Bylund's arguments in the primary reading are particularly relevant in today's global economy, where businesses face complex regulatory environments. The rise of digital technology has made it easier than ever before for businesses to operate across borders, but it has also created new challenges related to compliance with regulations in different jurisdictions. As a result, entrepreneurs must be able to navigate difficult regulatory environments in order to succeed. Government regulations can be lethal to an entrepreneur, argues Bylund when he claims ">For example, regulations aimed at protecting consumers may actually harm them by reducing competition and increasing prices>" (Bylund, 2016, p. 18). This quote emphasizes the idea that regulations can have unintended negative consequences on consumers, such as reducing competition and increasing prices. A perfect example of this is the argument to increase the minimum wage. Increasing the minimum wage may seem like a great idea on the surface, yet, in practice, only benefits the largest corporations that can afford it. The small businesses with minimal budgets are left to cut their already little labor force and lose money to pay for basic things to get done. Along with this, Bylund highlights that these regulations can make it difficult for new businesses to enter the market and compete with established players, which can lead to higher prices for consumers. As a result, entrepreneurs must be aware of the potential impact of regulations on their businesses and be prepared to adapt to changing regulatory environments.

Bylund's arguments are supported by Ayn Rand's speech titled "Francisco's Money Speech" (Rand, 2020). In her speech, Rand argues that the government's ability to print money leads to inflation, which causes prices to rise and devalues the currency. Rand's speech also touches on the importance of individualism and free markets in promoting economic growth. Rand (2022) claims, ">Stable money does not necessarily make for economic growth, just as unstable money does not necessarily inhibit it>" (p. 33). This quote explains Tamny's argument that the focus on stable money is not sufficient to ensure sound monetary policy and promote economic growth. Instead, he argues that the ability of individuals and businesses to make long-term plans and investments is a better indicator of sound monetary policy. This perspective is in opposition to Bylund and Rand's arguments, which emphasize the negative impact of government intervention in the economy and the importance of stable money for promoting economic growth. Rand also argues that individuals should be free to pursue their own interests without government interference, and that the market should be allowed to operate without unnecessary regulation. This view aligns with Bylund's argument that regulations distort the market and prevent the free exchange of goods and services. However, Tamny (2022) presents a different perspective in his essay "The Meaning of Stable Money". Tamny argues that stable money is not necessarily synonymous with sound monetary policy. He contends that the focus on stable money is misguided, as stability does not necessarily lead to economic growth. Instead, Tamny believes that a better measure of sound monetary policy is the ability of individuals and businesses to make long-term plans and investments. Tamny also argues that inflation is not always harmful, and can in fact be beneficial in certain circumstances. He points out that inflation can help to reduce debt burdens, and can incentivize individuals and businesses to invest in productive assets. This view is in opposition to Rand's argument that inflation leads to devaluation of currency and harms economic growth.

Furthermore, John Tamny's essay "The Meaning of Stable Money" (Tamny, 2022) discusses the impact of inflation on the economy. John explains, ">The harm from inflation lies not in its existence, but in the fact that it is brought about by government intervention in the economy>" (Tamny, 2022, p. 32). This quote emphasizes Tamny's belief that inflation is a result of government manipulation of the money supply, and that stable money is essential for businesses to make long-term plans and investments. Tamny believes that the government should adopt policies that promote stable money, such as allowing market forces to determine the value of money. In addition to this, even the government has minimal control over the monetary policy. The majority of substantial decisions are made by the Federal Reserve, which is private and has control over how the world economy functions.

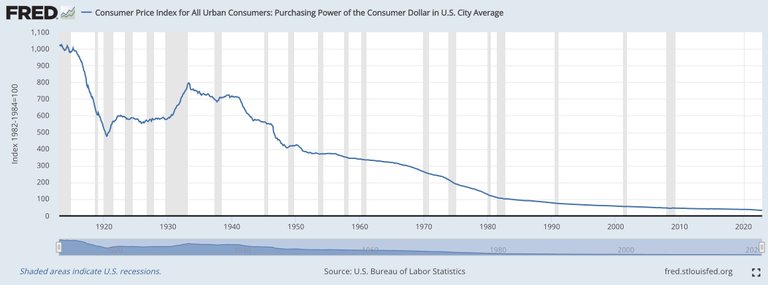

In my opinion, the arguments presented by Bylund, Rand, and Tamny are all valid. Regulations often increase the cost of doing business and reduce innovation, as Bylund argues. This can make it difficult for entrepreneurs to enter the market and compete with established businesses. Rand's argument that unstable money can lead to inflation and devalue the currency is also a valid concern. The picture above is an example of weakening purchasing power of the dollar throughout the past 100 years. Funny enough, the beginning of the chart is 1913, the year the Federal Reserve was initiated. One would think the Fed would be more accommodative to the purchasing power of the dollar, yet the opposite seems to be true under the guise of an average 2% inflation rate, which supposedly could rise to 3% after the current fiasco – due to excess monetary stimulus throughout the past couple years. The Fed stimulated the economy with $8 trillion from the onset of the Covid pandemic throughout 2021. It is no surprise inflation is so rampant and Jerome Powell is having a difficult time keeping it at bay, per the recent lack of a CPI cool off. Additional rate hikes are currently being priced into the markets, as inflation remains stickier than the Fed envisioned. Regardless, as an entrepreneur, it is important to be able to plan for the future, and inflation can make it difficult to do so. Also, it is quite depressing to come to the realization that the money I have now will be less valuable each year that passes. Tamny's argument that stable money is necessary for businesses to make long-term investments is valid in this regard. When the value of money is unstable, it can be challenging to make accurate predictions about future revenues and expenses.

In conclusion, the readings discussed in this essay emphasize the importance of understanding the impact of regulations and monetary policies on businesses. Entrepreneurs, like myself, must be aware of the potential challenges we may face in a regulated market, as well as the dangers of unstable money caused by government intervention. Bylund's arguments highlight the importance of free market principles and the dangers of market distortion caused by regulations, while Rand and Tamny's arguments emphasize the importance of stable money for long-term planning and investment. By understanding these issues, we can make informed decisions and navigate the challenges of the market successfully, rather than ‘hoping’ for a stroke of luck or favorable monetary policy.

I had a good time reading your essay prompt. You went to great lengths to provide opinions, and I appreciate that. These readings have ample opportunity to provide insight, so I thought I should mention my appreciation.

I agree with your quote here:

I believe Bylund was not being so one way or the other about this, but I do agree that he was trying to clue us into the unintended consequences of regulations. I read it less like regulation is bad and more like it is hard to predict as an economic driver. Your mentioning of the minimum wage is a good one, but I think that also highlights further that it is less of a "good or bad" issue and more of a general "too much or too little" governmental reach and how messy that could be.

Sure, I agree that raising the minimum wage at the federal level could be problematic, but we live in the U.S. Where individual states can adopt their own minimum wage. I am not claiming that as a solution. Instead, I am pointing it out to show that even between federal and state regulations, there can be a bigger mess regarding the unintended consequences of said regulations. What happens when 5 neighboring states all have disproportionate pay gaps?

Never mind the other potential issues: pay, labor force retention, profit, etc. Ultimately, I think it serves us well as entrepreneurs to be aware of regulations and their potential impact. I do not think it is for us to outright claim good or bad; this is something important to us to keep in mind. To put it simply, knowing how to play a sport is not the same as knowing how to run a sport.

Further on, you get Tamny. I found Tamny really refreshing and relevant. Tamny kind of touches on the points I mentioned when you summarize him.

I found this ridiculously accurate to our current day. Maybe because this book is pretty contemporary. I am of the Tamny school of thought; there may be ways for us to take advantage of the regulations in ways that truly benefit us. If we strip away money from the equation, we are left with raw trade. In raw trade, the more sound the trade policy, the more likely you are to thrive long-term. If we subscribe to the notion that money does not change the nature of trade, then having a sound monetary policy is synonymous with having a sound trade policy, and the importance of having one never went away. I believe Tamny is appealing to an individualistic perspective here, as being an individual entrepreneur places the onus of dealing with financial holes on you.

In this sense, I agree with the final Tamny summary.

Furthermore, I agree with your closing statements:

I think, whether you agree with them or not, staying in tune with these issues is imperative for a successful entrepreneur. Again, I enjoyed reading your work, specifically the number of opinions. Some essays tend to be really limited in that regard. Good work!