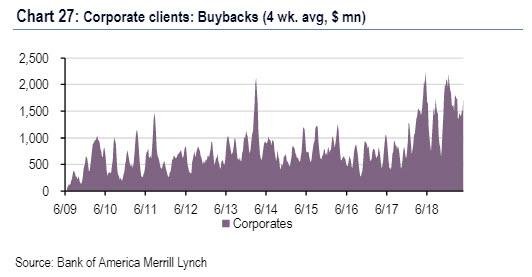

Comedians gets paid to make people laugh. But in this case, there is no comedian needed. The markets themselves are a laugh. Someone sneezes and it drops 4 or 500 points. It’s truly a joke! The only notable buyer has been of course, stock buybacks. The continued trend has persisted. Now while central banks have also been buyers, apparently buybacks largely persisted throughout the supposed blackout period of April. I hope they have an unlimited checkbook to keep this party going.

Markets: Indexes, Bonds, Forex, Key Commodities, ETFs

Dow drops 470 points on growing trade-war threat, biggest decline since early January

Gundlach: Better than 50% chance new tariffs happen, further hitting stocks

^NYA 12,778.50 -198.17 -1.53% : NYSE COMPOSITE (DJ) - Yahoo Finance

IT companies are on pace to spend the most on stock buybacks in 2019 - Axios

Stock buybacks ramp up while investors turn to ETFs — BofA | Financial Times

bofa buybacks 1.jpg (532×277)

Soaring bankruptcies in Farm Belt force banks to boost defenses | American Banker

https://www.cnbc.com/markets/

https://www.cnbc.com/2019/05/07/us-stock-market-us-china-trade-tensions-remain-in-focus.html

https://www.cnbc.com/2019/05/07/jeffrey-gundlach-sees-better-than-50percent-chance-new-tariffs-happen-further-hitting-stocks.html

https://finance.yahoo.com/quote/%5ENYA/

https://www.axios.com/stock-buybacks-2019-tech-sector-f75e4835-4934-442d-b13f-091b4b881c11.html

https://www.ft.com/content/651c05cc-70ce-11e9-bbfb-5c68069fbd15

https://www.americanbanker.com/articles/soaring-bankruptcies-in-farm-belt-force-banks-to-boost-defenses

https://www.americanbanker.com/articles/soaring-bankruptcies-in-farm-belt-force-banks-to-boost-defenses

▶️ DTube

▶️ IPFS