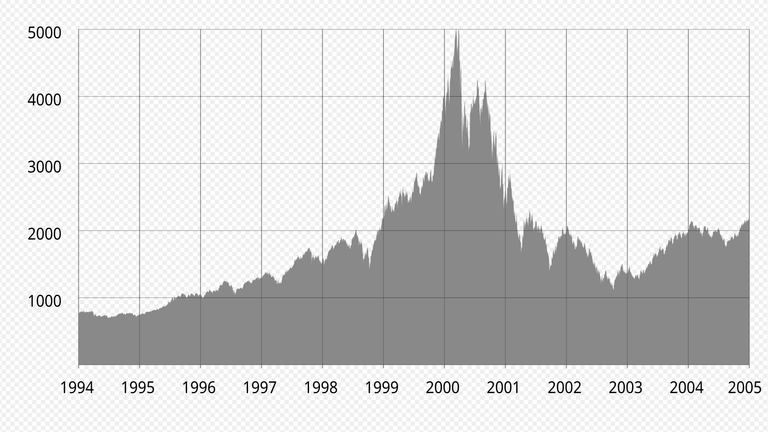

It's 25 years since when, on March 10, 2000, the Nasdaq Composite index reached a high of 5,048.62 points, which was the high point of the dot-com bubble. The index fell by close to 77% in the following two years to a low of 1,114.11 on October 9, 2002. The sudden plunge led to the collapse of numerous internet-based businesses and resulted in huge losses for investors.

Fast forward to 2025, and some market pundits are drawing parallels between today's investment climate in technology and the late 1990s. The recent AI bubble has led to insane valuations of tech giants, reminiscent of the dot-com bubble. The "Magnificent Seven" — a moniker for leading tech companies like Apple, Amazon, and Microsoft — recently entered correction territory, leading some to think we might be facing a "dot-com bust 2.0.". (Wall Street Journal)

However, there are differences between the two periods. Unlike many companies within the dot-com bubble without solid business models, the present-day tech giants are successful companies with diversified streams of revenue. Apple and Microsoft have continued to record healthy earnings, proclaiming their established market positions.

Despite such strengths, valuations are now are unsustainable, particularly in the AI sector. Financial journalist Jim Grant, who accurately predicted the dot-com bust, argues that "all the signs of a classic bubble are upon us," but cautions that "the timing is unknowable.".

The latest performance of Nvidia, a top AI chip maker, provides an example, when the emergence of DeepSeek pushed its market value down by almost $600 billion in a day. Although Nvidia stock has since reclaimed some of its loss, they remain about 25% below their 52-week highs, prompting one to wonder whether the decline is an indicator of a broader market adjustment or merely a brief glitch.

Another source of market volatility is the use of leveraged (ETFs). In 2024, these saw asset increases of almost $40 billion, the greatest increase since their start in 2006. But as larger indexes such as the S&P 500 fell, these funds lost millions, illustrating the risks of speculative investments. (MarketWatch)

Final Thoughts...

There's a lot of uncertainty out there in terms of the future of AI, I guess a sensible option is to treat such Vests as risky, and only have a small chunk of your portfolio exposed to the sector, but it's still worth a punt IMO!

NOT financial advice OFC.

Posted Using INLEO

There is also some concern about bundled corporate debt that is bankrupting otherwise profitable businesses that were obligated to take out loans by activist investors. It appears to be similar in scale to the 2008 mortgage crisis.

Oh OK that is something I'm not aware of, I'll have a look into it cheers!

please write up your findings, i would be interested to hear about it!

There's a lot of hype around this tech and people will be looking for big profits, but it only takes another newcomer with alternatives and it comes crashing down. You would think people would learn...

I know what you mean, but a lot people like the hype, nice profits to be made, but of course there are always losers!

The similarity between the dot-com bubble of 2000 and the valuations of AI companies today is disturbing.

I think it's true that today tech companies have more mature and profitable business models, but inflated valuations always carry risks.

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP