Dear Steemit friends,

What is financial literacy?

According to Robert Kiyosaki,

If you want to be RICH, you need to be FINANCIALLY LITERATE.

Robert Kiyosaki is an American businessman and author of self-help books. He is best known for the book series Rich Dad, Poor Dad. He is advocate of financial literacy teaching us how to invest and save money for the future.

Does Filipino needs financial education?

I' had an interview with the Steemians in Cebu during our meet-up. They have a common answers that Filipinos needs financial education. They argued that financial education will prevent extreme poverty in Philippines. I am grateful knowing that Steemians in Cebu are trying to inspires millennials today to be responsible of their existence. Inspiring them to creates brighter future by starting investing and saving money not later but NOW.

If you are interested in terms on Financial Education you can contact @jcvertucio in steemit. He said,

Steemit is a blessings to everyone there is no need for us to invest but just write something you love and earn. I am here to teach financial educations teaching young millennials today how to diversify their incomes.

@jcvertucio is friendly person kindly follow him in his blog https://steemit.com/introduceyourself/@jcvertucio/unbowed-unbent-unbroken. He can teach you on how to invest in any Cryptocurrency, saving money and investing in stock market.

ARE YOU INTERESTED IN FINANCIAL EDUCATION?

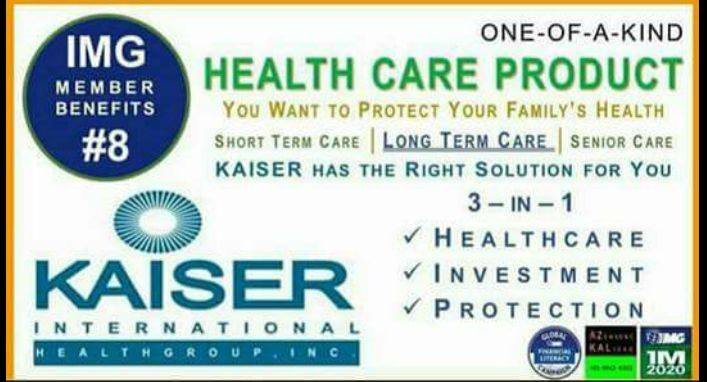

My is name is Edenjevy Oliveros i am also financial educator on how to invest and save money. I have been working at IMG INTERNATIONAL MARKETING GROUP, they have MISSION to EDUCATE 1 MILLION FAMILIES until 2020. IMG has offered free Financial conference you can attend for free

The IMG Preferred Membership Exclusive Benefits

- Free Financial Education Workshops and Books

- Free Financial Check Up

- Preferred rates on Car, home, property and other non life insurances ( Mapfre, Malayan, QBE, UCPB Gen)

- Access to Life Insurance Product and Services from PhilAm Life MOST

- Discounts from Real Estate Companies and you can also be a broker for SMDC, AyalaLand, DMCI, VistaLand and Megaworld

- Access to Estate Preservation Program by APS

- Access to Kaiser Healthcare Products and Services

- 0% Load to access Rampver Financials with Free investment seminars on Mutual Funds (Soldivo, ATRAM, PhilEquity, FAMI and Sunlife Asset Management)

- Memorial Services with Life Insurance at FidelityLife

- Everest Memorial Services 24/7 concierge for owner or relatives of an IMG member

- Access to Ozone therapy at discounted price

- Business Ownership with Commissions

- An opportunity to Travel the world

- Free HealthCare for SMDS

- World Class Recognition

- Discounts to Generika Drugstore

- Exclusive Trading to MyTrade in Philippine Stock Market Investments

- Globe Discounts and Freebies

- Free optical examination and eyeglasses frames

And more. 😉

GOOD NEWS!

IMG now has its very own mobile application. IMG Wealth is now available for download from your Android app store, and on your iPhone iOs App Store.

Managing our needs and doing the IMG business has never gone far more easy! Take advantage!

"The best investment you can make is Investment in yourself and your Financial Education."

It’s the obvious starting point to building wealth. Why?

Here are seven reasons:

1.)Provides dividends for life that nobody can ever take from you.

2.)Increases your earning potential.

3.)Increases your return on investment.

4.)Improves the quality of your life and finances.

5.)Secures your retirement.

6.)Defends your portfolio from unnecessary losses.

7.)Provides peace of mind around money.

That’s a long list of advantages, but what about the disadvantages?

Why doesn’t everyone master these essential skills for investing and develop their financial literacy?

Because it requires time and effort — and they’re too busy. That’s it! There are no other disadvantages.

If you’re willing to commit the time, you can have all the advantages that can make you become financially literate.

All you have to do is put out the effort, and a lifetime of benefits is yours for the taking.

Have you heard about KAISER?

I DON'T NEED LONG-TERM HEALTHCARE IF:

1.) I won't GET SICK.

2.) I can rely on our government to take care of us.

3.) if MY children will take care of us.

4.) If I can bring MY Company's HMO in retirement.

Can I save Php 88.00 per day?

(Let's assume Im 25 years old)

If I invest P2,647 every month for ONLY 7 years, I will have P524,776 at the age of 45.

I also have a benefit of Long-term Healthcare (50k Hospitalization) & Life Protection (225k - 450k).

What if I didn't withdraw the P524,776? It will grow 10% per year!

👉 At the age 60, I will have P2,192,119 and

Hospitalization of P219,212.

👉 At the age 65, I will have P3,530,429 and Hospitalization of P353,043.

Take Note: Only 7 years of Saving!

ARE YOU INTERESTED IN INVESTING MUTUAL FUND and BECOME A SHAREHOLDER IN JOLIBEE ?

INVESTMENT: Money working for you...

Masaya ang marami sa pagbubukas ng unang JOLIBEE sa Macau, pero mas masaya ang mga investors ng jolibee, dahil habang parami ng parami ang branch ng jolibee worldwide, mas lalong lumalaki ang kita ng mga investors. Eto ang isang way sa pagkakaroon ng passive income or money working for you...

Bes, kapag gusto mo din maging isa sa mga investors or maging isang Overseas Filipino Investors, eto na ang iyong pagkakataon.

Just ask me how or pm me bes at ituturo ko sa iyo kung paano?

From Overseas Filipino Workers(OFW) to Overseas Filipino Investors (OFW)

Financial Independence is not only a dream. It is a PRIORITY that every person should aim for. Take control of your future by learning how to:

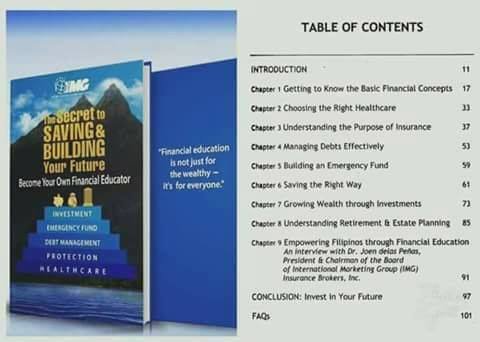

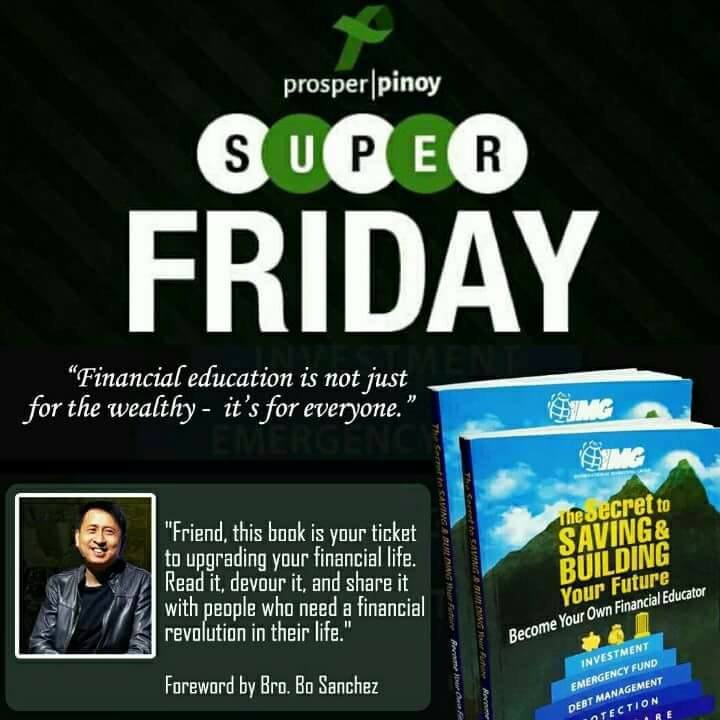

GRAB THIS BOOK NOW

- Make Money

- Save Money

- Grow Money

- Protect Money

No one else will do these for you.

#GrabthisBook

#TheSecretToSavingAndBuildingYourFuture

We were not taught financial literacy in school. It takes a lot of work and time to change your thinking and to become financially literate.

- Robert Kiyosaki

IMG INTERNATIONAL MARKETING GROUP CEBU;

Offered free classes on Financial Literacy. Join our financial campaign. We have mission today, one million families would be financially educated in year 2020.

Our 3 Major Financial Needs:

#1. Income Protection / Life Insurance

This will protect your family if you die too soon. Life Insurance protection can help you replace your income, help finance your children’s education, pay estate tax, pay debts, etc. instantly.

#2. Investment

This is the answer if you live too long. This will generate income for you when you retire. It is your money working for you.

#3. Long-Term Healthcare

This is the answer to your healthcare needs when you retire or get old. How comfortable your health care situation will be after you turn age 60 depends on the decision you make today.

invest learning today

“If you’ve failed, that means you’re doing something. If you’re doing something, you have a chance.” Robert Kiyosaki

Sincerely yours

▶️ DTube

▶️ IPFS

thanks for sharing this info sir. :)

take care and happy valentines day!