Many people have stated that bitcoin is akin to tulip mania. It’s not. It’s true that cryptocurrencies may be in a mania phase where price is decoupled from productivity, but that does not tell the full story. Blockchain technology, and by extension cryptocurrency, is a technological revolution and it follows the cycle of other technological revolutions like the Industrial Age and the Information Age. At times, I’ll use blockchain and crypto interchangeably. For blockchain technology to change the world, it must be implemented as cryptocurrency. The two are inextricably linked. This article aims to explain the difference between bitcoin (and the entire crypto-asset class) and tulip mania. I intend to show that cryptocurrency, as a technology in concert with other technologies, is driving the next long wave economic cycle. Technological revolutions transform the world and I will illustrate how, when and where cryptoassets fit within that picture.

Bitcoin was the first “killer app” of a technology called blockchain. Bitcoin brought forth something innovative by creating a global system to digitally transfer and store value. It does this through its design by using decentralization, immutability, incentivization in novel ways that allow commerce transactions without the need of a trusted third party (i.e. like a bank). Moreover, the next generation of cryptocurrencies bring forth the capability of smart contracts (i.e. programmable money). These capabilities are new and they will spark an entire wave of technological improvement centered around how we globally generate, store and transfer value. Let’s take a look at how technological revolutions and their long economic cycles are constructed.

The Model of Technological Revolutions

I just finished reading Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages by Carlota Perez. She outlines 5 surges over the past 200 years and explains the model and mechanics of how these long cycles evolve. It got me thinking about the past technological revolution during the Internet Surge. I wanted to see how my experience going through that cycle fit within the context of the book. It explained a lot and helped me think about the Internet Age in new ways. Then, I started to think if this could describe what’s currently going on with artificial intelligence (AI) and cryptocurrency. I believe it does.

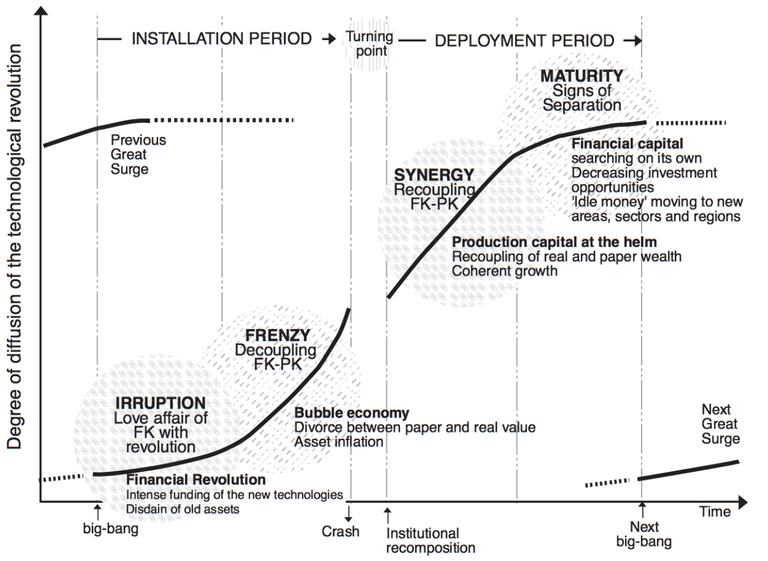

Each surge has has 2 periods that are very different in nature: the Installation Period and the Deployment Period. Generally, speaking each surge lasts 40–60 years and each period within the surge lasts 20–30 years.

Each period has 2 phases within it. The Installation Period has the Irruption Phase and the Frenzy Phase. The Deployment Period has the Synergy Phase and the Maturity Phase. The Installation and Deployment periods are separated by a key milestone, something Perez calls the Turning Point. Among other things, this is where “the crash” happens. Since we’re focused on the current technological revolution, we’ll focus on the current Installation Period and its two phases, everything up to the current surge’s Turning Point.

From “Technological Revolutions and Financial Capital” by Perez page 32

This book outlines some abstractions and models for how technological revolutions act similarly over time, describes the phases of the cycle and illustrates her model through past technological revolutions. The 5 surges over the past 200 years she discusses in the book are:

- Industrial Revolution: 1771–1829

- Age of Steam & Railways: 1829–1873

- Age of Steel & Electricity: 1875–1918

- Age of Oil & Mass Production: 1908–1974

- Age of Information & Telecommunications: 1971–20??

- Age of Autonomization*: 2009 — ?

- Note: This is my assertion or prediction and not a part of the book

From the book, “Technological Revolution and Financial Capital” by Perez

The 6th Surge — A New Age

Based on the model outlined in the book, I think we’re in a new Age — the Age to Autonomization. Many have talked about the “Age of Automation”, but I don’t think that description captures the full picture. Automation focuses on making systems and processes automatic without the need for continuous intervention or input from an operator (a human). Autonomization focuses on making an agent or system self-governing. As we’ll see, this slight distinction is makes all the difference.

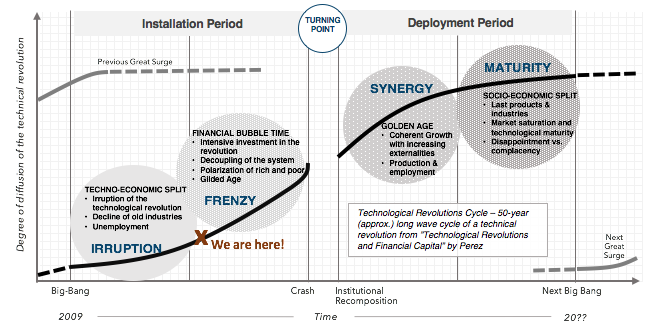

This new technological revolution fits within the model of the Kondratieff Cycle or long wave paradigm and the model outlined in the book by Perez. Some have written about cryptocurrency itself following the Kondratieff long wave cycle. Below we’ll discuss the patterns within a cycle of technological revolution, enumerate some of the events for each period and phase and describe the greater context.

Age of Automation — Descriptions to Date

Many people have written about the Age of Automation. Just google the term. It’s about artificial intelligence (AI), internet of things (IoT) and robotics. There have been stories and documentaries aplenty the past couple of years on these topics. There are exchange-traded funds (ETF’s) investments focused on AI/robotics and automation like $BOTZ and $ROBO.

Automation is an important trend but it’s not the important trend. I assert on their own these cannot bring about a technological revolution. The last required technology is blockchain and, within its architecture, the idea of decentralization. The important trend is autonomization.

Blockchain — The Last Piece of the Puzzle

While I think both points of view on automation and cryptocurrency add value to the general movement, I think the writers miss the application and model structure a bit. Technologies that advance automation, like AI or robotics, can easily fit within the current paradigm. Any company that invests in building these will reap the rewards of their investments. There is no paradigm shift and no change to the status quo.

There are 3 innovations that empower cryptocurrency to be the last pillar. The first is a new digital model for the global generation, transference and store of value. The second is the ability of smart contracts that allow for rules-based transference of value, programmatically. The third is decentralization which allows us to cross organizational borders and break the constraints of a centralized organization or a central authority.

The paradigm shift is in the transformation of how we come together to produce work and how we govern relationships. The shift occurs through decentralized autonomous organizations (DAO’s), smart contracts and new governance models. This shifts the power and the reward from the centralized organization back to the individual. All of these occur in the realm of cryptocurrency. Therefore, the last technology required to bring about a new age is cryptocurrency.

Just like in the last surge, the Internet was an important component of the surge, but not its core focus. It was an integral mechanism, but the revolution was about something bigger. It was the Age of Information. In the same way, this new surge is about autonomization. Cryptocurrency will be an integral component, but the revolution isn’t just about cryptocurrency. It’s the final pillar that will support a broader Age — the Age of Autonomization.

The Age of Autonomization — What’s Possible

This new Age is going to bring about transformational change. It will alter every aspect of how a business or organization will go about producing goods and services. Throughout the globe, each industry, community and government will begin building autonomous agents to produce work, generate value then transfer and store value.

These actions will be created and enforced by software — agents and bots implementing smart contracts through cryptocurrency platform networks. Robotics will achieve any movement in the physical world. The internet of things will provide the sensors and networks to measure and communicate data. Artificial intelligence will provide the judgement, expertise and evaluation within a closed system. And decentralized cryptocurrency platforms will provide movement across organizations via the smart contracts to govern and enforce the transfer and store of value from the work produced.

This will also restore balance between the individual and the group. Autonomous agents working in a decentralized world will allow people to invest and work on projects they’re interested in and be paid or rewarded for their contribution. Earning tokens through work or investing in cryptoassets you believe in allow the benefit to be restored back to the individual. No longer will there be a rent-seeking intermediary like Facebook, Uber, Google or any other to extract value from the whole. Central organizations will no longer accumulate all the benefit. The power is restored to the individual because they will be able to vote within the governance systems without politics and without an intermediary circumventing the will of the collective individuals.

Where Are We Now?

It’s important to try and figure out where we are in the cycle. I believe the “Big Bang” milestone happened with the invention of bitcoin in 2009. Artificial intelligence, internet of things and robotics all made significant improvements in their respective space in the early and mid 2010’s. The last nine years have been about the technology and has not diffused to a wider audience, yet. These clues tell us that we’re somewhere at the end of the Irruption Phase. Additionally, we’ve seen some market fervor in cryptocurrency in 2017, so that puts us in the early stages of the Frenzy Phase. As such, I’ve marked where I estimate us to be in the cycle below.

Irruption Phase — What has Happened?

As Perez defines it, the Irruption Phase is the beginning of the cycle where the new technology is discovered. The focus is on technology. The phase starts with a “Big Bang” moment which is when some new technology is discovered. This is good news because the world is experiencing economic discord and unemployment from the decline of old industries of the past surge. The irruption of new technology creates new possibilities and during the Irruption Phase visionaries and early adopters are inventing and figuring out exactly what the new technology is and how it could impact the world.

Frenzy Phase — What to Expect?

The Frenzy Phase starts with intensive investment. The focus of this phase is investment and speculation. The Frenzy Phase brings out the speculators and during this phase we see a decoupling of investment and production. Moreover, increased polarization between the rich and the poor can be expected. The Frenzy Phase ends in a “crash” event that starts the Turning Point in the cycle.

From Perez — “Neither the Tulip mania of the 1630’s nor the South Sea Bubble of 1720 qualifies in this sense as there were no technological revolutions driving the events. In fact, there are many psychology phenomena associated with speculative behavior, but not related to the assimilation of technological revolutions in a capitalist context.”

Not all bubble or mania behavior is a part of a technological revolution. Tulips are not a technological revolution. However, there do exist bubbles or manias that fit within this stated paradigm. Blockchain technology, and by extension cryptocurrency, do fit within the described paradigm. Therefore, we can expect the future cycle to follow past technological revolutionary cycles.

Photo by rawpixel on Unsplash

Conclusion

As you can see, we’ve started a new surge, a new technological revolution. Actions will be focused around building autonomy throughout the entire production cycle. Cryptocurrencies will play a key role. I predict by the end of this surge, we will no longer organize society around labor and production. Production, as a unit, will be solved. Robotics will automate production in the physical world, while sensors and data will move through the Internet of Things. Software, through bots, agents and cryptocurrency will generate, transfer and store the world’s value. Artificial intelligence will provide the brain power to learn, execute, measure and adapt each component within the decentralized system. New models will bring forth our new future.

Right now, we’re in the middle of an exciting time to be an investor. We’ve just started a phase where speculation and investment in the new technological revolution will bring about massive fortunes. Like the railroads in the 19th century and the last surge of the Age of Information and Telecommunications, we’re starting a peak period where investments can produce enormous returns. Cryptocurrency is not like tulip mania because it’s being driven by the adoption of a new technology which ends up reorganizing how the entire globe functions. This won’t happen overnight, but if we look closely we can see that it’s just history repeating itself once again.

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Please do your own homework.

Jake Ryan is the founder of Tradecraft Capital, a crypto hedge fund. He is also a startup advisor, an angel investor & a writer on investing. If you enjoyed this article “clap” to help others find it! For more, join us on Facebook, Twitter.

#crypto #cryptocurrency #bitcoin #investing #blockchain #tradecraft

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bitcoininsider.org/article/32925/cryptos-role-age-autonomization

Congratulations @jakeryan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!