The more things change, the more they stay the same

- Jean-Baptiste Alphonse Karr, 1849

The more things change the more the stay the same

The more things change the more the stay the same

Ah, is it just me or does anybody see

The new improved tomorrow isn't what it used to be

Yesterday keeps comin' 'round, it's just reality

It's the same damn song with a different melody

…

- Bon Jovi

Trumphoria!

As the curtain closed on an eventful 2016 and Old Man Tyme rang in a new year, the US Stock and Bond Markets moved in opposite directions.

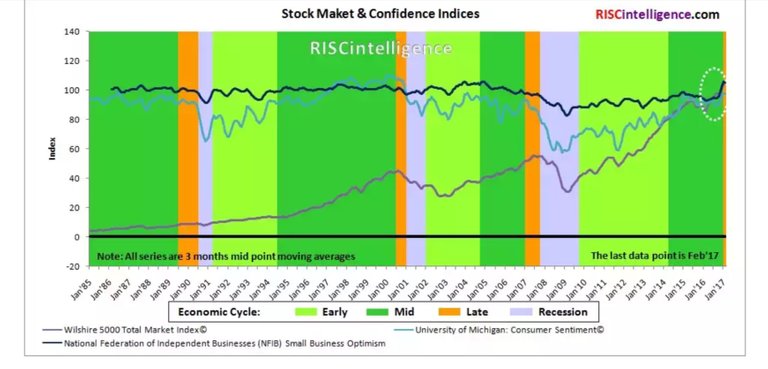

Mr. Trump’s electoral triumph unleased euphoria among Consumers, Small Businesses, and Stock Market Investors – apparently buoyed by the promise of lower taxes, infrastructure and defense spending; and job growth.

The Great Bond Massacre

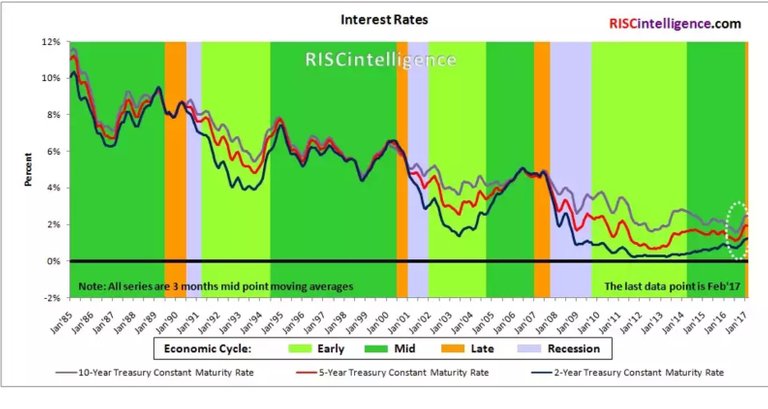

The Bond Markets however, were to put it mildly, decidedly less bullish. Ten Year Treasury Yields, which had been drifting up since the summer near all-time lows, rose sharply across the yield curve.

To accurately gauge the level of ‘pain’ in the economy caused by rising interest rates, it is useful to look at historical rate increases YoY and the relationship to GDP YoY growth.

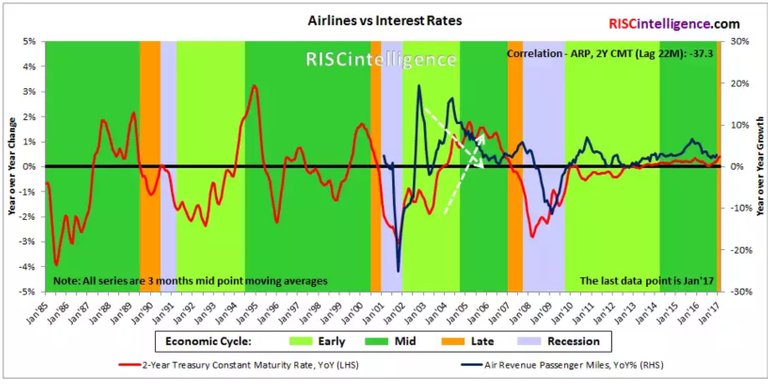

The correlation coefficient is -37.3% with a lag of 11 quarters. Rising interest rates are clearly a negative for the economy.

Rising interest rates are clearly a negative for the economy…

Causes

But, why are interest rates rising across the board? And, what are the likely consequences? As for causes, the speculation is that Mr. Trump’s election heralds global reflation with rising inflation and interest rates. We at RISCintelligence prefer to refrain from speculation and confine ourselves to Facts and historical Mathematical Correlations.

First, the Facts -

The Fed has lifted the Fed Funds rate off of the Zero Lower Bound (ZLB) floor with two 25 BP increases since December 2015. And, it has signaled more rapid increases in 2017 and beyond. Inflation is on the rise. This explains the rise in short-term yields.

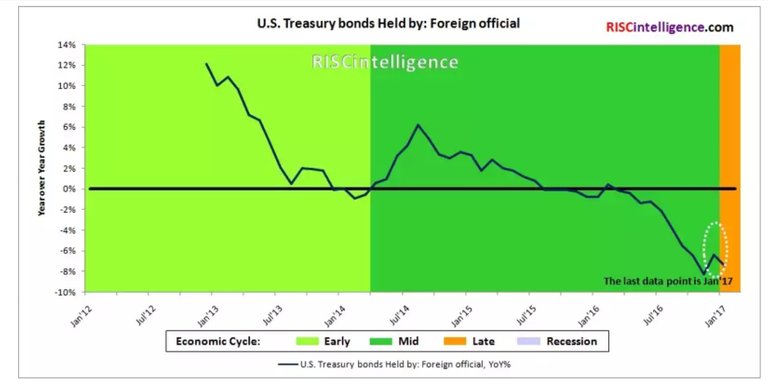

At the same time, foreign central banks and sovereign wealth funds have been selling treasuries at the fastest pace ever.

Foreign central banks and sovereign wealth funds have been selling treasuries at the fastest pace ever…

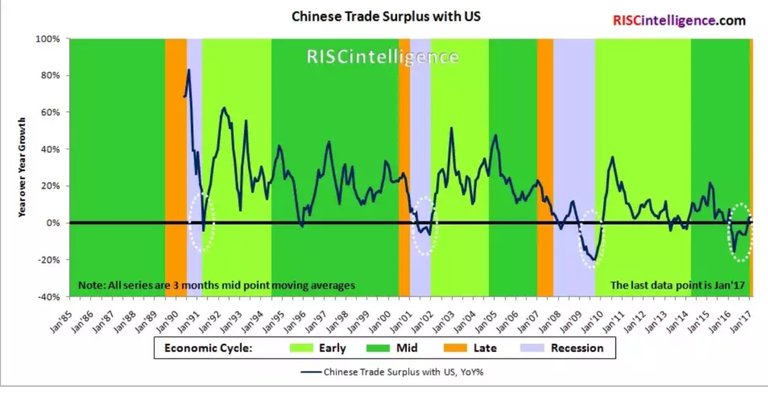

This explains the rise in long-term interest rates. But why are foreigners liquidating treasuries? For example, China has been liquidating US Treasuries at an unprecedented pace. A possible explanation is that they need U.S. Dollars and they are not generating enough of a surplus via trade. The surplus has been decreasing YoY …something that only occurred during the Great Recession.

China’s trade surplus with the US has been decreasing YoY - something that has only occurred during Recessions…

Consequences

While there is considerable room for speculation about the causes behind rising interest rates, there can be little doubt about the consequences.

According to Macroeconomic Dynamics Theory (MDT), ↑ interest rates lead to ↑ Debt Service Burdens for the Business & Consumer Sectors, leading to ↑ Debt Defaults, which result in ↓ Money (Credit) Creation and ↓ GDP Growth. Read more about MDT here….

http://www.riscintelligence.com/macroeconomic-dynamics-theory?pag=archive&id=MTk=

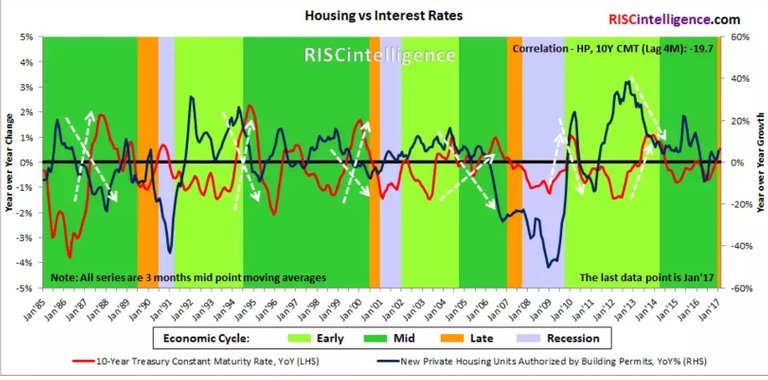

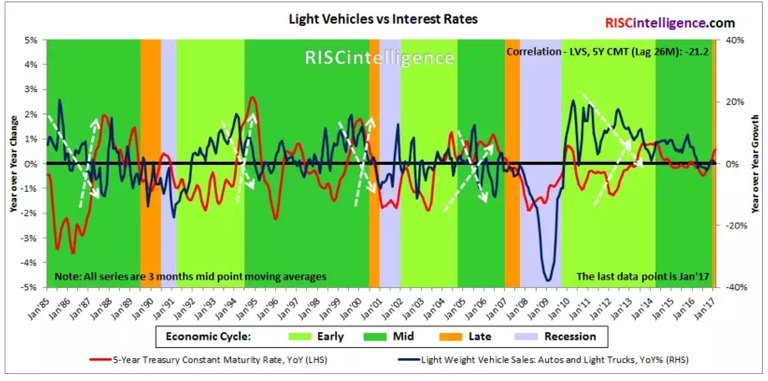

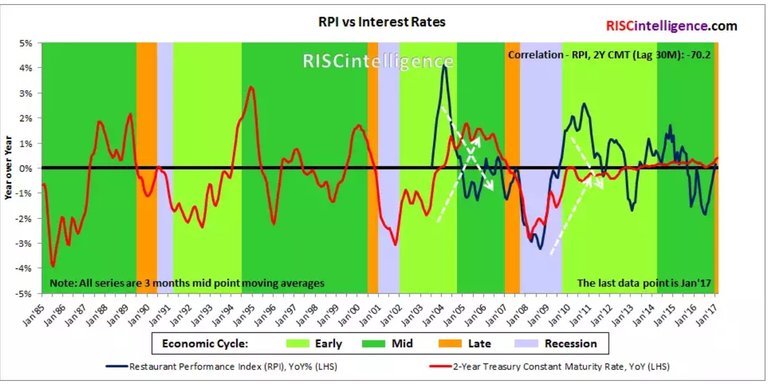

The following are the correlations between interest rate changes and Key Indicators of major economically sensitive sectors of the economy.

- Housing

- Light Vehicles

- Airlines

- Restaurants

Will Trumphoria Trump Reality?

Will rising Consumer & Business sentiment help the Economy & Stock Market weather the adverse impact of rising interest rates – especially in an already weak economy?

History is clear on this subject.

In the graph above, we show the relationship between Interest rates, Bank Delinquency and GDP growth. Note how rising interest rates late in an economic cycle have always led to rising bank delinquencies and charge-offs – which have led to recessions.

On the other hand, as the first graph in this report shows, consumer and business sentiment surveys as well as the stock market have limited predictive value … they tend to stay up until the economy is almost in recession.

Therefore, Reality will likely Trump Trumphoria.

Congratulations @obhutara! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThis is the 1,545,858th market crash prediction to be written online in the last 5 years. These come a dime a dozen and they have all been terribly wrong. Yours might be right, but you have a 1 in 1,545,848 chance. Good luck. And don't come back in two to three years thinking you can still break even. Once the market goes up 50%, you can no longer break even. Many blogs have predicted crashes before this 300% rally and think they are still right. It is now impossible for them to break even unless the market drops 80%. Time flies and inflation is KING! It has nothing to do with Trump. It has to do with every emerging market right now. Trump is nothing but a loud mouth pawn. I love him, but the rally is global, not regional! EEM is up 24% since Trump's win and the S&P is only up 20% since November. All the doomsayers will never break even when they went short last year. The doomsayers are doomed. How ironic