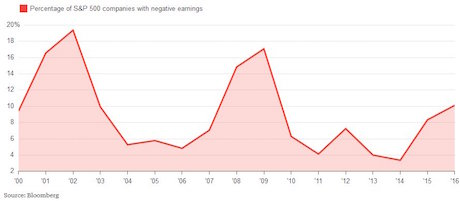

The number of S&P 500 companies reporting negative earnings is rising rapidly.

Why does this matter?

It matters because this usually signals right before a stock market peak.

Below is a chart illustrating the percentage of S&P 500 companies reporting negative earnings running back to 1999.

As you can see, we are now at levels that have usually occurred just before stock market peaks (the last two times we were at these levels were 2007 and 2000, respectively).

Both of those times (like today), investors believed that stocks could never go down… that the economy was roaring… that we’d reached a kind of financial utopia.

And both times the whole mess came crashing down.

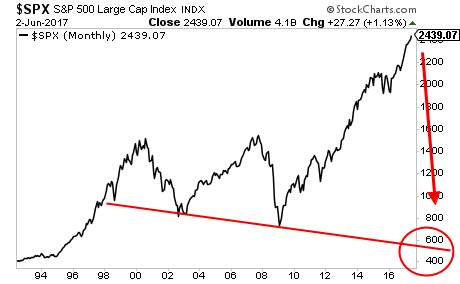

By the way, this time stocks are in an even larger bubble.

A Crash is coming... and it's going to horrific.

And smart investors will use it to make literal fortunes from it.