We are currently in the midst of an unprecedented worldwide economic experiment. Since the global financial crisis of 2008, the central bankers of the largest economies in the world have slashed interest rates to near zero, and in several cases, even below zero.

The aim has been to increase the supply of money by incentivising banks to lend more freely.

The ultimate goal is to get businesses and households to borrow, invest and spend, rather than playing it safe by keeping their cash in the bank. Keynesian economists believe debt-financed spending is the key to stimulating a “healthy” amount of inflation and keeping the world on a path toward economic prosperity.

With the Federal Reserve (Fed), European Central Bank (ECB), and Bank of Japan (BOJ) all devaluing their currencies, Australia, where I live, has been forced to follow the same easy money path in order to remain competitive in global trade. Now with a record-low 1.50 percent cash rate, which is likely to go even lower, the Reserve Bank of Australia (RBA) is fully engaged in the worldwide currency war.

No one really knows where this little experiment will take us, although we’ve seen from history that it hasn’t worked out too well for Japan. And since nothing fundamental seems to be improving in the United States or within the EU, there is little evidence that central bankers will dramatically change course any time soon.

Given enough time, however, as the new RBA governor Philip Lowe recently warned, we can be sure that interest rates will rise. Whether by central bank intervention or unstoppable market forces, higher borrowing costs are inevitable. Thanks to the statistical certainty of mean reversion, we know that someday interest rates will return to their historical average.

How high will interest rates go?

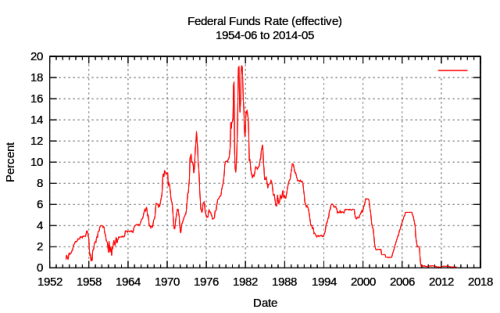

To answer that question, let’s examine the history of interest rates. Here’s a chart showing the federal funds rate from 1954 to present:

In the late 1970’s and early 80’s, interest rates in the United States hit 20 percent.

In Australia, the market I am most familiar with, interest rates were nearly as high, but not until the late 80’s. Here’s a little breakdown on the history of Aussie mortgage rates:

- The average standard variable home loan rate in Australia from 1990 to 2010 was 8.54 percent. That’s about double where we are today.

- As recently as January 2009, mortgage rates were over 9 percent.

- If history is our guide, we will likely overshoot the 8.5 percent mark in a correction.

- During the late 1980’s, Australian mortgage rates spiked as high as 17 percent.

- The average for the 1980’s was a little over 13 percent.

To put this data into perspective, let’s work through a little example, assuming you’re the typical Aussie homeowner. Keep in mind that in Australia there is no such thing as a 30-year fixed rate mortgage. You can fix a rate for about five years, but most people opt for the standard variable mortgage.

The average mortgage in Australia is about $450,000. At 5.5 percent, on an interest-only loan, that’s $24,750 per year in interest costs. Most households today could manage that.

At 8.5 percent, however, you’d be looking at $38,250 per year. This is a highly likely scenario that would drain an additional $1,125 per month out of the average family’s budget.

Based on the historical high of 17 percent, you would be paying $76,500 per year in interest alone. Assuming you didn’t default on your mortgage, you’d be forced to find an extra $4,300 per month, just to keep your home. And you’d still be $450,000 in debt, unless you were also paying down the principle.

The median home price in Sydney is now about $1 million, and in Melbourne about $750,000. Many people in Australia’s two largest cities would be in massive cash flow trouble if interest rates were to normalise.

I originally wrote most of these thoughts about ten months ago for PropertyInvesting.com to challenge Australians to consider the implications of such an economic shift. I challenged them to think through the following key questions:

- How would higher interest costs change your current spending habits?

- How would your lifestyle be affected?

- What would you be forced to sell?

- What could you no longer provide for your children?

- How would you cope emotionally?

Thinking through these questions can help to open our eyes. Whether you live in Australia, the United States, Europe, or Asia, we can begin to see that many of our current expectations and lifestyle decisions are based primarily on the fact we are living through this great economic experiment. The world is awash in debt-financed spending. When the party ends, many people’s lives will look very different.

7 Major Changes You Can Expect When Interest Rates Rise

When interest rates eventually rise, here are seven major changes you can expect, which would dramatically reshape the world economy:

1. Borrowing costs will increase.

This is the most obvious impact of rising interest rates, but it doesn’t stop there:

Your spending habits will have to change. Those who are in the unfortunate position of indebtedness will have less disposable income as they are forced to spend more each month on interest payments. Whether it’s the mortgage, credit cards or other consumer loans, those who owe money will feel the most pain. Those shielded through fixed-rate mortgage will have some relief.

If interest rates spike dramatically, many Australians will lose their homes. Investors who have redrawn equity to buy more properties may likewise face foreclosure, or at best be forced to sell their properties at a loss to cover their debts. Unrealised equity gains, which have defined wealth in Aussie culture, will vanish.

2. Cashed-up savers will be laughing all the way to the bank.

As interest rates rise, so do the risk-free returns available by parking your money in a savings account. Back in the 1980’s term deposits were paying over 14 percent. Could you imagine earning $14,000 per year on $100,000 savings, risk free?

While that’s an extreme scenario, even an 8 percent risk-free yield from a savings account would be remarkable in light of current interest rates. In today’s market, many commercial real estate yields are not even that high.

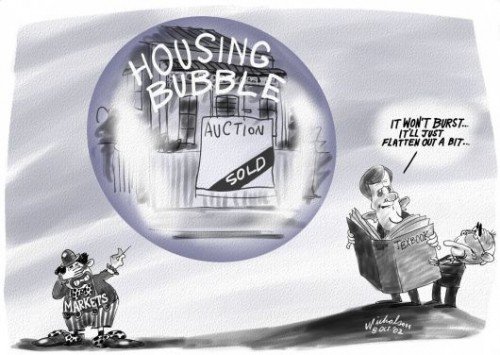

3. Asset values will decline.

As the risk-free rate of return increases, investors will be less willing to own shares and real estate. The aggravation, the risks of vacancy, and the loss of capital simply wouldn’t warrant it. This means:

Equity markets will suffer. Shares will take a massive hit as investors pull their wealth out of the equity markets in favour of the security of a savings account.

High interest rates will mean fewer people can service mortgage loans. The flow of credit into the housing market will diminish, taking away the primary reason real estate is so expensive, the availability of cheap credit.

With fewer homebuyers in the market, demand will dry up. Sellers will be more desperate, so home prices will fall.

4. The currency markets will be freaking out.

Just as lower interest rates lead to a depreciating dollar, so will rising borrowing costs cause many currencies to get stronger. This happens because:

The full impact upon a currency depends on interest rate activity in other countries.

For example, the Aussie dollar is typically priced relative to the U.S. dollar, the world’s current reserve currency. If interest rates are rising at the same time in the States, their currency should also appreciate, which would mean the value of our dollar might not change dramatically.

If on the other hand, the RBA decides to raise rates while other central banks are cutting rates, the Aussie dollar would get stronger.

International investment into Australia could increase.

If Australian rates start rising independently of the rest of the world, international investors will be more likely to stash their cash in Australian banks. This increased demand for Aussie dollars would cause our currency to become more valuable.

A stronger currency would make exports less attractive.

If the Aussie dollar strengthens, for instance, exports would become more expensive if priced in Aussie dollars. This would negatively impact Australia’s balance of trade, increasing the trade deficit. We would be motivated to import more goods, while exporting less.

The same would be true in any country where interest rates were rising relative to the rest of the world.

5. The demand for goods and services will decrease.

With families forced to make higher debt repayments and with less discretionary funds, consumer spending will decline. As a result, the demand for goods and services will decrease, causing the following domino effect:

- Companies will produce less, meaning some will go out of business.

- Commercial real estate will suffer higher than normal vacancy rates.

- The economy will slow down and may even contract.

- Businesses will aggressively compete for the fewer dollars that are changing hands.

- The silver lining may be deflation, as the prices of many goods and services may decrease. The dark side of deflation however is that as businesses suffer, they can’t afford to pay wages.

6. Unemployment will rise.

A slowing economy will lead to higher rates of unemployment because:

- Companies will produce fewer goods and services, so they’ll need fewer workers.

- Some companies will go out of business, leading to job losses.

- The median wage may also decline, as people become more desperate for work and are willing to accept lower pay.

7. Government debt costs will increase while revenue falls.

If inflation gets out of control and central banks voluntarily raise rates, higher borrowing costs will cause bond yields to go up, leading to an increase in the cost of your government’s borrowings.

The Australian national debt is now approaching $500 billion, making current annual interest payments about $12 billion. If bond yields were to spike to 4.5 percent, that repayment amount would more than double. At 14 percent, the Commonwealth would be required to pay about $70 billion per year in borrowing costs. That would definitely hurt, because:

- All of this would happen at a time when unemployment is on the rise and consumer spending is dropping.

- Since both businesses and households would earn less, the government would collect less revenue in the form of tax dollars.

- Government spending would tighten up, meaning family payments would likely decline, and investment in infrastructure would diminish.

- Over time, this could even mean higher taxes, because politicians would have to seek to recover the shortfall, just to keep the nation afloat.

- Higher taxes would put an even harder squeeze on household budgets, and increase the likelihood of social and political unrest.

All the same will be true in the United States. The difference there is that per capita, the people are much less productive than in Australia, and the debt levels are even higher. There, the entire economic system could implode.

4 Things You Can Do To Prepare Yourself

Go ahead and face the fact that at some point, we can expect at best a recession, at worst, something resembling a depression. The money supply will contract, and there will be less of it moving around in the economy. It could be months or it could be years from now, but it is coming.

We should see market corrections as a normal part of a healthy economy. Ideally, when the market is left to itself, these periods of adjustment should be relatively painless. Unfortunately, the economy isn’t influenced solely by supply and demand. Market distortions due to monetary and fiscal intervention are the new reality.

No matter what central bankers do to avoid economic corrections, they are a certainty. While regulators can kick the can farther down the road, they are only prolonging the inevitable, and can often make the corrections much more dramatic and painful once they do occur.

As legendary investor John Templeton famously said,

“Bull markets are born on pessimism, grow on skepticism, peak on optimism and die on euphoria.”

The best investors position themselves to buy at the point of maximum pessimism. To do so, you must see the death of the market before the majority of other people do.

Here are four things you can do now to prepare yourself for higher interest rates while the financial markets remain relatively euphoric:

1. Stress test your asset portfolio.

Warren Buffett once said, “Only when the tide goes out do you discover who’s been swimming naked.”

Buffett’s point is that investors should consider the outcome of an unfavourable economic shift. If you’re swimming naked, but don’t yet realise it, it would be helpful to know before you’re exposed to the elements and it’s too late. Ask yourself this:

- If your borrowing costs were to rise by two percent, how would that impact your cash flow?

- What if rates rose to the historical mean of 8.5 percent? How would you be affected then?

2. Pay down your debts.

When interest rates are low, debtors win. When interest rates rise, savers regain the advantage, and debtors lose.

As I said, in the United States, it’s possible to lock in a 30-year fixed rate mortgage. Australians are not afforded that luxury. In Australia, we carry a higher degree of interest rate risk.

If you’re inclined to believe that interest rates will move higher, wouldn’t it be wise to stop borrowing to buy assets, and to start reducing you debt exposure? Of course, if you can lock in a 30-year fixed rate mortgage, now would be the time. Just be mindful that in a deflationary environment, wages could fall as well, which could make it more difficult to repay debts, regardless of interest rates.

3. Build up your cash reserves.

Because liquidity is king when interest rates are high, if you expect monetary policy to tighten, it would make sense to cut expenses and save.

You could use this reserve as a buffer against higher interest costs. Rather than dramatically tightening up your lifestyle, you may be able to weather an economic storm by drawing from your own savings.

A higher interest rate environment tends to lead to depreciating asset prices. Therefore, option two would be to use your reserve of capital to purchase higher yielding assets after asset prices correct.

4. Diversify out of fiat currency.

When central banks finally lose control of the system, the currency markets will go haywire. Currencies that have been printed into oblivion will lose an immense amount of their value.

I see two primary ways to diversify: precious metals and crypto. Regardless of whether we see hyperinflation, deflation, or both one after the other, these two asset classes will likely outperform virtually everything else.

While this perspective may seem dramatic or far fetched to many, regardless of your view, you should recognise two crucial points:

1. We are living in unique economic times.

2. These times can’t last forever.

I highly doubt the Keynesians can achieve the soft landing many people are hoping for. We need a clear mental picture of what a hard landing would look like.

What are you doing to prepare yourself and your family?

interest rate bomb, Fed rate history, Obama easy money, currency wars, Zim $100 trillion, Templeton quote, bill, bank cash, bubble, currency, out of business, unemployed, debt clock, shelter, no debt, cash up

Perfection... Damn, the future scares me. I feel like nothing is really working for me at the moment, like borderline depression. At the moment it doesn't look like housing prices in Aussie are affordable for most people my age (mid 20's) unless they pair up with someone else such as a girlfriend or wife to help pay it off. Retirement is out of sight and most of us who are lucky enough to get a job are gonna be working til the day we die anyway. I'm unemployed at the moment too, jobs are becoming far and few between and I can't help but feel like I'm falling behind or becoming redundant to this place. So, I'm kinda frozen, waiting for that impending doom to kick in. Steemit gives me a bit of hope, but still, putting 5 hours work into something and getting a cent makes me question myself again, like "Wtf are you doing with your life, Shred?"

I guess time will tell, sooner or later.

Mate, thanks for your comment and sharing your perspective. I believe there are many people like you who are feeling similar frustrations. It just so happens you have come of age in the midst of a very imbalanced and unfair system. But we have reason to feel very optimistic, just as @conspi-theorist shares below. What's coming is just a necessary correction back to true price discovery of asset values. The road will be bumpy, but better days lie ahead.

Getting crap pay for a lot of work on Steemit can be really frustrating. I felt it a few months ago. But try to see it not as time wasted, but an investment in your own skill and a necessary part of building your following. Low payouts are not a reflection of your personal worth.

My encouragement to you is to keep improving yourself. Keep writing and developing your skills. You have many productive income earning years ahead of you and time to prepare yourself for whatever changes are coming. Don't do what many are doing in your generation - looking to the government to be the saviour. Take responsibility for your own future. Grab it by the balls and lay hold of your own slice of the next wave of economic prosperity, one that I believe will reward any and all who have the vision to create and solve human problems.

You're a bad mofo @shredlord. You were here on Steemit long before the rest of the world. Keep the faith!

Same boat as you, Don't be depressed. It's a joke, just laugh!

@shredlord @projecthor - guys cheer up! In couple of years you will be able to buy a house 20 times less than what it is now ;)

Excellent article. Thank you very much for that!

I agree with almost all your points except one. Interest rates will never rise again. Many people still believe in cyclical economic cycles but I don't. I don't think that because interest rates where high at some point they will be again.

I think that there is no way Governments can fix this unless:

The end of capitalism is near and we need to find a new economic model. I like the bitshares economic model, where every value has to be locked in x3 of collateral value and this is monitored at any time by everyone on the blockchain. Something easy as that may solve a lot of the speculative problems of capitalism and yet banks and governments still choose to ignore it. Banks are talking about proof of concept and how they will use blockchain and yet they miss the most important point...Decentralization of power is everything. Not many people trust banks anymore and they won't trust them because they decide to use "blockchain" technology...

Ouufff...I think I am getting of subject so I will just stop here.

@mf-tzo - Agree, agree, agree! 100% we need a new eocnomic model. What do you think aboud Communism - Marx' model?)

Please see my reply to @mf-tzo. I'd like to hear your thoughts. Cheers

I doubt that communism is the solution. There is no reason to try again something that failed. We need innovation not going back. I think that communism ideologically maybe good but doesn't apply in real life without completely change people's education all over the world, their mentality, their perception of money, values and what is really important in this life.

I hope that capitalism doesn't end. I do hope though that the new form will be a decentralized and much more transparent form of capitalism. Blockchain technology can deliver this. I think it is a matter of time before this happens and I think it will inevitably happen sooner or later once people all over the world say ENOUGH IS ENOUGH and demand from corporations more transparency.

Thanks @mf-tzo for your thoughtful comment.

I agree we need a new economic model, but I believe higher interest rates are inevitable, not because we will continue in the cyclical central bank driven old model, but because the free market will demand it. Interest rates represent the cost of money, or debt, which I believe will always exist, even under the best system.

Ideally, the free market will determine the cost of money (interest rates), based on supply, demand, and risk. If central banks took their hands off today, interest rates would spike because there would no longer be new money creation. The supply of money would fall, and risk would no longer be absorbed by monetary policy expectations.

In my next post, I'll write about four economic shifts that I believe will send interest rates higher. I do agree with you that an economic reset is inevitable, but I believe the outcome of that will be higher interest rates.

I hope the end of capitalism is not near. While I agree wholeheartedly we need a decentralised form of capitalism, and that the blockchain will deliver that, in my mind, capitalism is the natural outworking of a free market. If there is not capitalism, then I'm afriad we'll be living in a very centralised world, one where civil liberties are few.

Thoughts? Perhaps I'm missing something. I'm here to learn.

I also hope that capitalism doesn't end. I do hope though that the new form will be a decentralized and much more transparent form of capitalism. Blockchain technology can deliver this. I think it is a matter of time before this happens and I think it will inevitably happen sooner or later once people all over the world say ENOUGH IS ENOUGH and demand from corporations more transparency.

@jasonstaggers - Perfect article! We should write more of these to attract people's attention, at least Steemit users and especially what they can do NOW in order not remain with nothing.. Upvoted!

The only thing - instead of words "decrease" and "go down" I would use "crash" and "fall of a cliff". The driver of global economy of the course of last 40 years was constant decrease of interest rates , as you said, such that people can borrow more and more and sustain debt servicing.

Once this house of cards starts falling it will have a huge effect on the economy, even more then the Great Depression. The US should decline ~55% GDP; Europe ~45% GDP...

But anyways, article is cool ;)

Thanks very much @conspi-theorist. You are right. "Crash" is probably a much better description of what we should expect.

The super low interest rate in the states and asset bubble effect is why I have diversified into some real estate of the past few years. Bottom line is people always need somewhere to live so as long as I buy right I can rent the properties and make income, regardless of what the market does.

P.S. - Love me Australia, Sydney to be specific. Almost stayed there for good!

Melbourne is much better :)

If you're an income investor, it doesn't really matter too much as long as you get the yield you're happy with. If you're a growth investor, it might be a different story. I guess it depends on what happens in the lending market. If the Fed can bring about some wage inflation, property could be a good store of wealth. If not, then perhaps not.

Of course, here in Australia, the market is much more inflated than in south Florida, especially in Melbourne and Sydney.

Thanks for commenting!

Well now the future doesn't look too bright does it, I really like that you included what we can do to prepare, lets hope steem does well, thank you J