So, to get straight into it... You could use Ray Dalio's examples of credit and debt cycles.

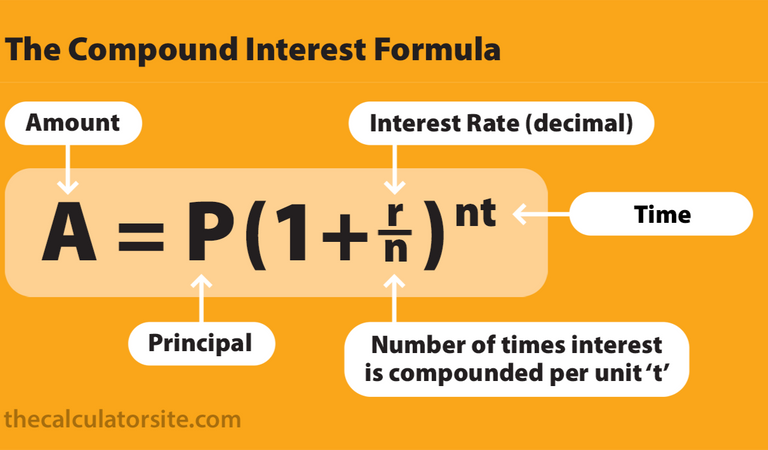

When rates are low, that encourages business and people to take loans for productivity or financings (credit cycle). This means its cheaper to borrow money, and pay very few in return when rates are zero or low. Since compound interests rates formula works in relation to the rate agreed and the time (exponencial factor). I won't get into this formula again, link for it bellow.

https://peakd.com/hive/@dstampede/compounds-and-time-liquidity-pools-and-hive

Well, the credit cycle normally comes with growth in productivity, jobs lvls, demand for consumption (that can lead to inflation). However this is good for real state in general and simultaniously to stock market...

If we see inflation of real state assets thats where guys like Michael Burry comes and says that value investors won't pay that price for thoses real state properties, because it went so much up that turned it iliquid, since no one that really understand its fundamental or intrinsic value would pay such price for it.

So the tendency is that we see rise of interests to control it. So that not only turns bank loans, real state buyings and mortages rates more expensives on long term (debt cycle), as this also tends to get jobs lvls down, and then inadimplency.

This somewhat explains the subprime crisis, but in that case Burry made a counter guarantee bond with a hedge fund cash flow to back mortages inadiplency for the bank, so it would start to be creditor of the debt (and interests) from people or banks in case people couldn't afford it in time. I know it seens a bit complicated... But that how bank insurance works.

However if interests are high, then bonds linked to real state market starts to pay better, so if talking about real state hedge funds, you got understand what segment they are in, if its on bonds or immobiliare itself, there is this exchange of opportunity in the cycle turn from one type to the other.

Congratulations @dstampede! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 100 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

Your next target is to reach 1000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: