A recently published report by the Roosevelt Institute suggests that the Federal Reserve won’t have the same influence in the next recession because there isn’t enough room to drop interest rates as much as has been required in the past.

Roosevelt Institute Report:

http://rooseveltinstitute.org/wp-content/uploads/2017/11/Monetary-Policy-Toolkit-Report-1.pdf

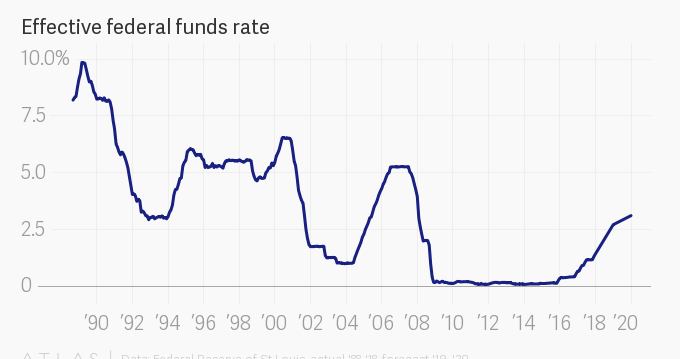

Historically, the Fed has had to drop rates by 5-6 percentage points during recessions; it cut rates by 6 points in 1990, 5.25 points in 2005, and 5.25 points—down all the way to zero—during the Great Recession of 2008.

With rates forecast (by the Fed itself) to only go as high as 3.1% by 2020, there’s not much scope to stimulate the markets by cutting them significantly if another recession was around the corner. And many economists do expect a recession soon—as early as next year or 2020.

The Roosevelt Institute said:

When the next recession happens, it’s unlikely that reducing the short-term interest rate will be enough to stabilize demand, simply because rates will almost certainly not be high enough for a big enough rate reduction to give the economy the boost it will need.

************** RTD NEWS UPDATE ****************

If you found this informative please upvote this post and share. For more commentary like this visit and subscribe to Rethinking the Dollar social media sites below:

RTD YouTube Channel: https://www.youtube.com/c/rethinkingthedollar

Twitter - https://twitter.com/RethinkinDollar

Facebook - https://www.facebook.com/rtdworldnews

The next recession is around the corner and a lot of people are unaware of why this time it will be a lot worse than the Great Recession of 2007-2013. In this new eBook, "5 Reasons To Hold Precious Metals Before the Next Recession ", I share my thoughts on how being prepared ahead of time will help those that hold tangible wealth in their hands through the next crisis.

Download a copy of the FREE eBook instantly here: http://bit.ly/5ReasonsEbook

#5Reasons #gold #silver #soundmoney

0% is pretty low. They could go negative.

Yes indeed. Unless they cook up something new they have no choice.

The FED won't be able to save us?

The FED was never about saving us, it was all about control and slowly eroding people's savings. And, when they feel the house of cards is about to collapse, they will initiate the collapse.