As of this week, there have been 666 interest rate cuts worldwide since the collapse of Lehman Brothers in 2008. Sounds ominous, but don’t worry. It won’t be long until there’s another one.

Your Government is on the Central Bank Tit

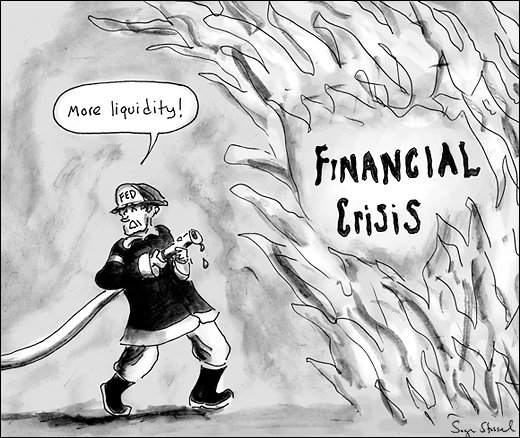

A third of government bonds globally have yields below zero. Central banks around the world have been madly devaluing their currencies in hopes of kick starting their fledgling economies. Ridiculous amounts of new money have been created out of nothing, and there’s no end in sight.

This new money is mostly being used to buy sovereign (government) bonds. The Bank of Japan now owns over a third of all of Japan’s debt. The Fed has become the lender of last resort for the U.S. government. The European Central Bank has bought over $1 trillion euros of bonds in the last year and half.

Most governments find it relatively easy to borrow money (sell bonds). In fact, many investors consider sovereign debt to be risk free. Why? Governments have guaranteed revenue. If their people don’t pay tax, they just throw them in prison or kill them. Sounds a lot like theft really.

We have the Keynesian economists to thank for all of this madness. They argue that a pure free market economy will always lead to inefficiencies, and therefore governments must intervene to smooth out the peaks and troughs of the business cycle.

The idea is that during a recession, a nation should decrease taxes and increase spending in order to stimulate the economy. This creates a budget deficit, which requires the nation to borrow more.

Then after things turn around and inflation heats up, the goal is to reverse course by raising taxes and decreasing spending, then paying down debt. Nearly all developed nations today subscribe to this school of economic thought.

The problem is that raising taxes and decreasing expenses to reverse course is not politically expedient. Once citizens get used to free government handouts, they don’t like giving them up; and politicians don’t like disappointing voters.

The easy fix is to keep borrowing more, which eventually means firing up the printing presses to cover the shortfall. Rather than increasing revenue to pay down debt, many governments tend to borrow more just to roll their debts over.

Obviously this is a slippery slope. The largest economies in the world are now borrowing money just to cover their interest. This makes them technically insolvent. If that’s true now, when interest rates are near or below zero, what will happen if interest rates rise?

For the U.S. government, a minimal one percent increase in interest rates would equate to over $100 billion more in interest payments. If interest rates were to normalise to around four percent, their interest expense alone would double to nearly $1 trillion per year.

I haven’t even brought up the issue of unfunded future liabilities.

Can you say FUBAR?

What’s a FUBAR Government To Do?

The United States, Europe, the United Kingdom, Japan and China are all screwed. They have no chance of paying off their massive debts with their strong currencies.

As we learned in 2008, all the economies of the world are interconnected. We don’t know which one will be the first to go down. It doesn’t really matter, because once one of them falls, they are all finished.

In light of their debts, slow growth and inability to raise taxes, they are left with only two options. Both of them are painful, but one is more politically expedient than the other.

Option 1: Default

The first option is to default. This is when the government says, “Sorry, we thought we could pay you back for all that money we borrowed, but it’s just not there, so tough luck.”

This scenario has some significant down sides. A default would most certainly lead to a banking and currency crisis as banks write down loans to the state, and foreign investors avoid the country like the plague. Not only that, but it makes the politicians look really bad.

Option 2: Inflate

The second option is to inflate the debt away by printing new money. As the laws of supply and demand teach us, the more there is of something, the less it’s worth. As a central bank continues to print money, the money supply of that currency grows, and in turn that currency becomes worth less, which makes their debt “worthless” in the hands of the debtor.

The down side to this strategy is that it equates to massive inflation and people end up needing a wheelbarrow to transport their cash to the bakery. The upside however, is that this strategy let's the government save face. They can simply point the finger at some other nation or event. Worse, they can create their own event.

Out of the Ashes Will Rise Cryptocurrency

In either scenario, people will completely lose faith in fiat currencies and the central bankers that determine their value. This is inevitable. It will happen.

Once people realise their currency is being destroyed, they will look to store it someplace safe. Traditionally, that safe place has been hard assets like real estate or gold.

Because real estate has been so inflated through debt, if there is a bond market crisis, I believe real estate values will be destroyed. So much for real estate.

Many will turn to precious metals and I fully expect gold and silver to be worth much more in the future, relative to the U.S. dollar. Even since the beginning of this year, my gold miner shares have nearly doubled, and gold hasn't even hit US$1400 yet.

But many will turn to cryptocurrencies. The problem is, we need some kind of a platform that can make crypto not so geeky. If only there was a way to combine it with something we are all currently using. Hmmmm.

Steem will be the easy choice.

As the Steem social network grows, more and more people will join and grow accustomed to earning money on the platform. Even those who don’t join will look favourably on the Steem brand as they hear their friends tell stories of posting and earning.

When the proverbial shit hits the fan, and people start looking for a currency safe-haven, they’ll simply transfer funds into their internal Steem account. They’ll wish they had done it sooner, because the price will likely have already risen as the sovereign debt crisis writing was already on the wall.

By that time there could be millions or tens of millions on the platform, and the Steem market cap will skyrocket. Their previously reluctant friends will join, just so they can salvage the buying power of their savings.

And the age of a normalised decentralised cryptocurrency will have been born.

Really good piece! Let's hope the number of users here on steemit continues to rise...

Thanks Roy. I believe it's inevitable!

Excellent stuff, us steemers shall be at the front!!

The front is definitely a good place to be :)

good)))))))))

good indeed!