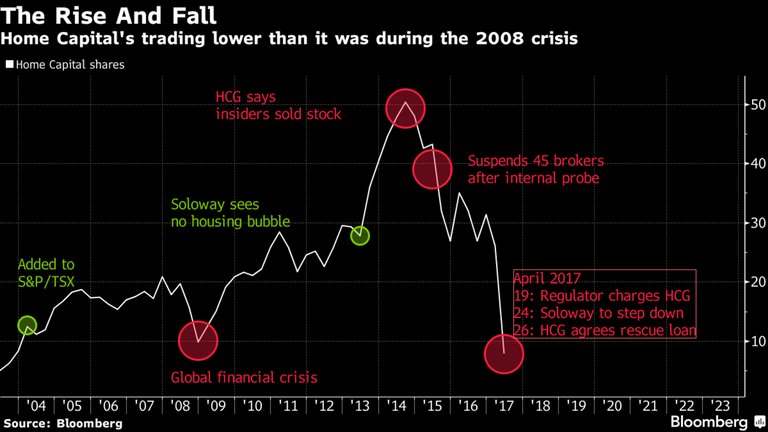

Home Capital has had %95 of it's deposits withdrawn since the end of March.

That's a bank run in my opinion. Home Capital is currently looking for a syndicate of banks to give them a 2 billion dollar loan to replace the emergency funding they agreed to in April.

But just who are Home Capital Group, and why are they important.

They are Canadas Largest Mortgage Lender of course, a SUB PRIME (sub par credit individuals) lender at that.

That means at the peak of a housing bubble in Canada, mortgage lenders are starting fail, and the first one to fall is the most precarious one. It makes sense but the implications are disastrous and it signals the reality of the situation we are actually in.

The temporary band aid of the "emergency funding" loan, was just that temporary. They have to find a real loan in the very near future or else they will cease to exist.

But who would lend to another lender that just failed?

"Royal Bank of Canada, Bank of Montreal and Toronto-Dominion Bank are among the Canadian lenders that are expected to be part of the syndicate, the people said on condition of anonymity as the talks were confidential."

Well this is starting to sound like the beginning of bailouts, and it is starting to look like 2008 with the accusations of shady business practices to top it off.

The bubble will pop this fall, watch out.

Very interesting post!

click here!This post received a 23% upvote from @randowhale thanks to @lvl! For more information,

It does seem eerily similar to Countrywide. It's a much smaller market than the US subprime was though. It will still do some damage, but I'm not sure if it's really systemic outside of Canada.

It sounds like you're Canadian. If so, how are the markets looking in person? I remember driving around in 08/09 and having for sale/auction signs everywhere.

Yes I'm in Canada.

To be brutally honest, the Canadian dollar sucks now and houses for sale everywhere because people want to sell for top dollar. But they sit. Not too many people have good jobs anymore, and most that do waste all their extra income paying down debts, school is crippling now. Rents are CRAZY as well with the double whammy of the CAD-shitcoin and the bubble.

That's just my angle anyway.

"CAD-shitcoin" lol. Not laughing at you. It sucks that the CAD is essentially pegged to oil prices. Not looking good anytime soon I'm afraid.

It will be interesting to see what happens once those underwater owners start "jingle mailing" their keys to the bank. That's what happened in the US a lot. People just gave the middle finger and said, come take the house. That's when all the underlying MBS went to shit.

There's that great scene in "The Big Short" when they're driving around Florida and there's a For Sale sign in every yard and the realtor is like "Don't worry, the market's just in a little trough." Ha

Thanks for the Canadian insight BTW.