Most people that want to buy a house cannot afford to buy a house outright. Therefore, these people obtain a loan to afford to pay for the house. This type of loan is called a ‘mortgage’. The house bought is used as collateral to support the loan. In other words, if a person cannot make the repayments on the house, the lender, typically some form of bank, can repossess the house and sell the house to repay the loan.

House prices rising faster than income

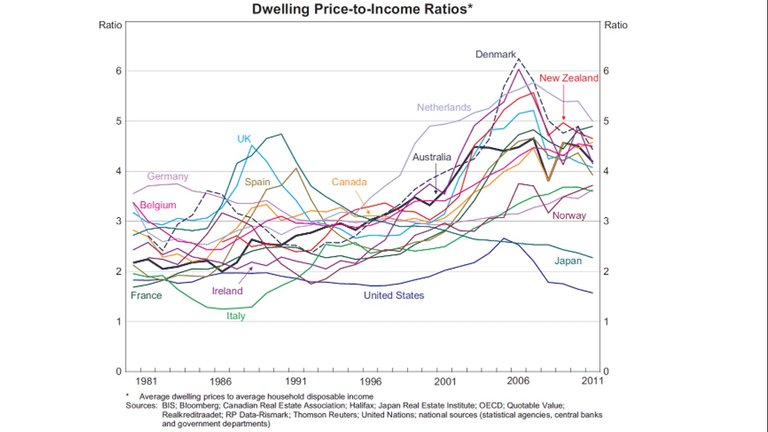

Average house prices have been consistently rising faster than average income in most developed countries. The graph below shows the ratio of house prices to average income between 1981 and 2011.

Source: http://rba.gov.au/publications/bulletin/2012/dec/2.html

As can be seen from the graph countries such as the United Kingdom, Australia, New Zealand, Netherlands, Denmark, Ireland, Italy, Canada, Belgium, Norway and Spain all experience increasing house price to income ratios. Germany and the United States of America indicate roughly constant house price to income ratios between 1981 and 2011. Japan appears to be the only country where house price to income ratios are falling.

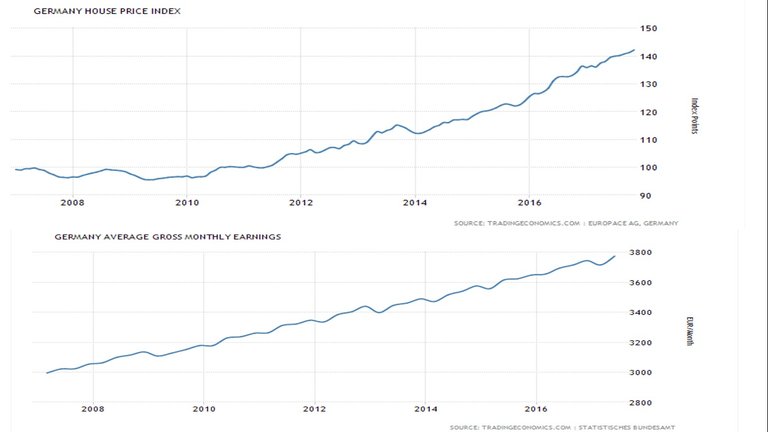

In regards to Germany, since 2011 the German property market has increased substantially. The average property price in Germany is 40% higher in 2017 than in 2011. Whereas, the average gross monthly earning only increased by 15% over the same period. See the graphs below.

House price index (Source: https://tradingeconomics.com/germany/housing-index)

and

Average gross monthly earnings ( Source: https://tradingeconomics.com/germany/wages)

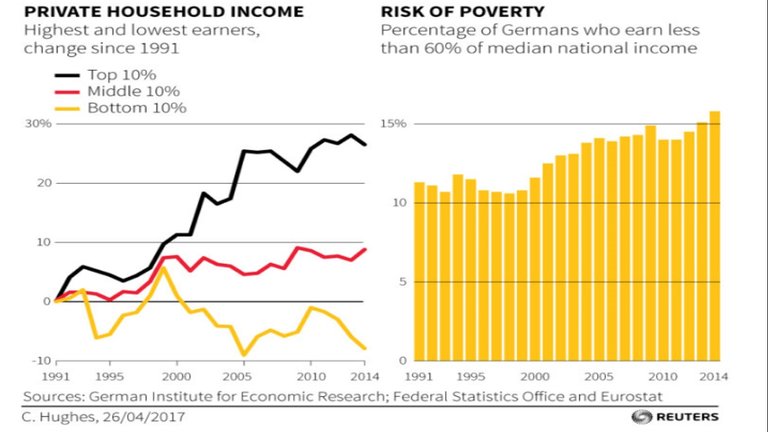

The problem is further compounded in Germany as average income is increasing mostly because of the increase in income of those in the 10% of highest income earners. See the graph and table below comparing income increases for those in the top 10%, middle 10% and bottom 10%.

Source: https://www.vvox.it/2017/05/08/euro-poverta-non-vorrei-che-litalia-finisse-come-la-grecia/

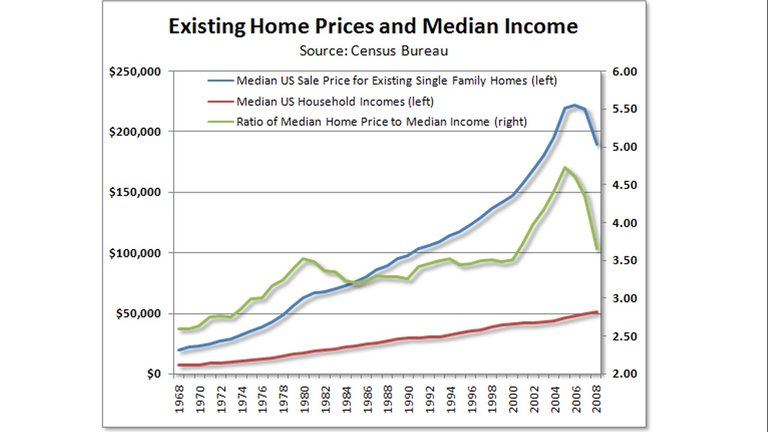

The house price to income ratio in the United States of America also appeared reasonably constant between 1981 and 2011. The income ratio shown in the graph relates to mean income rather than median income. If we look at house price to median income ratio we see a slightly different story. See the graph below.

The graph also illustrates the difference between average (mean) income and median income in the USA. For example in 2006, the house price to average income is about 2.5, whereas, the house price to median income is about 4.75.

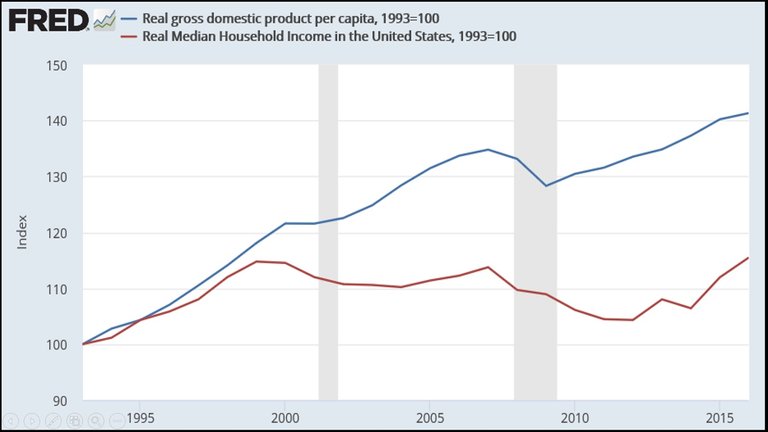

The graph below makes a comparison between median income and Gross Domestic Product per capita in the USA.

Source: https://www.nytimes.com/2014/09/17/upshot/you-cant-feed-a-family-with-gdp.html

What does an increasing house price to income ratio imply?

We have established that the house price to income ratio is increasing for most developed countries. For some countries that ratio has close to doubled. So what does this ratio mean? The ratio indicates the number of times more the average price of properties are than the average annual disposable income. High ratios indicate lack of affordability of houses.

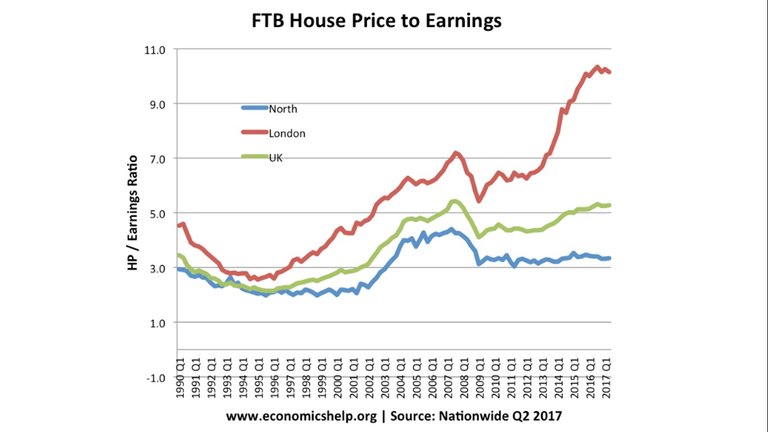

So where are properties least affordable, rural or urban areas? Both the United Kingdom and Australia appear to indicate that house prices are climbing faster in urban areas. The higher house prices are pushing the house price to income ratio up. The graph below compares the house price to income ratios of London compared with the rest of the UK.

Source: https://www.economicshelp.org/blog/5568/housing/uk-house-price-affordability/

The ratio is increasing fastest in London, this is particularly true from 2009 to 2017.

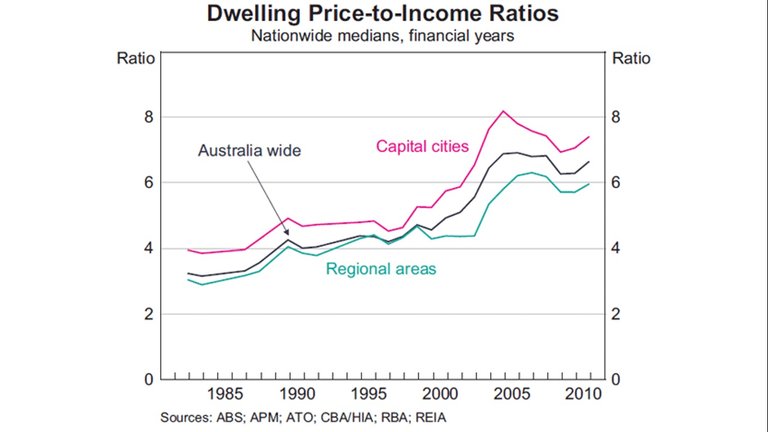

The house price to income ratio is higher in Australian state capital cities than regional areas. The house price to income ratio increased substantially in cities between 1999 and 2005.

Source: https://www.rba.gov.au/publications/bulletin/2012/dec/pdf/bu-1212-2.pdf

House price to income ratios around the world

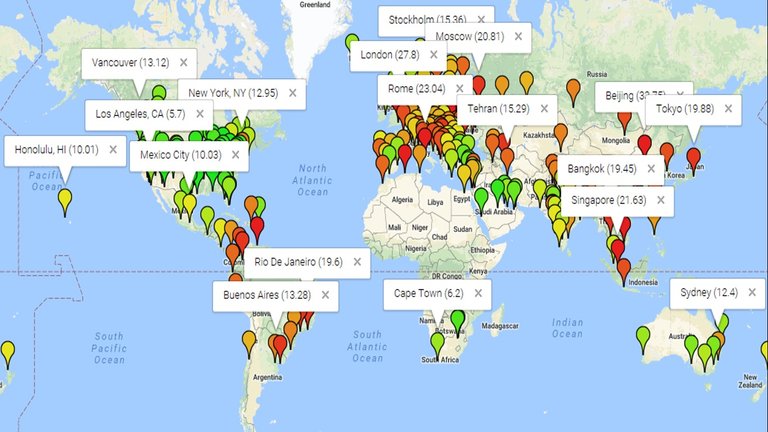

Let’s take a look at the house price to income ratios of some of the major cities around the world. The map below contains the house price to income ratios for several capital cities in 2017

Note: House price to income ratios may vary from website to website depending on how city limits and income/earnings have been defined. For example, the London house price ratio to income reported by www.economicshelp.org is substantially low than the value reported in the map above.

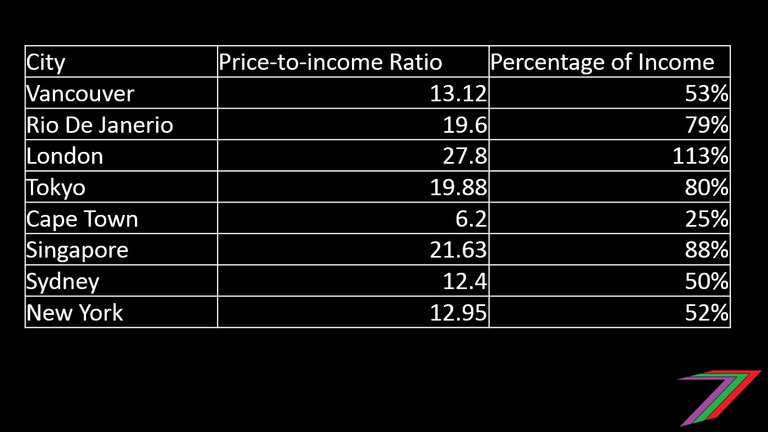

So roughly, how affordable are houses in these cities? Let’s assume 30 year mortgages at an interest rate of 3% (this will vary considerably from country to country) and a 20% down payment. What percentage of the average earning person’s annual income is required to pay for the annual mortgage repayments of an average priced property? The table contains the percentages for a few selected cities around the world.

Percentage of Individual Income required to pay for mortgage of an averaged priced house

Note: Mortgage repayment calculations performed using yourmotgage.com calculator available at:

https://www.yourmortgage.com.au/calculators/home-loan-repayment/

These percentages are far higher than the recommended 30% of annual income to be spent on accommodation. These numbers also indicate that many people cannot afford to own their own homes. The fall in home ownership in many western countries demonstrates the lack of affordable housing.

Home ownership in England at 30 year low.

Home ownership in Australia has been declining for three decades.

Home ownership in the USA is lowest since the census began in 1965.

In Canada, home ownership is down from 69% in 2011 to 67.8% in 2016.

How do people survive with such high expenditure on accommodation?

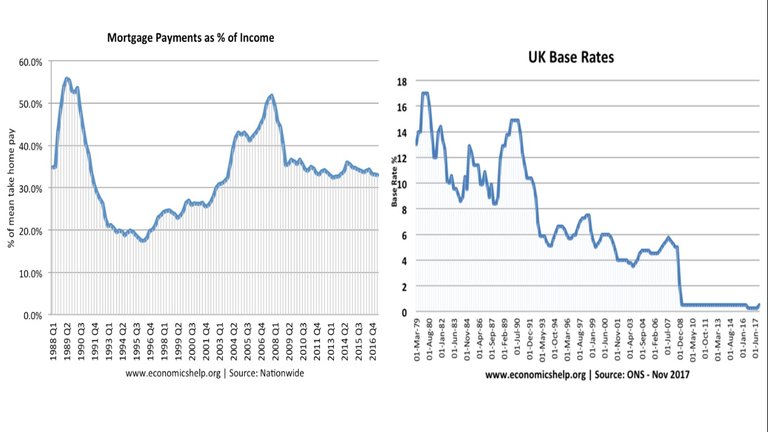

Let’s take the UK for example. For about 50% of couples, both parents work full time. For another about 40% of couples, one parent works full time while the other works part-time. Almost 50% of people are looking for additional work outside regular working hours. If we also deduct the number of people that do not have mortgages because they cannot afford the down payment or repayments and factor in the exceedingly low interest rate in the UK, the percentage of household income spent on accommodation is closer to the more desirable 30%. The table below shows the percentage of household income spent on mortgage repayment in the UK.

Mortgage payments as percentage of income and interest rates over time

Source: https://www.workingfamilies.org.uk/wp-content/uploads/2017/01/Modern-Families-Index_Full-Report.pdf

For the factors mentioned above, the percentage of household income spent on mortgage repayment is plausible. This has come at the expensive of dramatically increased total household paid working hours. Extra working hours incurs additional costs such as day care for children and additional transport cost. The very low interest rate makes this possible as well. If the interest rate was to increase even by as small as 0.5% (approximately 6.5% increase in monthly mortgage repayments), many households would be in dire financial problems.

So why are house prices so high?

We can look at it from a demand and supply perspective. Let’s start with supply. Supply of housing is going to be limited in the city. There are only so many houses a city can hold. Limited supply forces people to compete to obtain these houses. Hence the price of houses go up.

Let’s take a look at demand. In 1900, 14% of the world lived in cities. In 1950, 30% of the world lived in cities. In 2008, more than 50% of the world lived in cities. In developed countries, approximately 74% of the population currently live in cities. It is projected that approximately 70% of the world will live in cities by 2050. Source

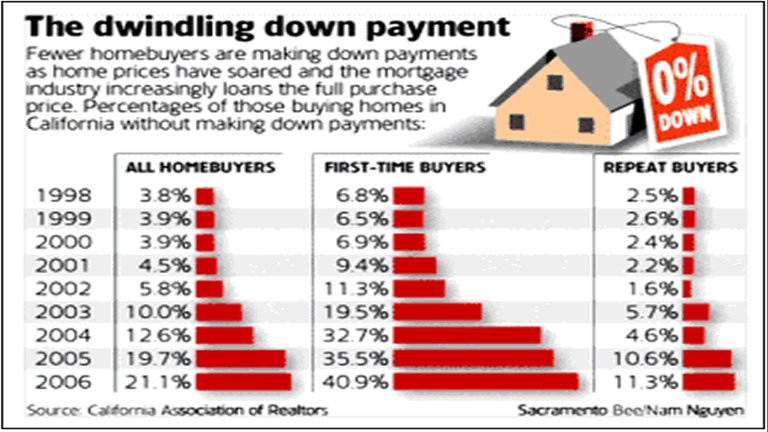

Increasing demand and a limit on supply forces house prices up. That is not the only pressure on house prices. Lower down payment requirements on houses creates the illusion of affordability. The percentage of home owners that did not have a down payment on their homes increased dramatically in the USA from 1998 to 2006

Percentage of zero down payment home purchases in California

Source: https://ridgeliner7.wordpress.com/2008/10/16/examining-the-causes-of-the-credit-crisis-of-2008/

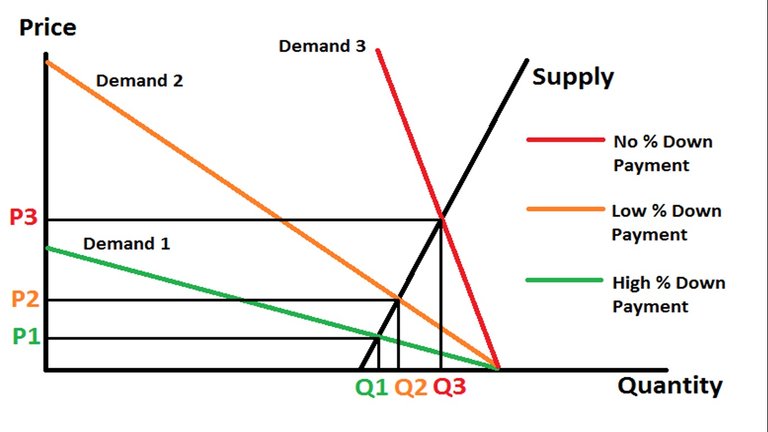

Lower down payments further stimulates demand for houses and thus pushes the prices of houses even higher. The demand supply graph below demonstrates how house prices can be pushed higher because of lower or no down payments.

A no down payment scenario makes buying a house possible for people that have close to zero savings. All these additional people that can get into the housing market adds significant pressure on prices. What makes things worse is that the problem is self-perpetuating as the high house prices make it even more difficult for people to enter the housing market unless a very low down payment is allowed.

The increase in number of investment properties is also adding to demand. Very low down payment requirements make it easier for people to acquire multiple properties, hence pushes the price of properties up and forcing those with less wealth into renting. Those that cannot afford a home rent from those that have multiple properties. Those that buy multiple properties with very low down payments are putting themselves at extreme risk as the amount of debt accumulated for all properties can be enormous. Even a short period without tenants could result in an inability to make mortgage payments on the investment properties.

Government programs do not support people who desire to place a higher down payment on properties. In the USA, programs such as Veteran Affairs (VA) and Federal Housing Administration (FHA) loans do not offer better terms to those who are willing to pay higher down payments. Therefore, many people do not pay higher down payments as there is no incentive to do so. Source

Who benefits from high house prices?

There are a few groups of people that benefits from increasing house prices. They are:

- Those that entered the housing market back when housing was affordable

- Those that own their houses outright

- Those that own multiple properties outright

- Banks

- Government

Those that bought houses when prices were low benefit from higher valued properties without the high repayments of those just entering the market. This group are only partial winners as higher house prices will require the owners to pay higher rates to councils and government. If the owners have no intention of leaving the property market, the gain in value in the property may never be realised.

Those that own their properties outright do not have to worry about increasing interest rates. Higher house prices also means a higher payout when they want to leave the housing market. Those that own multiple properties outright can gain from increasing investment property prices as well as charge higher rent as prices increases. Owning investment property also provides tax breaks to owners as well. Most of these tax breaks are for owners who still have mortgages on their properties. This is yet another incentive by the government for people to stay in debt.

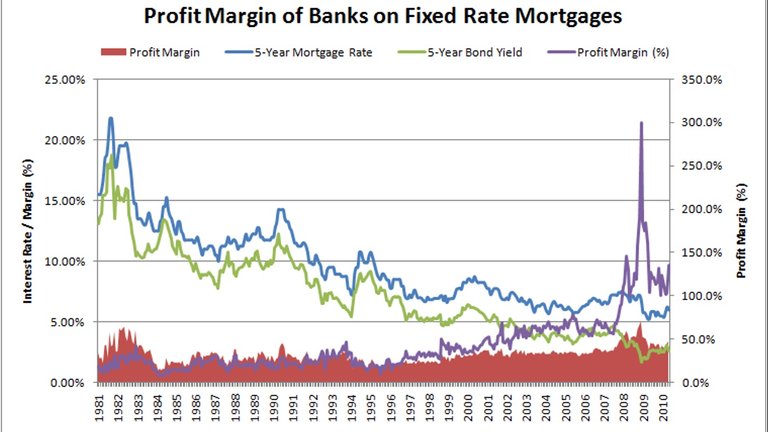

Banks are the biggest winners when it comes to higher house prices. Banks can make more, larger and longer loans. The current low interest rates are also enticing many people into getting fixed rate mortgages to protect themselves from future mortgage rate rises. The graph below shows bank profits provided by the bank of Canada.

Source: https://takloo.wordpress.com/2010/06/12/profit-margins-on-fixed-rate-mortgages/

Another winner from higher prices are governments. Higher property prices allow government to charge higher property rates. If property prices increase, government can also benefit from capital gains tax from property sold as well. Governments often use high property prices as a selling point for their government as a claim that the people are becoming wealthier by owning more expensive properties.

Summary

The high house price to income ratio is making us slaves to the mortgage. Many people are faced with mortgages that they struggle to meet, which forces them to live from paycheck-to-paycheck. Many other people cannot afford to buy a home even on a mortgage and are forced to settle with living in rented accommodation, which many people also struggle to make payments.

Another thing that is concerning is that banks and government treat property as a form of investment rather than a consumer durable (consumer durables are goods that have a long life). Homes are meant to be lived in, the moment they are treated as investments, the more unaffordable they will become. Do not buy more properties that you do not need, you are only adding to the problem.

Thank you for taking the time to read my post. I hope you have found the content interesting. I will be writing more posts relating to mortgages and property prices in the weeks and months to come. These posts will focus on particular countries and cities. This initial post is more general in nature just to give the readers a more general idea of the extent of the problem of excessively high house prices.

But what work have you given man! excellent publication.

That's right, if banks start lending money like crazy for buying houses, there is a group of people who are benefiting by making only the initial payment and leveraging their money, this ends up increasing the total demand, which makes increase the price even more, and then when it goes up, end up selling to those who want to buy, the bank wins, the government wins, the speculators win, but those who just want to have a roof over their heads end up enslaved, evidently this is the result of a system of acquisition of corrupt housing, it is necessary to give more space to the free market and less mafias.

Well said @vieira. It is a system that benefits the few.

The modern mortgage is a form of debt slavery that one works for they technically can earn financial freedom but in a way you are indebted to a structure that limits your overall freedom which can be a bad thing when you consider the power of compound interest in the future if you can afford to save or offset the cost of the mortgage. The alternative is that it offsets rent although there are other prices to pay for that exchange.

If I could choose between a mortgage or paying rent, I would rather have the mortgage. I hated it in rented accommodation. The house inspections, the rude agents, rent payments increasing, and fear of not getting another contract. I would rather buy a place on a mortgage that is further out of the city that costs much less. There are inconveniences with that as well but I feel it is a better option.

The compromise at this time is a Condo or a duplex it's a partial ownership with fees for maintenance. Ideally a house is cheaper to maintain.

The benefit at this time to a condo or a duplex is you own the content at the same time you have more upside than say a trailer park due to the changing demographics that makes it a viable Airbnb rental and speculative long term investment as older individuals want condos and duplexes after moving from a large house that is hard to maintain as they get older with pensions and face rising property costs. Or a senior community.

Your right though I would rather take the mortgage the money at least is utilized in the most Pareto optimal way outside of buying it outright since you get utility for owning an asset you will use.

The only exception is when a mortgage crisis occurs although one can argue that you can always walk away from it and declare bankruptcy.

In regards to suburbs and outlet areas outside of the main city it is a viable approach in some cases the main concern is transit costs related to driving into the city and the time lost in traffic if your job is located farther out from where you work. High speed transit is the viable solution to that however given the car focused society we live in people will tend to waste a lot of their lives in traffic. And a lot of arguments will be made we don't have the population density for trains yet we spend so much to maintain the road network I do wonder how much is really just lobbying to keep the status quo versus the real cost of implementation and change in the long run although I will digress that is another topic for another day.

Classic transportation economics

https://www.theglobeandmail.com/real-estate/mortgages-and-rates/thinking-of-buying-a-suburban-home-dont-forget-the-commuting-costs/article29202895/ http://www.metrovancouver.org/services/regional-planning/PlanningPublications/HousingAndTransportCostBurdenReport2015.pdf

Wow, I am really shocked to see these P/I ratios around the world as high as they are now. I was aware of Japan and their bubble-to-stagflation scenario that's been hanging around for a generation, so that was the one part I was not surprised with. Apart from that, I thought that the situation was really bad in America, but you've made it abundantly clear that the affordability issue is much worse almost everywhere else.

All of that begs a couple of other questions: How much longer can the upward pressure on housing prices last before the current worldwide bubble bursts? And has no one in positions of power learned any lessons from the previous Japanese and American housing bubbles?

This is all just jaw-dropping to me; there's no other way to put it.

I think we are right on the edge. Interest rates cannot get any lower. Even the slightest increase in interest rates and people will not be able to make the repayments. It does not end with mortgages either, household debt as a whole is constantly growing. The whole system is in danger of collapsing.

Very nice article on some of the big problems our modern society faces! Well written and clearly based on solid research. You got my upvote :)

One thing: you state that the governments benefit from the high housing prices. This is obviously not true in the long run (cause we are the government), and also short term aren't the high mortgages heavily reducing the purchasing power and therefore reducing the general tax income?

In regards to government it is quite interesting. Government generally do not care that much about the long-run as problems caused by the current government are often pushed onto future governments. That future government then blames it all on the previous governments and claim that they are doing a good job at resolving these problems.

High house prices are reducing disposable income, therefore could result in less spending and a reduction in GST income. What is happening in many cases is that people are able to maintain their current levels of expenditure by working more hours and getting additional part-time jobs. People are also making more purchases on credit cards. In the long-run, none of this is sustainable.

This is a quality post! Thank you for putting this together. It is scary how much of a burden mortgages have become for many people.

No problem @kp138. The banking system is designed to keep us in as much debt as possible. It's all about greed and power.

I was so deeply impressed with the study of mortgage services. Thank you.

No problem. I am glad you enjoyed the post.

The system is designed to make the rich richer, they know that time is limited & as such they try to get as much wealth as possible. This can only come from the poor & middle class who are struggling. I see housing costs are increasing all over the world while the pay remains the same. I don't think this trend will stop. After all even if you win the rat race you still remain a rat

Very well said @njoromuts. The mortgage is a great control mechanism. It keeps people competing with each other to just get enough money to get by.

The mortgage rates are increasing daily and it has become difficult to pay the rents

Higher mortgage repayments are passed onto tenants as higher rents. Mortgages even effective those that do not own property.

This also has a huge impact on the rental market. As these home prices rise and subsequently the mortgage payments, that added expense is passed down to the renter - who generally couldn't afford to purchase a house in the first place and will now find it harder to save money to purchase a home in the future.

In the US it is now said that there is no place that a person working full time at minimum wage can afford to rent a 2 bedroom apartment.

I can that there are two problems. First, the high rent because of high mortgage repayments. Second, minimum wages are too low for anyone to have any quality of life. All of this stems back to greed, from corporations, banks and government.

Yes, very true! Thank you for your in-depth post. I cant wait to see what you write about in the future. Following.

This post has received a 8.21 % upvote from @upmyvote thanks to: @spectrumecons. Send at least 1 SBD to @upmyvote with a post link in the memo field to promote a post! Sorry, we can't upvote comments.

Thanks for deep and very informative stats and study of mortgage service. You said true that mortagage making people slaves of banking system, i am also an example, we are striving so much but still not able to own a house due to non affordability of prices, and there are Billions other who are facing the same problem, but common human beings will not get a house until some greedy influences stops. Thanks for sharing.

Have a great day and stay blessed.

Mortgages are very profitable to banks. The higher the house prices, the larger the mortgages and the higher the repayments. It is very sad that so many people have to suffer because of this greed. Government are also not willing to do anything to ease the problem.

True.

STEEM WitnessYou got a 1.90% upvote from @upme requested by: @spectrumecons. Send at least 1.5 SBD to @upme with a post link in the memo field to receive upvote next round. To support our activity, please vote for my master @suggeelson, as a

This post has received a 3.84 % upvote from @buildawhale thanks to: @spectrumecons. Send at least 1 SBD to @buildawhale with a post link in the memo field for a portion of the next vote.

Steem WitnessTo support our daily curation initiative, please vote on my owner, @themarkymark, as a

My "raise" this year won't even meet the cost of living increases in the next year lol my first house is gonna be a small fixer upper, something I don't have to worry financially at all about. This post is 2007 in a nutshell though, people buying properties they couldn't afford and banks handing out the loans like candy since the housing prices were going up so fast

For those not in the housing market it is a never ending price chase. Getting a small fixer upper is probably a good way of at least getting your foot through the door.

The problems leading up to the 2008 financial crisis have not been resolved. The amount of household debt as a whole is insane. I think the next financial/economic crisis is going to be far worse.

@originalworks

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

@spectrumecons 10$ upvote added

I've had many conversations with economists where I pointed out that the widening gap between debt and incomes is a bubble that's inflating. Either they're really good actors and are only pretending that they think I'm wrong or they're incredibly thick.

APRA has a lot to answer for when it comes to unaffordable housing in Australia. They've allowed the banks to extend too much credit to speculators. The RBA could have put a stop to it, but didn't.

It seems like a combination of people living a lifestyle they cannot afford and the greed of the banks. There is also the idea that the banks are too big to fail. If everything collapses the banks will just get bailed out. Thus, they don't have to worry about the real risks of lending to those who will struggle to make the repayments.

I don't blame people for wanting to buy a home and paying an inflated price for it. They don't have much of a choice other than to move to another country.

And investors are led to believe that they're smart to own a lot of properties and collect rent from people who actually work for a living. I'll never forget the photo of a young woman in her 20's holding an enormous bunch of keys for all of the houses that she owned and the accompanying article that painted her as a role model.

Lowering other taxes and replacing them with a land value tax would benefit the vast majority of Australians. It would also deal with the issue of absentee landlords sending the money they've collected from rent offshore and prevent corporations from evading taxes by declaring revenues in offshore tax havens.

Interesting read, showing the cruelty of the system as it is - is there any cure @spectrumecons?

There isn't a simple solution. If prices continue to rise, people cannot afford to buy homes. If prices fall, those people that have mortgages may owe more money than their property is valued at.

Stopping the banks doing whatever they like would be a good start. Discouraging people from owning multiple homes would help reduce demand for housing. Encouraging people to live out of the major cities would also put less pressure on house prices in cities.

If only we could take fear out of the equation - it is essentially fear that drives both the insanity of the banks and the indulgence of the buyers, I think!