My crystal ball (actually some simple graphs) tells me that a huge debt-related crisis is sneaking up on us and it is really underrepresented in the media.

2007-2008 was a year which will be remembered for a while. There was a financial crisis present and the whole globe was affected by it to some degree. It was called the Mortgage crisis as the high amount subprime mortgages combined with loss of new jobs in the United States triggered this crisis. Lots of American banks and mortgage firms were on the verge of bankruptcy. In order to save the banking system the United States government passed a 700 billion bail out bill on October 3, 2008. (not all was used for banks) In my opinion this date is a very significant date as it started a huge globale race for debt.

There were some alternatives proposed instead of the Bailout package, but banks were too big to fail and had to be saved.

- John McCain proposed the government to but 300 Billion in mortgages from homeowners. This would have helped with cleaning toxic mortgages from banks balances as well as keeping the housing market up as there wouldn't be a lot of foreclosed houses. However, this wouldn't address the problem banks had with other banks. Banks were afraid to lend each other money.

- Another proposal was to do nothing. A lot of people suggested to let time and free market solve the crisis, but again banks not giving out credits would suffocate businesses around the world as businesses would have a hard time finding credit.

So what would you expect to see in OECD balance sheet after experiencing such a crisis.

I personally would have expected to see some action against extreme indebtedness.

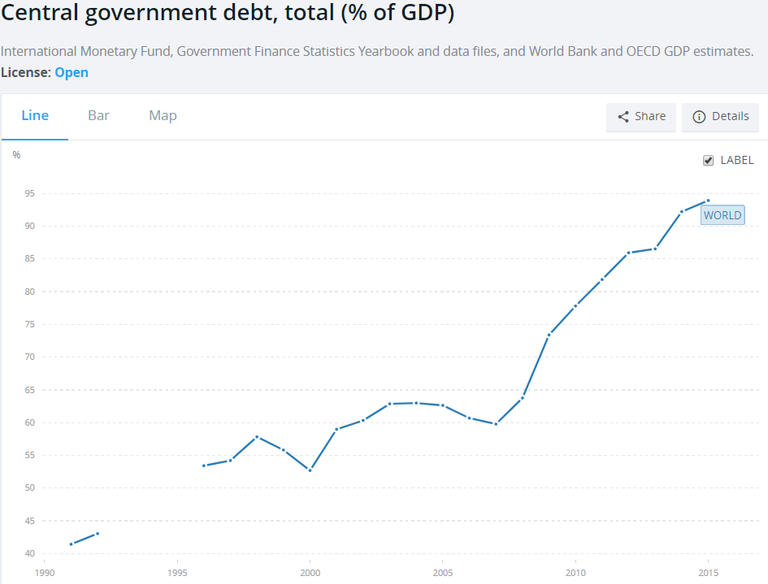

Lets look at a graph showing Global Central Debt, total GDP (%100) graph.

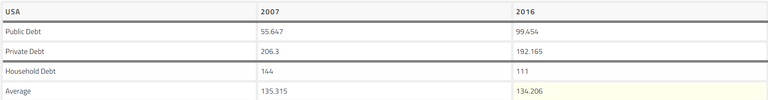

In 2007 the public debt ratio was around 60% by the end of 2015 it was around 94%. Unfortunately, lesson not learned.

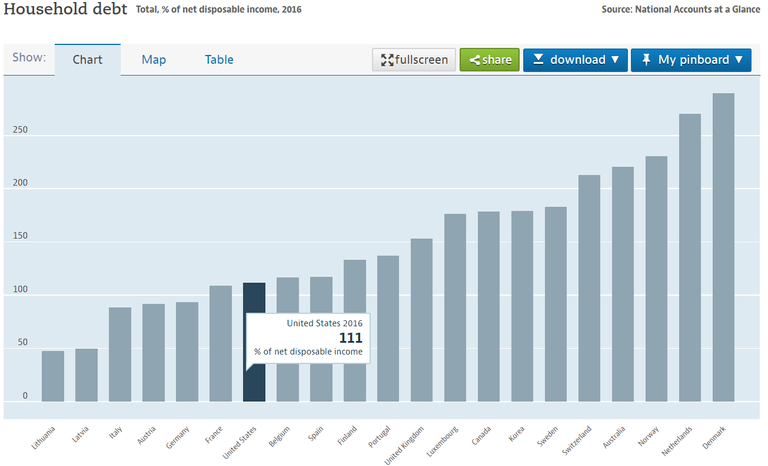

So governments kept on increasing their debts but what about households?

127% in 2007 and 131.5% in 2016 - slight increase in Domestic credit to private sector (% of GDP)

In 2016 debt levels are around the debt levels of 2007. However 2017 the debt is growing.

US had the highest household debt recorded over 13 Trillion dollars in 2017.

Public debt to Gdp ratio is over 104%.

And Private sector debt also increased compared to year before.

Sources:

https://data.worldbank.org/indicator/GC.DOD.TOTL.GD.ZS

https://www.thebalance.com/what-was-the-bank-bailout-bill-3305675

https://tradingeconomics.com/united-states/households-debt-to-gdp

https://data.oecd.org/hha/household-debt.htm

This is great data. I'm increasingly worried about the US economy (and world economy by extension). Glad that crypto exists in order to hedge against the "mainstream" economy.

Well this isn't a fully finished article but, I know that infrastructure spending will increase the US public debt. New tax system will increase household debt and as debt in US increases debt in whole world follows it. In short term lack of extra fiat could be bad for crypto but if something similar to 2008 happens crypto has a huge upside.