the next 24 hours though.

A great service indeed but it seems the website has some problems, its not a private connection. and shows

Cannot GET /when visited. please solve these, thanks.Edit: just saw your reply to another user who had the same issue, the working address is http://dswap.trade/

Should work now ;)

I am getting the same "Cannot get" error.

Issue resolved! Can you try again?

Looks good!

Will take try it when I ain't on the train :D

Market taking work is still in progress, but you can start playing with the Market Maker ;)

Hi @lion200 , I've got a tx stuck in dswap and am not sure whom to contact.

Details:

The only thing I have to show for it is the transaction https://hiveblocks.com/tx/66aafcd18848d491072a20eeb2bf78f671f454d9 and the screen-shot below:

Are you able to help or direct me to someone who can?

Thanks

Hello @krunkypuram thanks for using #Dswap and reaching out. I just refunded your swap request: https://he.dtools.dev/tx/d2125a44a5bf37e49bec2b0f29c5499d20b3e33b

It looks like your swap request didn't reach Dswap api. That's possibly because you didn't wait after the keychain transaction went through. We show a popup displaying that a couple of seconds are needed to queue your swap request in DSwap after the hive transaction has been sent. Can you try again and let me know if everything works as expected?

Many thanks for getting back to me @lion200 and for the refund. You are right, I didn't wait long enough :)

I tried again with 1123 Weed to Leo, and then again with 623 Weed to Leo.

In both cases, the queue starts, then returns an error saying it's failed.

I'm guessing there's not enough liquidity.......!?

PS. tried again with just 123 Weed, same error

Good move..! Congrats man..!

Any chances for something like uniswap? User just picks what tokens to trade (swap), confirms and it's done :) and then trading fee distribution for liquidity providers? Damn, that's essentially building own defi swap platform.

that's the market taker side, and it's getting built.

Ahh yes, missed that part when going quick trough the post. Noice.

Yeah, just add the word "Defi" somewhere on the site and millions will start flowing on your project xD

hivedapps.com needs a DeFi category and list hive-engine and other Hive DeFi apps as well.

The DSwap link before the EDIT title is pointing to dswaps.trade instead of dswap.trade.

It just happened to the link I clicked.

Typo in the post. Fixed.

Great step in improving hive-engine! But I have mixed feelings about it...

$220 to set up trading prices out smaller guys - way too high cost to test something.

Larger guys already might have own bots so that may miss some of them too.

To achieve really good liquidity it would be helpful to have as many market makers as possible and having liquidity is so important, especially for smaller (well anything but top 5 or 10) tokens.

So for these reason I welcome this a lot, but also hope that you will reconsider pricing model - either drastically reduce price or offer basic functionalities for free and charge for frequent trading or computationally expensive things.

The basic service is quite cheap, that's designed to allow you to get a feel for it with committing much capital.

When compared to work needed to create own bot yeah its very cheap.

When compared to potential not so much at least at the moment. Market making is not print money for free licence it is business with risks and reward like any other. If you have for example $1k dedicated for hive-engine tokens(=HET later) $220 is brutal. Compare that to stocks/fx/commodities where you can use bot trading for free - difference is that brokers collects fees for trades, but you can still do it and easily try it with low capital allocation. Really amazing liquidity might happen when people with $5 can do market making.

And keep in mind that dedicated $1k in HET isn't that little when we count in diversification of total portfolios.

"Normie" inverstor will hardly have more than 0.01% in HET - $10M total portfolio

investor who likes crypto might have 0.1% in HET - $1M total portfolio

investor who likes HIVE specifically can easily have 1% in HET - $100k total portfolio

all those are priced out.

Which more or less leaves only people who really wanna focus on trading on hive-engine as focused job and I don't think volumes are there to support them yet.

Thanks so much for this. I have been thinking about creating my own market maker bot for a while now. Alas I do not have the coding skills...yet. This looks to be a good stop-gap for me.

Looks like ya'll have already fixed the security certificate thing :-)

Got it up and running. Seems OK so far.

I do have questions about some technical aspects of the top of book protocol. Does it reposition orders to top of book on each tick every time? Or is there some type of if this then that algorithm to close and open new orders?

I guess these questions are best asked in discord or some such. Just wondering if there is somewhere to see an algorithm explanation.

Yes, it will attempt to reposition orders as needed, according to your configuration settings. If you need more detailed information, feel free to contact us on our Discord.

Thank you for this. Helps me alot