Myth of the Robber Barons

Economic development of the 1800's

In the early 1800's England was advancing in mass production of things like textiles and then eventually iron and steel to allow for railroads to develop. By the 1840s, the steamship industry was gaining serious momentum. For the young United States, they had one of two options to try and compete against Britain. They could use government money to bolster local entrepreneurs or allow for only free enterprise to dictate the economic growth. This decision about government involvement would have ramifications that are still seen today.

On one side of the argument, the US might be starting off slow, but with the amount of freedom and expected entrepreneurship that should follow, the US will improve economically soon.

On the other side, because England and other European countries have heavy government involvement and are doing well economically, the United States should implement more government to have the same economic benefits that England is experiencing. The difference comes down to immediate vs delayed gratification.

The compromising idea was that since the US was behind, they could use government funding to help get the entrepreneurs to get to a level comparable to England and then take away the government funding once a foundation is built. However, once you give the government an inch, they will take a mile. That is the same with any powerful entity.

Time is money

Steamships back in the 1800’s were like the internet today. It shortened the time of communication. Before steam powered ships, it could take over 2 months to make a trip from the east coast of the US to England. With the volatility of prices within an economy, 2-3 months is not feasible for profitable business. Steamships decreased the travel time to 2 weeks, it increased migration, and improved global communication. The diminishing costs improves the way of life to people on both sides of the transaction.

The Edward Collins Story

Edward Collins was an entrepreneur who "volunteered" to receive subsidies as a way to build a steamship company to compete with England. National debt was at 10 million dollars in 1840. Edwards Collins asks for 3 million dollars to build ships and $385K for initial costs. Congress accepts. Why? To compete with the British!

But after 1 year when Collins came back to Congress, they were all congratulatory for what he had done, but Collins said he needed $400k more because he experienced a slow start in business. Then the next year was $500k because he had a ship out of commission part of the year. The next year he requested $600k. This is when a skeptic arose by the name of Cornelius Vanderbilt who was also involved in the steamship business. Vanderbilt found it absurd that Collins kept asking for more subsidies, so he made the plan to come before Congress and what Collins asked for, Vanderbilt was going to bid to do the same job but for half the price. So when Collins asked for $700k the next year, Vanderbilt asked for $350k to compete with Collins. Congress still voted to accept Collins offer. This is where human factors play larger roles than economic factors. Financially, Congress is spending $350k more for what they feel is assurance and insurance.

Vanderbilt's Reaction

Vanderbilt goes into the steamship business without a subsidy. The competition begins between a true entrepreneur and government-backed business. Vanderbilt realized some of the struggle of supporting this new escapade and immediately tried to find ways to decrease costs and increase profit. He decreased the ticket price for passengers to incentivize more people to ride. This is the idea of “economies of scale.” To save fuel, he went slower than Collins’ steamships. With more people and longer travel time, the entrepreneur inside of Vanderbilt helped himself realize he could sell food on the ship and make even more money that way. These are century old principles that still hold true today.

At the end of Vanderbilt’s first year, his company made a profit! Collins asked for $858k from Congress because he said he had to compete with Vanderbilt now. Quite the discrepancy between the two businesses. And yet, Congress still gave Collins the subsidy he asked for. Some might call this shocking, and reasonably so.

Because of the loss in business that Collins was experiencing, he had to find some way to gain a competitive edge over Vanderbilt. Collins had to market his ships as being the fastest on the water! Many complications followed with Collins trying to go so fast. He sank one ship and lost another, yet Congress gave him another 1 million dollars to build a new ship for his fleet. This ship was built too quickly and began to take on water. Collin was no longer worried about providing good business. He was only concerned with competing with Vanderbilt.

By reviewing this story, one can see an excellent example of quality versus quantity or luxury versus economy in the demand of steamship services. It juxtaposes the market entrepreneurs to the subsidized entrepreneurs. If only the United States was able to learn from this lesson. Unfortunately, Congress made the same mistake with transcontinental railroads. They decided that they would subsidize two railroad companies and let them compete with one another instead of letting market entrepreneurs arise.

Railroads

After many issues arose between the Central Pacific and Union Pacific, the US government said they were finished with subsidies to businesses. Either the entrepreneurs will lead the US to success or they will lead the US to failure. Regardless, all the subsidies will be withdrawn and only private financing will be available. In this sink or swim scenario, the United States swam. After the civil war, market entrepreneurs led the US to being a world leader. This is where the stage is set for new type of businessman.

Robber Barons or Opportunists?

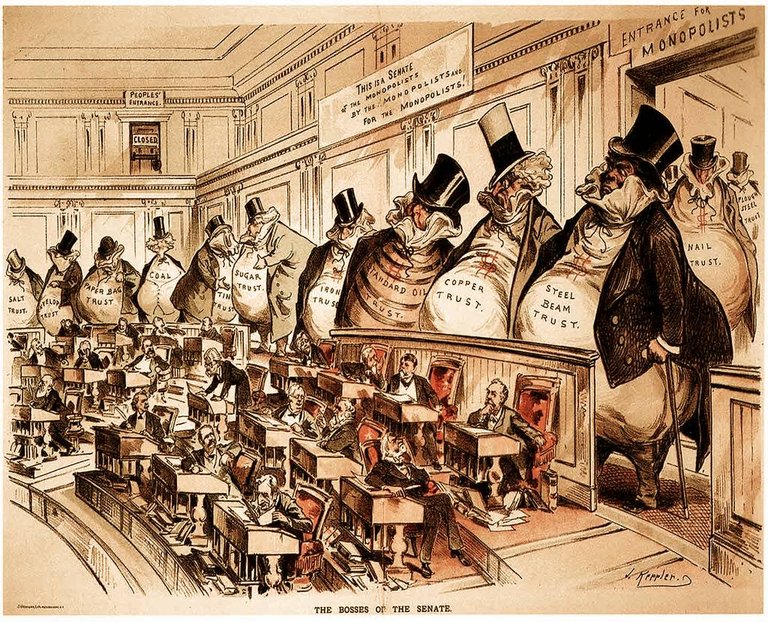

Companies like Standard Oil arose under leadership from John D. Rockefeller and they accomplished feats that the world had never seen. Standard Oil sold 65% of all the oil sold globally. Carnegie helped the US become the world leader in the steel industry. In the early 1900’s automobiles from Henry Ford became widely available. I argue that these people are not greedy businessmen as some political cartoons or even history books may make them out to be. They are examples of how true entrepreneurship can and should operate. When someone can produce a good with better quality and lower prices than competitors, they should succeed. A principle that I remind myself of when I feel that other people are benefiting while I am not is this: “there is always someone who has had it worse but still done better.”

The myth of the Robber Baron is that they succeed at the cost of someone else. They monopolize and cause other people to suffer. Suffering here, in my opinion, is relative to perspective. Did some companies fail when trying to compete with these giants? Yes. Did the United States become one of the strongest economies and world powers from the efforts of these men? Yes.

In the end, it could be said that the companies that failed against these monopolies should have found a different industry to get involved in. That is a matter of opinion. And for some reason, people tend to have negative opinions toward people who are more well-off than themselves. Could that be the case with these "Robber Barons?" Is there entrepreneurial spirit and hard work being framed as greed? Maybe they were just at the right place at the right time and willing to take a chance that just so happened to change the world forever!