Volkswagen exemplifies the shifting patterns of global trade and the complex interplay between globalisation and nation states.

Established in 1937 under Nazi rule as a state-owned automaker, it evolved into a symbol of Germany’s industrial prowess. Following World War II it then became one of the world’s leading car exporters, and one of the world’s most recognisable auto brands. China had recently become VW’s most important export market. In 2017, 41% of its 10 million-plus vehicles were sold there.

Today, however, only a third of VW’s exports go to China as Chinese consumers increasingly favor domestically manufactured vehicles (EVs), and many of these are EVs.

Currently, EVs represent 43% of all car sales in China, with 16 of the world’s top 20 EV brands being Chinese. Companies like BYD have surged ahead, leaving Volkswagen trailing far behind.

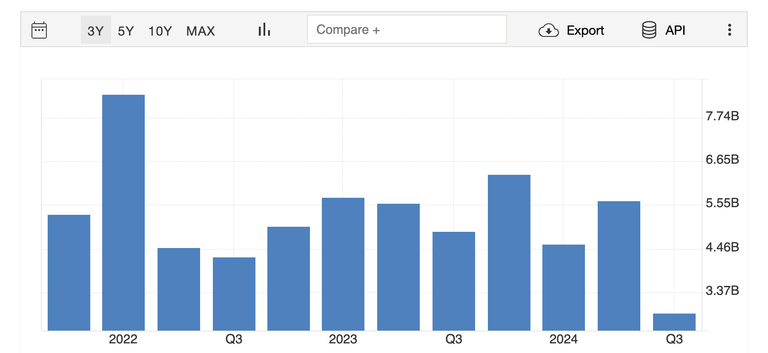

Volkswagen is facing significant challenges. Profits fell by nearly 42% in the third quarter of 2024 compared to the same period last year, and the company’s 662,000 employees may face a 10% workforce reduction.

Q3 2024, oof!

Not just global forces...

However Volkswagen’s predicament isn’t solely due to external factors. The company missed its opportunity to pivot when the electric vehicle revolution gained momentum a few years ago. Instead of heavily investing in affordable, high-tech electric cars, Volkswagen focused on producing larger, gas-guzzling SUVs, prioritizing short-term profits over long-term innovation.

And many of its most talented EV designers and techies left Germany to pursue more lucrative positions in China.

Another factor working in China’s favour is its better command over the global supply chain when it comes to domestic vehicles. It’s been much more focused on striking deals with various African countries over the last couple of decades and now has preferential access to the rare earth minerals required for battery manufacture.

Then there’s the unions… Volkswagen has long offered workers generous pay packages and robust job security, which created resistance to much-needed reforms aimed at improving efficiency and competitiveness. Now they are kind of stuck with very highly paid dinosaurs who specialise in old-school vehicle manufacturing, the kind which are in decreasing demand.

VW Final thoughts...

Now Volkswagen is in a position where it is forced to make changes, which are going to be harder now it’s behind the curve. There will probably be huge lay-offs if this iconic car manufacturer is going to survive.

It’s an interesting case study of how Chinese innovation and increasing focus on their own domestic markets are putting globally oriented companies such as VW into trouble.

Posted Using InLeo Alpha