by James Corbett

corbettreport.com

January 21, 2018

Sometimes the truest of hard truths are to be found smack dab in the middle of the fakest of fake news. You just have to read between the lines.

Take a recent story that bubbled up amid all the hype about the all-time record highs in the "What Could Possibly Go Wrong?" manipulated stock markets. You might have seen it. It was reported all over the usual MSM dinosaur fake news financial press outlets.

Here's the headline that the mother ship of the banksters' fake news press, the Financial Times, ran with:

And here's the NY Times formulation:

And, perhaps most telling of all, this hot take from perennial market pimp CNBC:

The global market "punch bowls?" That sounds like a Corbett Report headline, not something from CNBC. So what's going on here?

Well, the story is about the Bank of Japan's (BOJ) recent decision to scale back its purchases of Japanese government bonds (JGBs). You may or may not know that the BOJ has been single-handedly propping up the Japanese bond market for the last five years by engaging in (in the characteristically blunt words of the banksters themselves) "Outright Purchases of Japanese Government Bonds." These purchases have amounted to several trillion yen (i.e. several billion dollars) worth of bonds per month every month since 2013, a buying spree that has seen the BOJ become the largest holder of JGBs in the market. Then, as if that wasn't enough, the BOJ actually promised unlimited bond purchases (literally whatever it takes to "calm markets") last summer when word came that other central banks were starting to tighten their own monetary spigots.

Not the subject of these particular headlines, but very relevant to the larger story, is the fact that the BOJ's purchase of Exchange Traded Funds (ETFs) made it into a top 10 shareholder of 90% of the companies in the Nikkei 225 in 2016 and the largest single shareholder of 55 different companies in "Japan Inc."

What these latest headlines speak to is the fact that investors who have been riding the waves of BOJ-fueled euphoria in the rising Japanese stock market are now freaking out that the central banksters are getting ready to take away (as even CNBC calls it) the "punch bowl" of central bank funny money. The key words there are "getting ready." As even (Rothschild) Reuters notes, "When Japan’s central bank made a small cut to its regular bond purchases this week, what should have been an unremarkable market operation to manage monetary policy shot the yen and bond yields higher as investors began to price in a rapid exit from crisis-era stimulus."

To be clear: This is not a change in policy. This is not an end of the BOJ's JGB buying spree. This is just easing the foot off the gas pedal ever so slightly. And people are freaking out. So, in other words, the heroin might be in danger of running out sometime in the foreseeable future and the junkie is having pre-withdrawals.

This is understandable. You don't have to be a Corbett Report die-hard to know that the central banks have been behind the incredible decade-long bull run that has emerged in the wake of the Lehman debacle. Even the normiest of normies who only get their news from Yahoo! found out last year that a whopping 93% of that bull run was directly caused by the Fed's intervention.

As I say, you don't have to be a regular at corbettreport.com to know that the central banks blew this market bubble...but it helps. After all, I've talked about it over and over and over and over since the very beginning of the Lehman crisis. In fact, as I noted in a previous article:

This point is not even controversial. It has been the universal consensus of institutions ranging from the Bank for International Settlements to the Official Monetary and Financial Institutions Forum, and from OECD officials to former Fed Governors and even Alan “Bubbles” Greenspan himself.

In fact, analyst after analyst and pundit after pundit–including the most mainstream of mainstream publications–have been sounding the alarm on the stock market bubble for much of the past year.

And so finally, after our 10 year voyage through the looking-glass into economic wonderland, where bad news is good news because it means more central bank intervention, we now find ourselves traveling back the other way. Now good news (growing economic productivity, reflation, increasing optimism) is bad news because it means the BOJ and its bankster counterparts around the world are about to stop the carnival ride. Brace yourself accordingly.

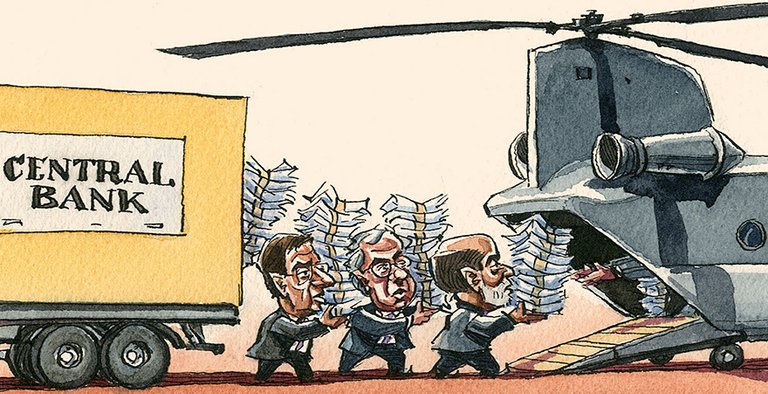

But is there anything deeper we can take out of this topsy-turvy journey? Perhaps this: the markets run on perception. When people believe the central banksters are willing to rain helicopter money down on Wall Street to keep the party going, they'll invest and manifest that perception in reality. Markets will rise in response. When people believe the central banksters are going to take the punch bowl away, they'll sell off their investments and manifest that perception in reality. Markets will fall in response.

This is why the banksters call themselves the "Wizards of Wall Street." It's because they are performing magic. Magic in its non-mystical sense, that is: manifesting will into reality. The banksters can make the markets rise or fall, and believe themselves to be masters of the universe.

Like all magic, it is an illusion. A trick. A sleight of hand. They get you looking at their jiggering of interest rates and buying of bonds to get you focused on a narrative that becomes self-fulfilling. "Don't fight the Fed," they say, and, because no one does, they usually end up being right. But the trick is that the banksters don't have the power. You do. If you buy their narrative and follow their lead, you will bring their wishes into reality. And if you fight it, you'll get steamrolled by the zombie hordes of Fed followers. The only alternative, it would seem, is to find your own path. One that doesn't depend on the banksters and their rigged markets in the first place. Good thing I've talked about some of those alternatives in the past and will continue to talk about them in the future.

In the meantime, watch for more bumps in the road as the BOJ and the European Central Bank and the Fed start to unwind some of the excess of the past 10 years. And look for the "madness of crowds" effect to take the stock markets in unexpected ways as people start believing in (and manifesting) the "Make America Goldman Again" stock market boom.

But you and I know the real action will be on that third path. The one that the bankers don't even want you to know about...

What I find laughable, and mildly infuriating I might add, is when one of these so-called market analysts goes on one of those ridiculous financial shows and proclaims that cryptos aren't backed by anything and that bitcoin is a Tulip-style bubble. LOL

Ten years after the financial crisis central banks are still injecting money into the system to keep it from imploding, and these financial wizards are calling bitcoin a bubble?

If a lie is repeated often often enough in many "reliable" sources (CNN, NYT, BBC etc.), it must be "true". Stop worrying and go back to watching "reality" TV.

The fact that markets for all assets are artificially elevated does not change the fact that most cryptos are backed by nothing and are a pure speculative/ponzi play.... o, sorry, forgot about the “backing with wasted energy spent on pointless calculations & cracking of rare math puzzles”, that really inspires con-fidence.

They will continue with the same plan, after creating their own centralised cryptocurrency......

The Global Economy is duct taped together and glued with complicated explanations that do not make logical sense. Yet, I find I often play along as if I think what they are saying is true.

Like they always say, "Don't fight the Fed," at least in terms of pushing against the unlimited money free-for-all spigots of the world. The triple-bank threat of the BOJ, Fed and ECB unwinding their assets is going to create a tsunami of pain for anyone foolish enough to have done things as dumb as invest in leveraged B-rated corporate debt (can't believe that's a thing). Hold onto your hats because the ride to unwind is going to be a wild one.

Everyone knew this was coming, but the tipping point is the only safe exit point, and the rush to find safe harbors to shield investors from the incoming waves of destruction means all of those investments that were once out at sea enjoying calm weather and good, steady catches will try to sell their fish at fire-sale prices before the perfect storm hits.

What goes up must always come down, and anyone riding clouds ever-higher built on nothing but promises of gaseous hot air and fumes is going to realize that none of the money spent went towards a solid foundation for our future. More debt is not the answer and was never the cure, debt is the shackle the master will attempt to control future generations with.

At least in Japan they are relatively economically equal on a per-person basis, their GINI isn't too high and many Japanese have sizable cushions they can use in downturns. The same can't be said of the US where inequality is higher and most are just a paycheck away from bankruptcy or homelessness.

Thanks for writing the article up for those who aren't up to date on the central bank situation. The madness was always meant to maximize the gulf that stands between the haves and the have-nots, the debtors and the lenders. Ordinary citizens surely haven't benefited from the price floors banks have placed under assets that people can't even afford.

Thanks for mentioning the GINI, a concept that is not as well-known as it should be.

James, I would love to see a debate between you and Warren Mosler.

Someone else whom likes you replied to me in the past about this wish of mine, that you may be over your head against him.

He is not exactly a conservative economist, he is a MMT pioneer.

According to one of his disciples, QE is deflationary and the ending of it is stimulus.

I doubt this claim, I think I rebuked it, but I do agree with that same disciple Interest rate hike is a fiscal stimulus when the state is a net borrower.

I wonder what Mosler himself, and not that disciple of his thinks about QE.

We are under MMT conditions, not gold standard.

Also Mosler said that one of his firms had shares of the Federal Reserve in the past, and that neither he or any representative of his firm was invited to any Federal Reserve FOMC/meeting.

He said Federal Reserve shares only pay interest and gave no additional rights, or at least that was the spirit of his words.

The main idea was that the Federal Reserve itself is not a private enterprise, but state owned.

Yes, I watched "Century Of Enslavement" and liked it.

This is why I remember what Mosler said about it.

This comment has received a 14.71 % upvote from @steemdiffuser thanks to: @stimialiti. Steem on my friend!

Above average bids may get additional upvotes from our trail members!

Get Upvotes, Join Our Trail, or Delegate Some SP

Wow awesome post

I have been saying this FOR YEARS. And still Corbett doesn't get the full fraud. He thinks that what they are doing with what he calls his "sleight of hand" is a trick being pulled within a system whose rules allow for this. He doesn't get it.

The very rules within which all of this is being done are completely man-made. There isn't a single stock, security or bond in the world that needs to operate on interest, inflation or even markets. None of these things, nor the formulae used to represent their fluctuations are expressions of occurrences that happen in nature or physics. Is it the weak nuclear force that causes a bubble in one sector to crash the entire market as diverse as the ones in the world currently? Is it osmosis that forces the profits companies make from increased production to funnel into the vaults of the 1%?

It is neither. There is literally nothing but man-made manipulations causing "money" to flow the way it does in these entirely man-made market systems. Nothing in nature or physics requiring that, nor nothing in nature nor physics causing the markets to "react" that way.

Everyone believes that every activity resulting in markets and their reactions to be of a Living System that reacts this way to these maniulations. It does not. The actions AND reactions are both directly and totally made up in advance. The formulas are applied to perpetuate the illusion.

Try to imagine that a small community of 400 adults with an average salary of $75,000 managed to break off of any nation anywhere. They produced enough of what they neede to be self-sustaining and more. They would need to print 300 million of their own currency a year to pay everyone for what they worked to earn. Would they turn to a private bank to "loan in" that currency? Exactly how would a private bank come to HAVE any? Did they have some laying around BEFORE this nation separated?

So right there you have the entire premise behind the idea of the Federal Reserve totally exposed for the fraud it has always been. The currency never was "loaned in" by them. This itself has always been THE fraud that all other concepts leading to the rest of all the other frauds like "debt-creation", "inflation" and "interest" are built upon. Inflation of the currency. In that scenario of 400 working adults, what would happen if they accidentallt printed 400 million one year? They would be FORCED to put it into circulation causing a drop in its value? By who? Some financial market system? If the $ weren't needed, there would be nothing to force them into this, and if i WERE needed, then it would be necessary TO print it and it wouldn't affect its value. It's a self-fulfilling prophecy of no content whatsoever.

Or can you imagine the insane panic caused by a "Great Depression" caused by what ours was, when they simply pulled money out of circulation? In this scenario, they COULD either simply print more of the currency or calculate how much to raise the value of what was left to compensate. Yet that doesn't explain why the U.S. $ didn't automatically make this adjustment during our REAL "Great Depression" does it? In fact, according to ALL market-driven theories of Corbett, Bill Still, G. Edward Griffin and the Von Mises institute, the remaining currency would have actually HAD to rise in value regardless of how there came to BE so little. Whether it was caused by the deliberate retraction of currency and/or caused by the calling in of all loans, according to themselves, ALL of these "experts" say everywhere else in everything they say about markets that the value of the currency would have risen to compensate for its lack in circulation automatically.

Simply put, it's THEIR refusal to admit that the entire system is a fraud that prevents them from seeing it's ALL an entire sham.

Make your own path. That is the message of the day and a good one. That's where the power of the individual is and that's the awareness I continue to practice, promote and hope for - for all of us. Cheers James, great article.

amazing post about bank..i am a student in banking. so i know about banking.i think everybody learn many think from here because its very informative post..good job

Herd mentality in 1,2,3....

Charades & shenanigans...

wonder banking of news, great post, thanks for sharing

This is a very informative article

thanks for update news, excellent informational post.

nice article great info

I think the U.S. Dollar is the real bubble to worrie about. I want to see it pop once & for all. Crypto for the WIN!

Japan has been kind of an economic guinea pig for USSA. EU is always a step ahead with negative interest rates and everything. So what's happening in Japan is bound to happen in the old "Free World" countries. They are also lagging behind on blockchain tech and their regulations are killing everything.

As a small time gamer it was sad to hear how EU regulations had crushed the game devs there. It's not just video games but also all sorts of innovation. On the other hand I'm seeing some good stuff from Estonia and Singapore.

Excellent report to read. Yes, we do take cues from all different sources and many people are desperate to make money that have not trusted that government for a long time. Time for a little optimism. Thanks