The Dot-Com bubble was a very disastrous time in American economic history, but compared to the Great Recession of 2007, it is now seen as a minor inconvenience. Imagine if this too, will soon be seen as a simple setback compared to the coming economic crisis.

I have compiled a great deal of evidence to make just this case. I have tried to back up every claim with supporting evidence, arguments, and many hockey-stick shaped graphs. There are over 70 links in this article. I have not listed every problem with the US economy; healthcare, for example, requires its own page, and I'm sure there are many more problems that are unknown to me. I have done my best, however, to mention a vast array of market malfunctions that may go unnoticed to many people.

I make the claim that America, and possibly the world, is currently facing an economic crisis like we’ve never seen before. We’ve seen the collapse of a few specific sectors of the economy, but I make the claim that there are now numerous sectors of the economy that are due for a correction; their combined negative effects may create the mother of all financial disasters.

Overly Optimistic Stock Market

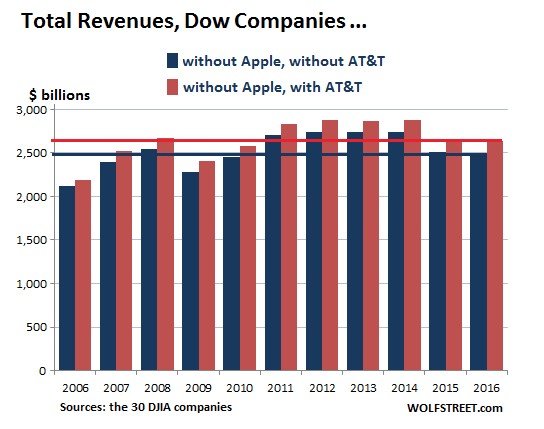

The Dow Jones is over 21,000, which by itself is not concerning. What makes it so concerning is that the Dow Jones is valued at 21,000, despite most Dow companies reporting the worst revenues since 2010.

Apple replaced AT&T in 2015 on the Dow Jones, and Apple revenues have skyrocketed 1000% since 2006. It seems that Apple has been carrying the Dow Jones, because without the massive Apple revenues, it seems most companies are stagnating, as this chart to the left shows.

Over the last 5 years, 12 of the 30 listed Dow Jones companies have suffered major revenue declines, most of which come from the oil and construction industries. Despite such terrible revenue losses, share prices of nine of these companies were higher still. This indicates an overly-optimistic stock market; we may, once again, be due for a correction.

The Coming Auto Loan Crisis

Finding evidence for this was surprisingly easy. It seems most financial commentators are in a consensus that the auto industry is behaving in a similar manner to the housing market pre-2007.

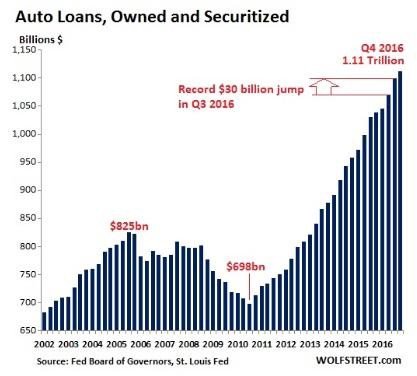

Subprime lending has again become the norm, and the number of auto loans outstanding has escalated to 1.1 trillion. Consumers are falling for irresponsible zero-down, 84-month finance plans, and apparently many of these loans have been given out to buyers who have no credit score at all.

It’s getting harder to ignore rising subprime auto defaults, and new car sales are dropping. Car inventories are building up across the country.

“Subprime auto-loan default rates match those seen just before the 2007–2009 recession. It’s a red flag that’s been flapping for some time for analysts worried it could pose risks to the broader credit market, bank health and, ultimately, the consumer-driven economy.”

— Rachel Beals, Marketwatch.

“Subprime auto bonds issued in 2015 are by one key measure on track to become the worst performing in the history of car-loan securitizations, according to Fitch Ratings. This group of securities is experiencing cumulative net losses at a rate projected to reach 15 percent, which is higher even than for bonds in the 2007, Fitch analysts Hylton Heard and John Bella Jr. wrote in a report Thursday.”

— Matt Scully, Bloomberg

“Property values fell so much [after the housing bubble] that people suddenly owed more on their homes than they were worth. Those homeowners then had to make the decision of whether to wait it out and keep paying their inflated mortgage rates or cut their losses and sell. Cars, on the other hand, have never been an investment, and this kind of situation in the auto industry would likely trigger an avalanche of private sales as people try to get out from under their debts.”

— Shaun Bradley, AntiMedia (who’s done fantastic research on this subject; I’ve stolen a great deal from his work to write this. Check out his in-depth article on the auto bubble here)

If trends continue, it’s likely that car dealers will be forced to lower prices; they’ll have to shed inventories and cover their bad consumer credit loans. Morgan Stanley predicts that this will impact the used car market, and some predictions are calling for up to a 50% price decline by 2021. This is great news if you’re looking to buy a new car, or a reason to move fast if you’re looking to sell. This is terrible news for car dealers and manufacturers, however, and will certainly throw a wrench in the gears of the economy.

The Coming Student Loan Crisis

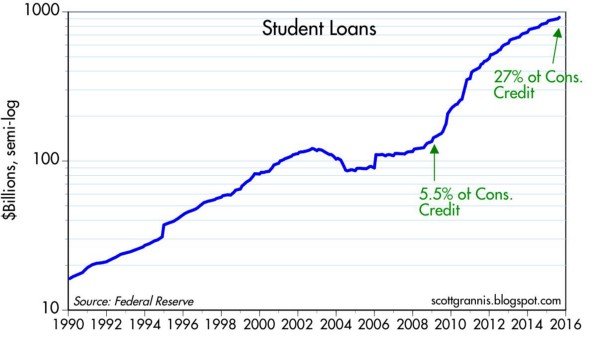

Just as deadly as the auto loan bubble; the student loan bubble is now $620 billion higher than the nation’s credit card debt. 70% of college students graduate with college debt, and the average debt of a college graduate is said to be $35,000. According to the Wall Street Journal, the revised Education Department statistics show, at more than 1,000 schools, at least half of students defaulted or failed to pay down debt within 7 years.

It gets better.

According to a report by the Global Financial Literacy Excellence Center at George Washington University, (what a mouthful); more than half of students did not bother to calculate their postgraduate loan repayments. And according to a new study by Nerdwallet, nearly half of undergraduate students say that they borrowed, on average, $11,597 more than they actually needed to pay for their educations.

Risky lending; it’s back in style!

"In the days following the foreclosure crisis of 2008 and 2009, approximately 10 percent of home loans were 90-days delinquent. But today, in a period when employment and earnings are vastly better than what they were in 2010, the delinquency rate for student loans is more than 11 percent, and has been that way for four years."

-Ryan McMaken, Mises Institute

This is a disaster.

Many of these kids- they’ve just gotten their degree in something like economics, (I actually wanted a degree in economics), and they get out into the real world only to find that economics is actually not a highly marketable skill. Businesses don’t frequently hire economists, and if they do, it’s not the kid who just got his degree, it’s PhD’s, or people with experience in that certain industry. They forgot that simply having a degree does not create job openings; they thought they could cheat the supply and demand for labor. They’ll be forced to settle for a lesser job, after all, they have no real work experience, and paying for these loans will be difficult, if not impossible.

What makes it worse is that the terms for these loans do not differ from student to student. When a homeowner applies for a loan, he expects that the terms of the plan will be somewhat based on his credit; a poor credit history is going to merit higher interest and fees. But a student can expect to receive excess loans regardless of his degree. A person with a degree in gender studies can expect to have the same terms as someone with the engineering degree, despite the future projected incomes these students are expected to have.

The Part-Time Problem

Former President Obama bragged about a lower unemployment rate, but a report from Princeton and Harvard economists found that 94% of jobs created from 2005–2015 were part-time.

“We find that 94% of net job growth in the past decade was in the alternative work category,” said Krueger. “And over 60% was due to the [the rise] of independent contractors, freelancers and contract company workers.” In other words, nearly all of the 10 million jobs created between 2005 and 2015 were not traditional nine-to-five employment. …”

— Alan Krueger, Economist at Princeton University.

Even Janet Yellen is worried about the rising amount of part-time workers compared to full-time workers. The number of people who work part-time, but want full-time jobs is at the highest rate in 30 years.

People who work part-time are more likely to be lose their jobs, no health benefits, unpredictable hours, and no paid-time off. About 25% of part-time workers in live in impoverished conditions. It’s no question that a large percentage of the American workforce is in less-than-ideal working conditions.

The Debt Crisis That Will Cause a Dollar Crisis

As I am writing this, the dollar sits at a fairly high valuation, higher than it’s been in 15 years. The dollar is this valuable, despite this being the worst economic recovery since World War II, and despite the fact that the Federal Reserve recently pumped 3.5 trillion dollars in credit into the banking system. This expansion of credit can create some of the same inflation effects as simply printing more dollars. It seems to go against basic economics for something to be valued more when it’s being replicated almost infinitely.

The dollar is valued on faith in the US government; it has no intrinsic value. People only seem to realize this fact when economic downturns occur, in which they flee to the currencies of other nations, or gold and silver. The dollar lost almost 40% of its value compared to a basket of other currencies in the last economic downturn. If this next economic downturn is worse than the last crisis, it’s possible that the dollar may never recover.

The dollar is the leading reserve currency of the world, meaning that other countries acquire dollars to use in cross-border transactions. The dollar is used in 43% of all cross-border transactions and 61% of reserves held by foreign central banks is in dollars. An economic downturn may send foreign countries parting with dollars for other means of exchange. This is what happened to the euro after the Eurozone debt crisis, and the euro’s use as a reserve currency declines every year. Recently, countries like China, Japan, Switzerland, and Belgium have been reducing treasury holdings on US debt concerns. If the dollar were to lose it’s position as the lead reserve currency, I think it’s very possible, (and I’m not the only one to make this argument), that this could send the dollar tumbling.

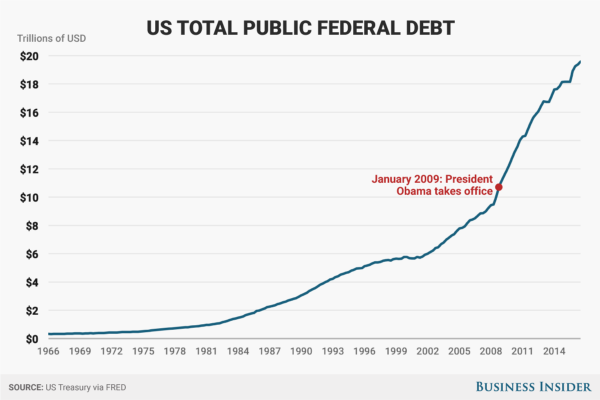

America’s debt is the largest debt in the world for a single country, at almost $20 trillion. Some make the claim that we have little reason to worry about the national debt, because a government has advantages to paying off a debt that a civilian does not have. They make the argument that the debt could be paid off over a period of decades, or possibly hundreds of years. And of course we can always print money, they say.

It is technically true that the government could pay off this debt over a long period of time, but I seriously doubt this will happen. The last time the debt-to-GDP was this high was during WWII, a very unique time in our nation’s history. 20% of the male population was out for the count, and the United States was diverting a large percentage of its resources to producing war machines. In contrast, we now borrow large sums of money to simply keep many government programs alive, such as Social Security, Medicare, Medicaid, Obamacare, and other such benefits. I highly doubt these programs will be discontinued voluntarily, and I personally doubt the fiscal responsibility of the government; we should expect government spending to continue to increase.

So we’re backed into a corner: we can inflate the dollar to pay back the debt, which could bring the dollar to complete collapse, (think Germany after WWI). Or we can tell our creditors to take a haircut, which will substantially hurt the credibility of the dollar, and probably revoke the US dollar’s reserve currency status. I think the latter is a better option than the former. Contrary to popular belief, inflation is always harmful; it depreciates the value of the currency, raises everybody’s cost of living, imposes what is, in effect, a tax on the poorest, wipes out the value of past savings, discourages future savings, redistributes wealth and income wantonly, and encourages/rewards speculation and gambling at the expense of thrift and work. Read, “What You Should Know About Inflation,” by Henry Hazlitt to learn more about the harmful effects of inflation.

Either way, we’re heading for a dollar crisis; either people are going to lose faith in its credibility, or it will be printed into worthlessness. Or both.

The Tech Bubble

I use the word tech loosely, to describe various tech sectors with monstrous valuations, the most concerning by far being cryptocurrencies, but also social media companies and Amazon.

I don’t think tech is as concerning as other overvaluations in the market, but it still is something to be concerned about. Tech, and specifically software, has made incredible improvements over the last several years, so it’s not unwarranted to see such a generally high valuation.

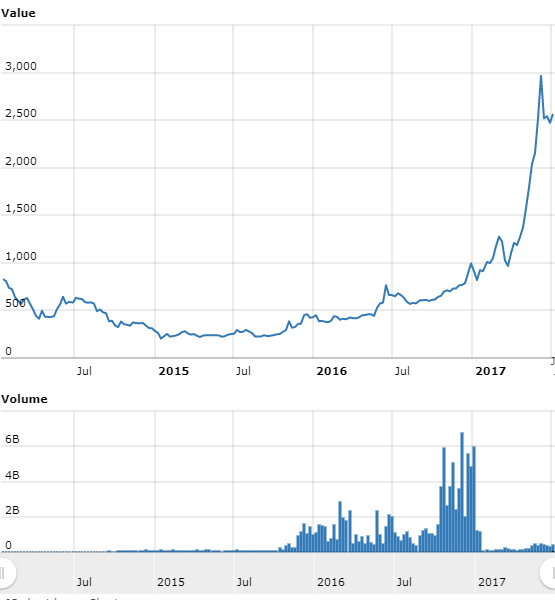

But just last month, Bitcoin was worth almost $3,000 dollars a coin, an absolutely outrageous price for something that doesn’t even exist in the real world. This is, undoubtedly, a great time for those who invested in Bitcoin when it was worth less than a dollar, but not a great time for those who adamantly believe Bitcoin will replace the dollar.

What kind of stable currency rises 225% in 6 months? A currency that fluctuates this wildly is simply not practical. Imagine you borrowed 10 Bitcoins from someone in January, with a value of around $10,000, only to find that you’d have to repay those 10 Bitcoins in June, which are now worth $27,000. Congratulations, you’re now deeply in debt. The best currencies are the ones that maintain a stable value, and Bitcoin will most likely never fit this definition. Regardless, Bitcoin and cryptocurrencies like it are becoming even more popular, and this bubble seems like it will continue to grow for the time being.

Something else to be suspicious of is Amazon.com. Although Amazon is a great company, have they really created a service so disruptive to the market that their stock price warrants a 11,000% increase!? At the end of the tech bubble, their stock was valued around $10 in 2001, and its high this year was around $1,100.

"Again, I think Amazon is an extraordinary company. Yet its stock price will not care what anyone thinks when margin call deleveraging and extreme overvaluation collide. Amazon still fell 94% from its insanely overvalued 1999 high to its ridiculously undervalued 2001 low in the dot-com bubble.

Bear in mind, investors said the same things about the future of online retail as well as the greatness of Bezos in late 1999. In fact, within days of Amazon fetching record prices for its shares, Time magazine crowned Bezos “Person Of The Year.” And the December issue’s byline? E-commerce is changing the way the world shops."

-Gary Gordon, SeekingAlpha

I can’t stress how much I love Amazon; I hope they completely destroy Wal-Mart, but I would never pay $1,100 for a share. It seems that people may be once again overconfident about what these tech companies can deliver, and generally everyone is making riskier investments.

Snap, the company that created Snapchat went public in March with an opening price of $17, which rose 44% it’s first day to $24. Today this company is still valued around $17. This is a company that lost $514 million dollars last year, and has openly stated that it may never make a profit! What’s even more comical, is that Snap CEO Even Spiegel is fully aware that investors are making risky investments.

“I think that people are making riskier investments and … there will be a correction,” he said on the first night of the Code Conference in an interview with Kara Swisher and Walt Mossberg.

“[I]t’s definitely something we factor into our plans,” he added.

Spiegel said the investment bubble is being fueled by an “easy money policy” and low interest rates…

The Still Unhealthy Real Estate Market

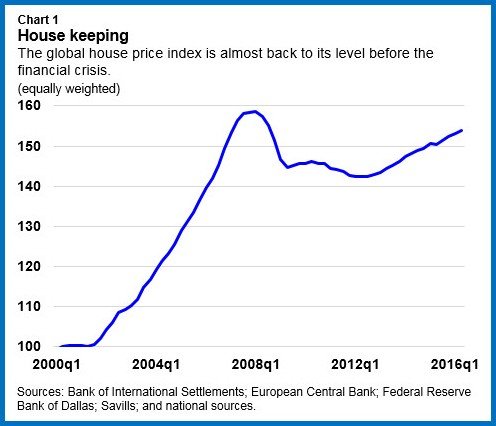

There is still a $90 billion dollar debt wave, (as Bloomberg calls it), heading towards the real estate market. Leftover debt from the 2007 lending boom is set to mature this year, which is not enough to collapse the market, but it may “show cracks in the real estate market.”

Cracks have already started appearing though.

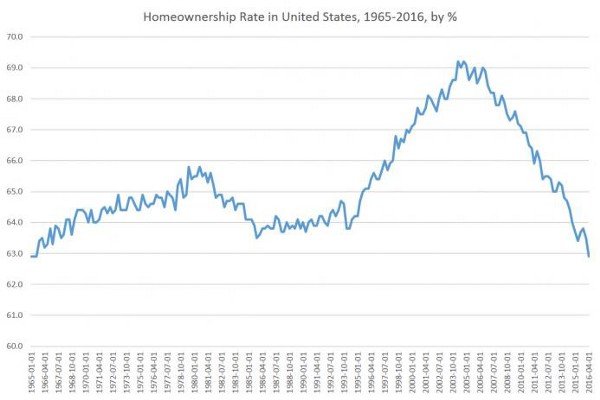

Home ownership is now at a 51 year low, which, in itself is not necessarily a bad thing. The economy is more mobile than ever before, and it’s not ideal for many Americans to get locked down in one place.

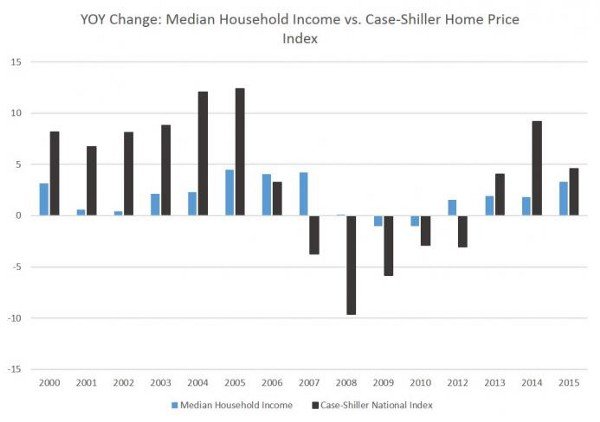

However, despite low ownership rate, housing prices boomed in recent years, and continue to rise well above the Fed’s 2% target inflation rate.

“The S&P Corelogic Case-Shiller National Home Price Index and the two composite indices accelerated since the national index set a new high four months ago. Other housing indicators are also advancing, but not accelerating the way prices are. As per National Association of Realtors sales of existing homes were up 5.6% in the year ended in March. There are still relatively few existing homes listed for sale and the small 3.8 month supply is supporting the recent price increases. Housing affordability has declined since 2012 as the pressure of higher prices has been a larger factor than stable to lower mortgage rates.

— David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices

Household income is not increasing in tandem with housing prices. First-time home buyers may need to simply forget about buying a home if trends continue, especially in places like Seattle or Portland. Very few people are seeing wage growth at almost 10% year over year.

On top of all of these depressing statistics, we’re seeing some of the same lending behaviors that helped cause the housing crisis. Fannie Mae and Freddie Mac have once again lowered lending standards. This less-stringent lending program started last year, and the aim is to fuel more mortgage originations for first-time buyers. The program allows borrowers to claim the income of those they live with to qualify for the mortgage. Remember that the federal government took over Fannie and Freddie in 2008 because they were too big to fail; the company is not too different from a government agency at this point. It’s much easier to make risky loans when you’re lending out money that is not yours.

What’s worse, it looks like these exorbitant housing prices are not a local phenomenon. It seems this real estate problem is global, with 57 countries seeing housing prices at pre-Great Recession levels.

“This time the property asset bubble is global, including high-end real estate, commercial office space, and warehouse facilities. (Subprime is under control, but that’s small compared to prime housing and commercial real estate. It’s never exactly the same twice.)”

— Jim Rickards, financial commentator

Poor Growth

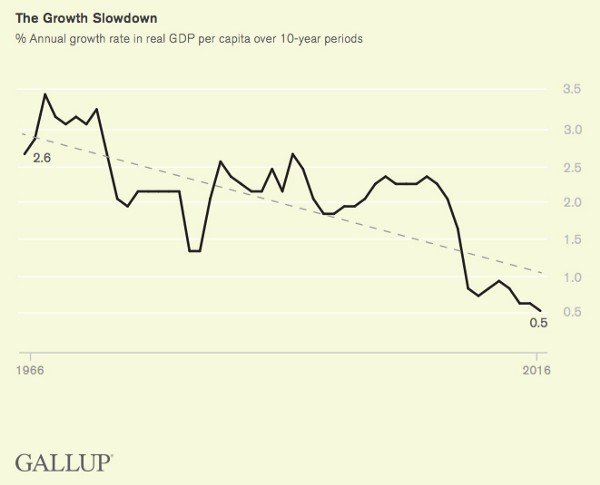

Many financial analysts and economists believe that consumer optimism is the key to a prosperous society, where as long as people are spending money, the economy is fine. But Americans have come to live today at the expense of tomorrow. Consumer optimism is not key to economic growth. Production must precede consumption, and despite ever increasing government spending, according to a Gallop study, annual GDP per capita growth has declined to 1%.

Retail Disaster

There has been a dramatic shift in shopping habits, and Amazon shopping is a key player in this movement. The internet has brought about a much more efficient way to shop, and I personally love it.

Retail stores are having a tough time competing however. Their struggle is most clearly seen in the amount of stores that are closing their doors. Companies like Guess Inc., Macy’s, K-Mart, The Limited, American Apparel, J.C. Penny, Payless Shoes, and Abercrombie & Fitch, are all closing more than 50 stores this year. Just last month, over 1000 Radio Shack stores and over 100 Michael Kors stores closed their doors in a single week. And one report by Credit Suisse predicts that up to 20–25% of US shopping malls will close in the next five years.

Although these stores are probably closing for the right reasons, this will aggravate the economy even further, as thousands are laid off as their company closes its doors. Most of these lay offs will be young people, who are already struggling in a tough housing market.

Commodity Trends

Commodity markets tend to follow a familiar cycle, sometimes called the “Commodity Supercycle.” Stocks and commodities have alternated leadership in regular cycles averaging 18 years. If you examine long term commodity trends of the last 50 years, it becomes clear that there are similar drawdown periods with similar characteristics.

When commodities are expensive, it’s generally harder for businesses to produce, and therefore, stock prices tend to fall. When commodities are cheap, business finds production is much easier, and stock prices tend to rise. Since the burst of the housing bubble, commodities have generally been in a bear market, which helps explain rising stock prices. But it looks as though commodity prices hit a bottom last year. If commodity prices start to soar upwards again, it could mean the end of the bull stock market, and the end of Dow 20k.

The Government is Preparing, Aggressively, for the Next Crisis

Federal Reserve Chairwoman Janet Yellen recently stated “Will… there ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not [happen] in our lifetimes and I don’t believe it will.” We have heard this before; almost at repeat intervals immediately before an economic crisis. Greenspan assured us that the housing market was fine. Even Milton Friedman stated “the economy is greater than it ever has been in history…” in Charlie Rose interview, about two years before the Great Recession. Even Wall Street ‘experts’ have failed to predict every stock market crash in the last 20 years.

Despite such positivity from public figures, behind the scenes, policy-makers are preparing for the next crisis.

The G20 Summit is a meeting where the leaders of 20 major countries discuss global policy. On November 15, 2014, a G20 Summit took place in Australia, which included President Barack Obama. The meeting’s final communique references to a new global organization called the Financial Stability Board; “We welcome the Financial Stability Board (FSB) proposal… requiring global systematically important banks to hold additional loss absorbing capacity…”

What do they mean by “additional loss absorbing capacity?” It may mean they’ll use your money to ‘bail in’ companies that they consider too big to fail. Governments did just that in the Cyprus banking crisis in 2012, and in the Greek sovereign debt crisis in 2015. In Cyprus, a bank run ensued in their two leading banks. With assistance from the European Central Bank, the banks were closed, ATM’s were shut down, and bank deposits above 100,000 euro were confiscated. A scramble for cash then ensued, and many fled to surrounding countries, only to return with wads of euros in their luggage. The same happened in the Greek crisis in 2015, where pressure from Eurozone countries forced them to also shut down the banks and ATM’s. This ‘solution’ to the Cyprus and Greek crises was called the ‘bail-in’ solution.

The G20 Summit of 2014 also produced a separate, 23 page technical report from the FSB. They reference to the bail-in power as the template for future bank crisis; “The Key Attributes describe the powers and tools that authorities should have to achieve this objective. These include the bail-in power, i.e., the power to write down and convert into equity all or parts of the firm’s unsecured and uninsured liabilities of the firm under resolution…” (page 7).

Shortly before this G20 Summit, the SEC adopted money market reforms, which made this amendment: All MMFs will be permitted, and under some circumstances required, to impose liquidity fees and gates against investor redemptions, if an MMF’s weekly liquid assets fall below specified thresholds, subject to action by the fund’s board of directors.

All of this was pointed out by lawyer and finance commentator, Jim Rickards, in his book, The Road to Ruin.

This is an extremely drastic measure, not seen since the Great Depression, one that places a much higher burden on the bank depositor. This sheds light on the apparent truth that whatever money you have in the bank is not actually your money, it’s the bank’s liability. Instead of bailing out the banks with taxpayer money, next time, they’ll just keep your money instead, saying, “sorry, the banks are closed; we’re going to sort this out for a while, come back later.”

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@AlextheYounga/the-financial-disaster-ahead-and-72-links-to-prove-it-ff357c5a04bd

Good content

Keep sharing good posts!@alextheyounguh