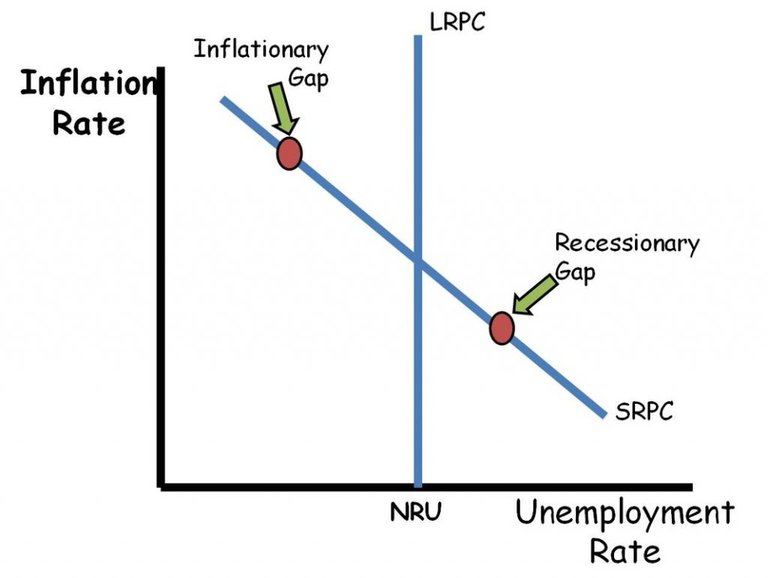

The Phillips curve suggests inverse proportion between inflation and unemployment.

Provided that all other things are equal,

- Higher inflation means lower unemployment.

- Lower inflation or negative inflation means higher unemployment.

- There is a "natural level" of unemployment at zero inflation.

It is assumed that higher inflation stimulates businesses, they expand production and hence, increase employment. While lower or negative inflation discourages business, they shrink production and lay off employees.

In reality, "other things" are not equal when inflation changes. Therefore, the relationship between inflation and unemployment cannot be observed directly. It is observed statistically, with a certain level of confidence. But it seems that there is this relationship.

However, this relationship is observed within certain limits of inflation and those "other things". Beyond those limits, stagflation is observed, when high and growing inflation is accompanied by high and growing unemployment.

In modern economics, the original Phillips curve is not used. The unemployment appears to depend not only on inflation, but also on expectations of inflation in the nearest periods and general optimism or pessimism of business about their future perspectives.

As for examples, I do not know if it is possible to find any of them in a pure form because of those "other things". It is necessary to analyze huge volumes of statistical data and apply econometrics to them to see any similarity to this relationship.

Congratulations @anditsgone! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 1750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!