It has to collapse.

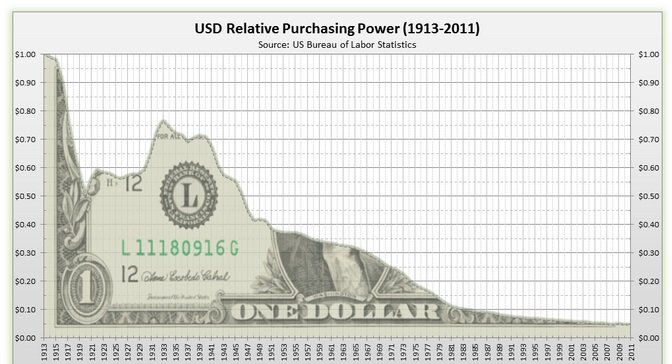

With further increased printing of money it becomes worth less and less each year..

...eventually the money will become worthless - people will not buy government bonds. Countries will stop buying it or using it (see the current transition away from the petro dollar over the last few years - and the US invasion of iraq and libya? - both governments stated they were coming of the petro dollar and using other currency).

When those dollars come back to the US - bang!.

You can keep printing until it has no value - as it what must happen when you charge interest on money that doesn't exist..

Interest on money loaned, doesn't exist.

How can you ever pay it back - if it doesn't actually exist?

Hence the fed res ponzi scheme set up in 1913 (jekyll island).

I t was designed to collapse - coming off the gold standard in the early 70's put off the inevitable, as the bail out of the banks on 2007/8

It has been put off for so long as possible - to try and transfer more real assets to the rich - but the end will happen - as sure as the sun coming up tomorrow.

The near identical thing happened in Rome all that time ago - they started putting less and less silver (printing more money) in their coins as social welfare systems - and the military - had to be paid for...

Eventually people walked away from Roman currency,...and the rest is history, as they say...

Yes i agree mostly, but the fed can also reduce money by increasing interest rates. That would lead to many defaults which would collapse the whole system. But the fed can then buy up bad debt from institutions it wants to survive and thus allow parts of the system to collapse while keeping it alive. As such i think it does have to collapse technically.

This would of course lead to other issues.